Emerging Market Links + The Week Ahead (June 2, 2025)

Seeking Alpha used to email out a daily Global Investing newsletter listing all their newest international stock write-ups, but they pulled the plug on that last week without so much of an explanation beyond saying:

Global Investing is ending — but your market insights don’t have to.

As of May 27, 2025, we will no longer be sending the Global Investing newsletter. Choose from our wide selection of newsletters to continue receiving timely market coverage and in-depth analysis:

I find this rather odd given the crazy valuation levels we are seeing in US markets and certain US stocks while (as noted in our recent Sunday posts) many funds and the corporate business press have been pushing Europe. I even saw a Facebook post today from a UK money manager friend patting himself on the back for putting clients into an aerospace and defence fund that’s up 20%+ in 2 months as Europe ramps up defense spending (to gear up for war according to alt-finance personalities like Martin Armstrong of armstrongeconomics.com).

Zero Hedge has also noted that a Trump-endorsed nationalist narrowly wins Polish presidential election 🗃️ by pointing out:

Heading into the runoff, the Polish stock market had rocketed ahead by 27% over the year to date, and 61% in dollar terms since the last parliamentary election, while government bonds returned 28%. Many observers expected a Nawrocki win to be a negative for the country’s markets. “It’s possible that the more NATO-skeptic Nawrocki may position Poland in a less favorable position when the time comes to rebuild Ukraine – a theme that has attracted investors to the Warsaw bourse of late,” noted Dow Jones’ Jamie Chisholm last week. Polish equities are trading at an average 9.7 PE ratio relative to estimated earnings for the coming 12 months, compared to 14.7 for the Euro STOXX 50.

For some specific Polish stock ideas, see our Poland tag; the 🇵🇱 Poland (44 stocks) section of our Emerging & Eastern Europe Stock Index; or the following posts:

However and IF Europe were to go to war with Russia, etc., it won’t matter much that you just made 20%+ on a defense fund investing in European defense stocks or 27%+ in the Polish stock market as capital controls and new forms of taxation (e.g. see Doug Casey’s From Taxation to Confiscation: Europe’s Wealth Exodus and the Coming Asset Seizure) will follow just like they did for WW1/II, etc. – meaning you might want to look beyond investing in the USA or Europe (see Frontier & Emerging Market Stock Index).

That’s just what investors in Asia are doing as The Asset has reported how Asia’s wealthy families pivot homeward amid global uncertainty 🗃️ according to the latest UBS Global Family Office Report 2025…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Link to an archived article

🌏 Asia’s wealthy families pivot homeward amid global uncertainty (The Asset) 🗃️

Succession planning moves to centre stage as next generation prepares to take the reins

Family offices across the Asia-Pacific region are preparing to deepen their local roots, with new data from UBS revealing a clear pivot towards investments in the region and a notable increase in succession planning among the region’s wealthiest families.

According to the UBS Global Family Office Report 2025, over half of Asia-Pacific ( APAC ) family offices plan to increase their investment allocations in the region outside Greater China over the next five years, while 30% are targeting Greater China itself.

This strategic reweighting signals a renewed confidence in local growth markets, especially in India, Taiwan, and mainland China, as regional dynamics shift amidst global volatility.

🇨🇳 The ‘wild’ writer who told the truth about work in China (FT) $ 🗃️

🇨🇳 European Firms in China Are More Downbeat Than Ever, Survey Shows (Caixin) $ / European Chamber Highlights Impact of China’s Deflationary Environment and Calls For Addressing Supply and Demand Imbalances (The European Union Chamber of Commerce in China)

European companies’ optimism about their prospects in China has dropped to its lowest level on record, weighed down by a faltering economy and rising geopolitical tensions, according to a new survey.

The poll, conducted by the European Union Chamber of Commerce in China and consultancy Roland Berger in January and February, covered 503 of the chamber’s members. The findings, released Wednesday, highlight growing challenges for foreign firms in the world’s second-largest economy.

🇨🇳 Meituan founder explains the decision to go to Brazil (Momentum Works)

Yesterday (26 May) after (Hong Kong) market closed, Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) released its Q1 2025 results.

In our opinion, the Q1 results were solid if not stellar. Revenue increased 18.1% YoY to reach RMB86.6 billion. Commission of new businesses increased by 85.4%, while operating profit of the group doubled.

The Q&A section of the earnings call this time was very interesting, as founder Wang Xing and CFO Chen Shaohui addressed a few key topics: competition, international expansion and AI, extensively.

We have taken some notes, and added some thoughts below on these topics:

🇨🇳 Pinduoduo – Game over? (The Great Wall Street – Investing in China)

PDD Holdings (NASDAQ: PDD) or Pinduoduo: From Fraud to Failure?

It’s remarkable how quickly the market rewrites its own stories. Just a few months ago, Pinduoduo was too profitable to be real—clearly a fraud. Now, after one disappointing quarter (which, by the way, played out exactly as management warned nine months ago), the very same experts are calling it just another worthless Chinese shitco.

Every earnings release sends Pinduoduo’s stock into a 15–20% tailspin, in either direction. That kind of volatility is rare for a company of this size and usually reserved for small caps or biotech lottery tickets. Yet here we are, watching a $200 billion business trade like it just released a Phase 2 trial result.

Pinduoduo’s management communicates as if they were electing the next Pope. They disclose the bare minimum, avoid all forms of guidance, and show zero interest in engaging with analysts—no matter how many times they beg for help modeling margins or forecasting growth. The attitude is roughly equivalent to: figure it out yourselves.

🇨🇳 What is behind PDD’s big earnings miss (Momentum Works)

PDD Holdings (NASDAQ: PDD) or Pinduoduo delivered another shock to the market in its Q1 2025 earnings, announced on Tuesday (27 May). Revenue growth was significantly behind market consensus, and operating profit dropped almost 40%.

As Temu’s parent company does not really communicate with the market like listed tech companies do (it doesn’t even have a CFO), the quarterly announcement and the ensuing earnings call are pretty much the only opportunities for many to gain an understanding of the company’s performance and plans.

What happened this time? Has it lost steam? Will the ‘Temu threat’ for other ecommerce players and retailers dissipate?

A few thoughts:

🇨🇳 Meitu, Alibaba find beauty in new e-commerce partnership (Bamboo Works)

The maker of beauty apps will sell $250 million worth of convertible bonds that could make the e-commerce giant its third-biggest shareholder

Meitu Inc (HKG: 1357 / FRA: M5U / LON: 0ZNC / OTCMKTS: MEIUF) and Alibaba (NYSE: BABA) have formed a major new partnership that will see the latter leverage the former’s skills in video and photo apps

The deal could give Alibaba nearly 7% of Meitu’s shares, and is one of Alibaba’s biggest investments since it was fined $2.5 billion for anti-competitive behavior in 2021

🇨🇳 AI powers Agora back to revenue growth (Bamboo Works)

The maker of real-time engagement technology is benefitting from new demand for products like real-time online virtual tutors and talking toys

Agora (NASDAQ: API) reported a slight revenue increase in the first quarter, as it returned to growth after three years of declines

The maker of real-time engagement technology said it is actively investing in “promising areas” such as conversational AI that can power virtual tutors and call centers

🇨🇳 State-Backed Chip and Server Firms to Merge Amid Self-Reliance Drive (Caixin) $

Chinese chipmaker Hygon Information Technology (SHA: 688041) announced it plans to acquire server manufacturer Dawning Information Industry Co Ltd (SHA: 603019) or Sugon, as Beijing ramps up its push towards tech self-reliance amid rising geopolitical tensions.

In a letter of intent signed between the two companies, the acquisition will be completed via an all-share swap, Hygon said in a filing to the Shanghai Stock Exchange Monday. The company said it intends to issue A-shares to Sugon’s A-share shareholders, along with a private placement to raise extra funds, without revealing the terms of the deal.

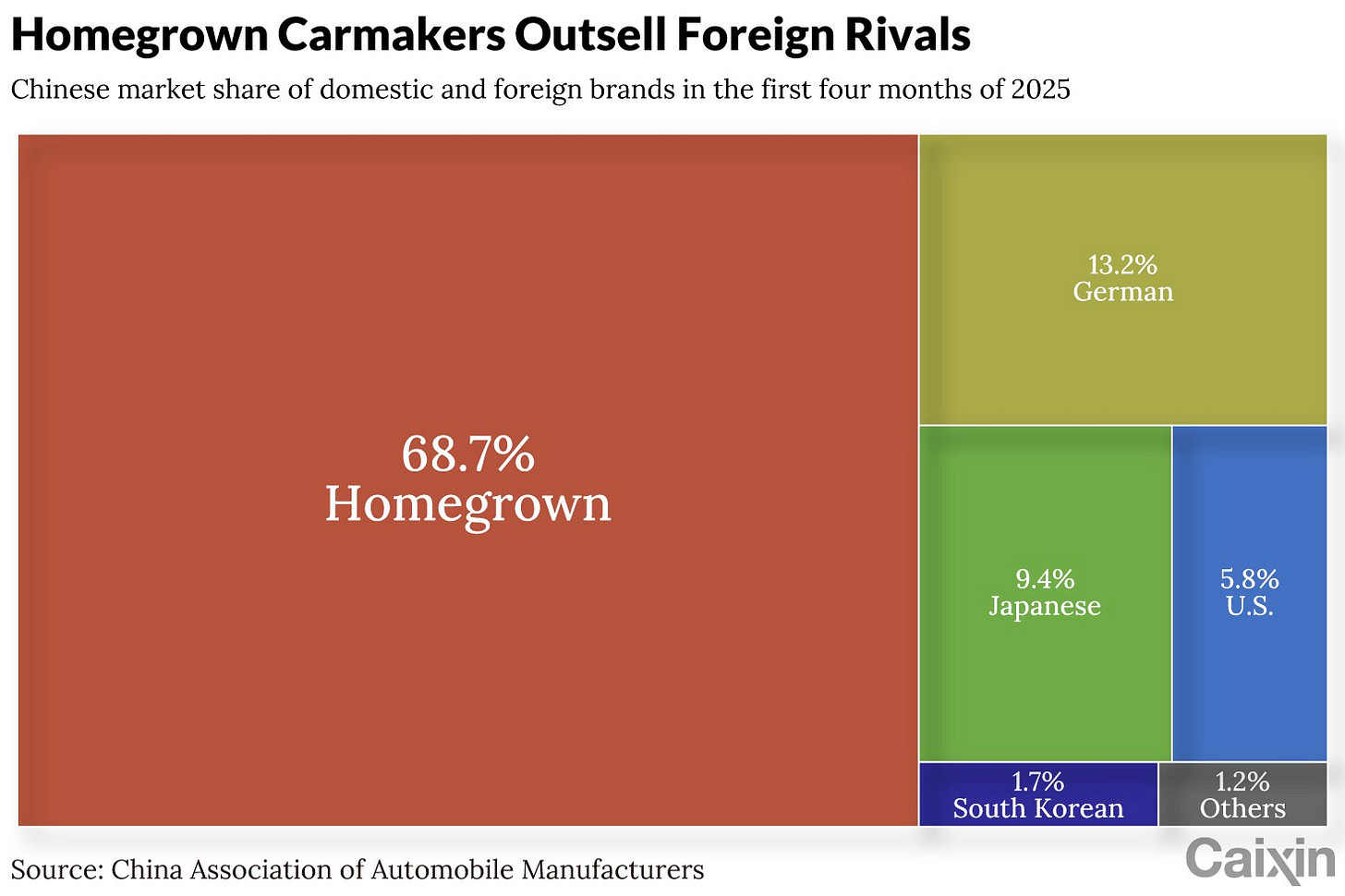

🇨🇳 In Depth: Foreign Carmakers Tap Local Expertise to Regain China Market Share (Caixin) $

Once industry leaders, foreign carmakers are now playing catch-up in China — tapping into local expertise and supply chains in a bid to regain lost ground.

The strategic shift comes as foreign carmakers lost ground after being slow to adapt to the local market’s rapid pivot towards electrification.

Driven by strong demand for new-energy vehicles (NEVs), homegrown auto brands surged to a record 68.7% share of passenger car sales in China in the first four months of this year, compared with 38.4% in 2020, according to data from the China Association of Automobile Manufacturers (CAAM).

🇨🇳 Chinese EV shares tumble as BYD sparks ‘rat race’ price war fears (FT) $ 🗃️

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) 🇨🇳 🇼 🏷️ / BYD Electronic International Co Ltd (HKG: 0285) 🇼 🏷️

🇨🇳 Chinese auto stocks slump after fresh wave of discounts (Caixin) $

A fresh round of price cuts is roiling China’s fiercely competitive auto sector, dragging down shares of domestic manufacturers and stoking fears that there’s no end in sight for the battle for market share in the world’s largest car market.

The latest discount wave was triggered by BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF), the country’s top electric-vehicle (EV) maker, which slashed prices on 22 models by up to 34% on Friday. Among the steepest reductions was for the Seagull hatchback — now priced at 55,800 yuan ($7,750). That reflects a 20% drop from its original 69,800 yuan price tag, which already made it the brand’s most affordable offering. Meanwhile, the plug-in hybrid Seal sedan saw its price plunge one-third to 102,800 yuan. The promotions will run through June 30.

🇨🇳 Brazil sues BYD, contractors for keeping workers in ‘slavery’-like conditions (Caixin) $

Brazilian prosecutors said they are suing Chinese electric vehicle (EV) giant BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) and two of its contractors, accusing them of trafficking Chinese workers to build a plant for the automaker in Camaçari and subjecting them to conditions “analogous to slavery.”

The civil lawsuit was filed Tuesday with the 5th Labor Court of Camaçari after BYD and its contractors — China JinJiang Construction Brazil Ltda. and Tecmonta Equipamentos Inteligentes Brasil Co. Ltda. — refused to sign a conduct adjustment agreement, the Public Labor Prosecutor’s Office (MPT) in the state of Bahia said in a statement.

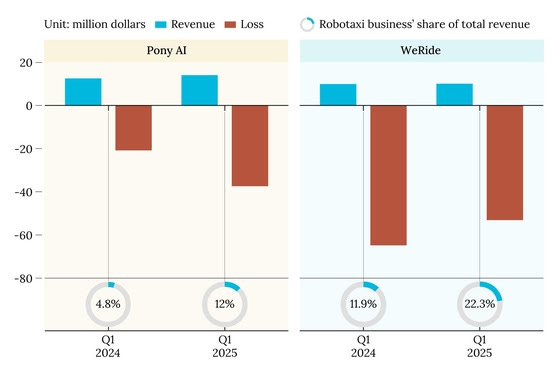

🇨🇳 Analysis: Strong first quarter shows promise of China’s robotaxi business (Caixin) $

China’s autonomous ride-hailing sector is gaining momentum, with top players including Pony AI Inc (NASDAQ: PONY) and WeRide Inc (NASDAQ: WRD) reporting strong first-quarter results that reflect rising demand and renewed policy support for the still-nascent industry.

Nasdaq-listed Pony AI earned $1.7 million from its driverless cab service, or robotaxi, in the first three months of 2025, up 200% year-on-year, according to the company’s quarterly results released last week. The business, which includes passenger fares and technical solutions, saw fare-based income alone leap 800% year-on-year.

🇨🇳 WeRide tries buyback maneuver in tight robotaxi race (Bamboo Works)

The developer of driverless technology has unveiled a $100 million share buyback program in a bid to reassure investors after a stock price slide

Shares in the robotaxi operator have fallen nearly 40% since its U.S. IPO last year

WeRide Inc (NASDAQ: WRD) is in a fierce contest with Pony AI for investor confidence and market expansion opportunities

🇨🇳 Shoucheng sheds ‘old economy’ label with robotic pivot (Bamboo Works)

The company, whose businesses over the years have included everything from steel to fund management, is trying its hand at robotic investment and incubation

Shoucheng Holdings Ltd (HKG: 0697 / FRA: SHVA)’s gross profit declined in the first quarter, but its profit jumped more than 80%, amid its ongoing move into robotic investment

The company’s pivot into robotics is being led by its establishment of a related fund whose holdings include a stake in up-and-comer Unitree Robotics

🇨🇳 China pushes for mergers to create global banking and securities giants (FT) $ 🗃️

🇨🇳 Lexin’s profit jump masks slowdown in its main loan business (Bamboo Works)

The company reported a big net income increase for the first quarter, but its revenue fell on sluggishness in its loan facilitation business

LexinFintech (NASDAQ: LX)’s net profit doubled in the first quarter from a year earlier, even as its revenue decreased 4.3%

A drop in bad loan provisions boosted the company’s bottom line, showing its efforts to improve risk management are bearing fruit

🇨🇳 Cango’s crypto makeover advances with sale of its China business (Bamboo Works)

The move could pave the way for the former car trader to relocate its headquarters outside the Chinese Mainland, with Singapore, Hong Kong and the U.S. as possible destinations

Cango (NYSE: CANG) announced it completed the sale of its China business, including its car-trading and financing services in a deal valued at $352 million

The company also announced a major overhaul of its board, bringing in new members with financial expertise, reflecting its new focus on bitcoin mining

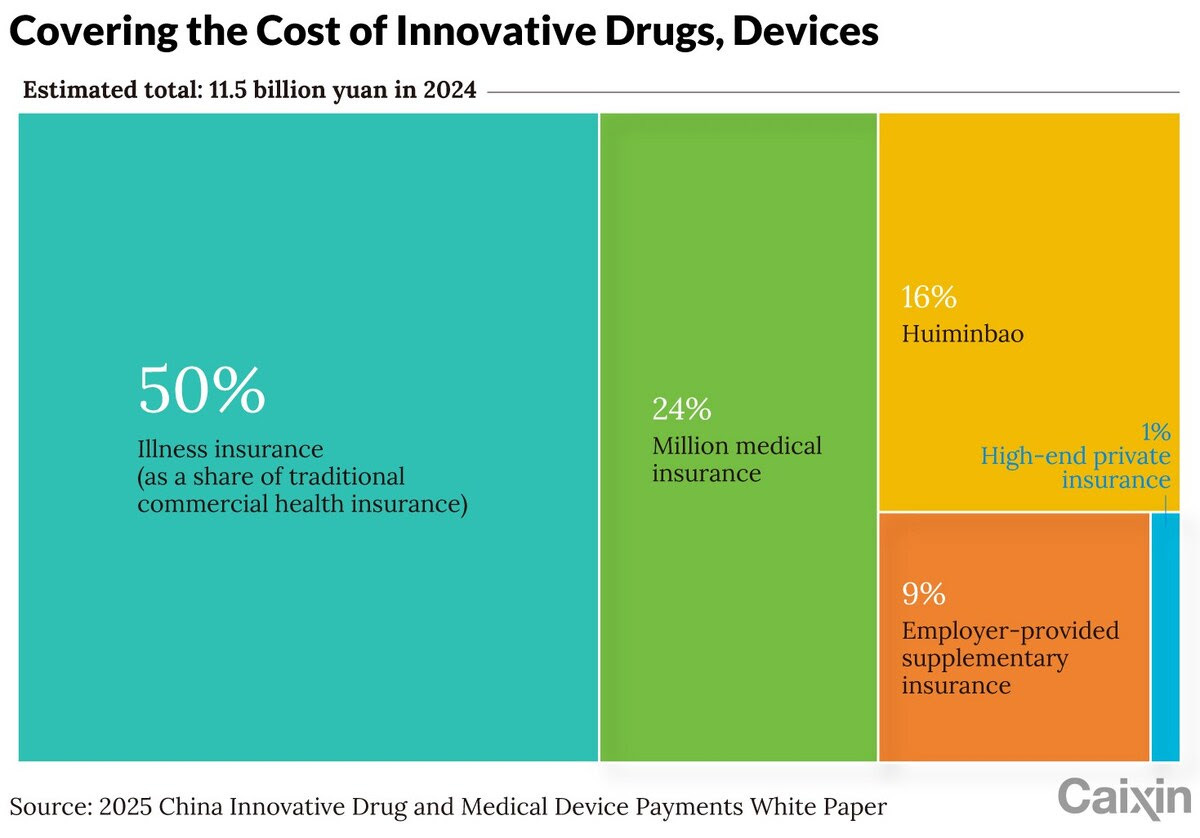

🇨🇳 In Depth: Commercial insurance’s rise exposes chokepoints in China’s medical system (Caixin) $

In late 2024, the distressed family of a mother undergoing treatment for breast cancer posted a video on social media describing how she was denied admission by two local public hospitals in Jiamusi, a city in the northeastern province of Heilongjiang, because she was using the commercial medical insurance she had bought herself rather than the state system.

After initially undergoing chemotherapy sessions at the Harbin Medical University Cancer Hospital, she was prescribed drugs and told to continue taking them at home for a year. The hospital is located in the provincial capital of Harbin, more than 300 kilometers from Jiamusi.

🇨🇳 State-owned shipping giant drops consolidation plans (Caixin) $

China Merchants Group Ltd. (CMG) has abandoned plans to consolidate its container shipping operations, a move one analyst attributed to unexpectedly strong first-quarter earnings from the business.

Two listed subsidiaries of CMG — China Merchants Energy Shipping Co. Ltd. (SHA: 601872) and Antong Holdings (SHA: 600179) — announced that the plans had been dropped in separate stock exchange filings Wednesday. The companies attributed the termination to changes in market conditions and the target companies’ situations, as well as a failure to agree on transaction terms.

🇨🇳 Zijin Mining (601899 CH / 2899 HK): Evaluating the Impact of Kakula Suspension (Smartkarma) $

A 4–6 month Kakula disruption could reduce Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF)’s 2025 copper output by 4–8%, cutting EBITDA by ~7–11%.

Ramp-Ups at Julong and Čukaru Peki can offset ~60–70% of the lost volume and partially protect margins.

Lithium is expected to grow from 8% to 20% of EBITDA by 2028, driven by 300kt LCE capacity from low-cost brine assets.

🇨🇳 YuHua Education’s profit doubles as it bids adieu to Thailand (Bamboo Works)

The Zhengzhou-based private education company’s shares have soared since last month as investors cheer its embrace of vocational training and debt repayment

China Yuhua Education Corp Ltd (HKG: 6169 / FRA: 2YU) has shored up its balance sheet by selling its Thai schools to help pay back debt from a 2019 convertible bond issue

With its revenue up by 7% in the six months through February and adjusted profit more than doubling, the private educator gets a gold star for its latest financial results

🇨🇳 ATRenew capitalizes on government incentives to achieve solid growth in its core business (Bamboo Works)

The recycling specialist’s revenue rose 27.5% in the first quarter, representing its fastest growth in more than a year

ATRenew (NYSE: RERE) reported its fastest quarterly revenue growth in more than a year during the first quarter, as it also reported its second-highest quarterly net profit

The company opened 25 new stores during the first quarter, with plans for 800 new stores this year as it significantly expands its brick-and-mortar retail network

🇨🇳 For Pop Mart, tiny blind boxes are big business (FT) $ 🗃️

Gen Z shoppers are driving a collecting frenzy for Labubu across Asia, the US and Europe

Meet the Labubu. Made by Beijing-based toymaker Pop Mart International Group (HKG: 9992 / FRA: 735), the pint-sized creature has sparked a collecting frenzy among Gen Z and millennial shoppers across Asia, the US and Europe. Fans line up for hours for new releases. Rihanna, Dua Lipa and Lisa from the K-pop group Blackpink have been spotted dangling Labubu key chains off their designer bags.

🇨🇳 3SBio hits the big time with $6 billion cancer drug deal (Bamboo Works)

The pharma giant Pfizer has bought international rights to the experimental cancer therapy and will take a $100 million equity stake in the Chinese drug developer

The mega deal for rights to the Chinese biotech’s cancer drug drove 3SBio Inc (HKG: 1530 / FRA: 83B / OTCMKTS: TRSBF)’s stock price to a seven-year high

Big hopes are riding on “dual target” antibody treatments, with Merck & Co. teaming up with another Chinese biopharma on a similar product

🇨🇳 Shein IPO: Hong Kong Yes, London No (Douglas Research Insights) $

Shein announced it is planning for an IPO in Hong Kong in 2025. Shein tried to go public in London, but its attempt has essentially failed.

Due to tariff war and ending de minimis for shipments from China and Hong Kong by the U.S. government, the valuation of Shein could decline to less than $50 billion.

Now, as long as the valuation is not excessive but reasonable, there could be a decent demand for this IPO of Shein in Hong Kong.

🇭🇰 HK 第42部分; Mental models & 8%+ yield (Jam_invest)

Covers/mentions: EDICO Holdings Ltd (HKG: 8450), China Tower Corp Ltd (HKG: 0788 / FRA: 2Y1 / OTCMKTS: CHWRF), American Tower Corp (NYSE: AMT), Zylox-Tonbridge Medical Technolgy Co Ltd (HKG: 2190 / FRA: 818), Allied Group Ltd (HKG: 0373 / OTCMKTS: ALEDY) & Sun Hung Kai Properties Ltd (HKG: 0016 / 80016 / FRA: SHG.F / OTCMKTS: SUHJY / SUHJF)

Mental models & An 8%+ dividend yield Hong Kong stock, named Sun Hung Kai & Co Ltd (HKG: 0086 / OTCMKTS: SHGKF), trading at a fraction of book value

Table of Contents

Intro

Mental Models

Sun Hung Kai & Co

Jaminvest resources

Disclaimer

🇲🇴 Macau GGR tally in May ‘impressive’ amid macroeconomic headwinds: analysts (GGRAsia)

The 5.0-percent year-on-year increase in casino gross gaming revenue (GGR) in Macau was “better than expected,” surpassing the market’s consensus estimate, said two separate brokerages.

Macau’s casino GGR reached MOP21.19 billion (US$2.62 billion) in May, showed data released on Sunday by the city’s Gaming Inspection and Coordination Bureau.

The latest monthly figure was the highest monthly tally post-Covid, according to official data.

The May GGR result “comfortably” surpassed “the consensus estimate of +2 percent year-on-year,” stated JP Morgan Securities (Asia Pacific) Ltd in a Sunday memo.

🇲🇴 Macau GGR nearly US$2.17bln in first 25 days of May: Citi (GGRAsia)

Macau’s casino gross gaming revenue (GGR) was estimated to have reached circa MOP17.5 billion (US$2.17 billion) in the first 25 days of May, suggested banking institution Citigroup, citing its own industry sources.

The figure implied a daily run rate of approximately MOP686 million during the week to May 25 (Sunday), 16-percent higher than the MOP593-million average a day in the previous week, stated the institution in a Monday note.

“The spike in last week’s GGR was a pleasant surprise. We suspect this was due to the newly opened Capella at Galaxy Macau,” wrote Citi analysts George Choi and Timothy Chau in Monday’s memo.

The Capella at Galaxy Macau hotel had a soft launch in early May, according to its promoter, Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF).

🇲🇴 UBS still cautious on Macau gaming amid uncertainty around de-escalation in U.S.-China tariff war (GGRAsia)

Uncertainty about the potential macroeconomic impact of the U.S.-China trade-tariff war – despite recent de-escalation – keeps UBS Investment Bank cautious for now on the Macau gaming sector, suggested the institution’s Hong Kong strategy and Asia gaming analyst Angus Chan, in Tuesday commentary.

His remarks were in response to a GGRAsia question at a UBS Asian Investment Conference 2025 session held in Hong Kong, about the bank’s equities-related investment strategy for Asia and Hong Kong.

Mr Chan noted: “We downgraded the growth forecast,” for Macau gaming, “in April, and subsequently this de-escalation of trade war (happened).”

🇲🇴 Moody’s maintains ‘negative’ outlook for Macau, affirms ‘Aa3’ rating (GGRAsia)

Moody’s Investors Service has maintained the outlook on the Macau Special Administrative Region (SAR) government as ‘negative’, while keeping the region’s foreign currency issuer ratings at “Aa3”, indicating a very low credit risk of default.

The Tuesday announcement follows Moody’s decision to affirm China’s ‘A1’ rating and maintain the negative outlook.

“The affirmation of the Aa3 rating for Macau reflects our assessment that the SAR retains formidable credit strengths, including very high per capita income and the absence of outstanding government debt,” stated the ratings agency.

🇲🇴 Sands China early repayment on 2025 notes possibly interest-saving move: Lucror Analytics (GGRAsia)

Macau casino operator Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF)’s “early repayment” of 2025 notes “could be aimed at achieving interest savings,” says a memo from Lucror Analytics, a Singapore-based specialist in credit research, carried on the Smartkarma platform.

Sands China said in a Friday filing to the Hong Kong Stock Exchange that it planned to exercise an option to redeem on June 11 the balance of its US$1.80-billion in senior unsecured notes due on August 8.

The 2025 notes – with US$1.63-billion in outstanding principal – consist of 5.125-percent registered senior notes issued on January 29, 2019.

🇲🇴 LVS boss calls Macau results disappointing, says group needs to be more aggressive (GGRAsia)

The Macau operations of casino firm Las Vegas Sands (NYSE: LVS) have not been performing as expected, says Robert Goldstein (pictured in a file photo), the group’s chairman and chief executive. That was in the context of the casino firm, according to him, not being as competitive as it should be regarding incentives to customers, as well as in terms of increasing earnings before interest, taxation, depreciation, and amortisation (EBITDA) across the Macau portfolio.

He added: “I’m not here to say they (Macau market rivals) are right and we are wrong. We need to be more aggressive, and it may cost us some margin (points).”

🇹🇼 TSMC: AI Resilience Should Keep Bears At Bay (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor Manufacturing: Ai Winner With Cyclical Upside (Seeking Alpha) $ 🗃️

🇰🇷 SK Telecom: A Rare Opportunity For Value Investors (Seeking Alpha) $ 🗃️

-

🇰🇷 SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) – Wireless telecommunication services in Korea. 3 segments: Cellular Services, Fixed-Line Telecommunications Services & Other Businesses. 🇼 🏷️

🇰🇷 KOSPI 200 and KOSDAQ 150 Constituent Changes Announced: A Few Surprises (Douglas Research Insights) $

Korea Exchange announced its KOSPI200 rebalance changes on 27 May. It added 8 companies and deleted 8 companies. KRX also added 9 companies and deleted 9 companies in KOSDAQ 150.

These 8 new inclusions in KOSPI200 are up on average 49.8% in the past one year. The 8 deletions to KOSPI200 are down on average 45.2% in the past one year.

There were numerous surprises to the KOSDAQ150 rebalances. In particular, three companies are relative surprises to the KOSDAQ150 additions including Solid Inc (KOSDAQ: 050890), Zeus Co, and Wemade Max (KOSDAQ: 101730).

🇰🇷 Korea Value Up Index: Outperformance Relative to KOSPI200 & KOSDAQ150 Likely to Attract Greater Capital Inflow (Douglas Research Insights) $

Korea Value Up index is up 8.2% from 30 September 2024 to 28 May 2025, outperforming KOSPI 200 (up 3.4%) and KOSDAQ 150 (down 7.9%) in the same period.

More capital is likely to flow into the Korea Value Up index going forward. The government’s efforts to continue to push the Korea Value Up index is also positive.

The median market cap of the 27 new additions is 2,310 billion won versus 835 billion won for the 32 deletions. KRX is emphasizing on companies with higher market cap.

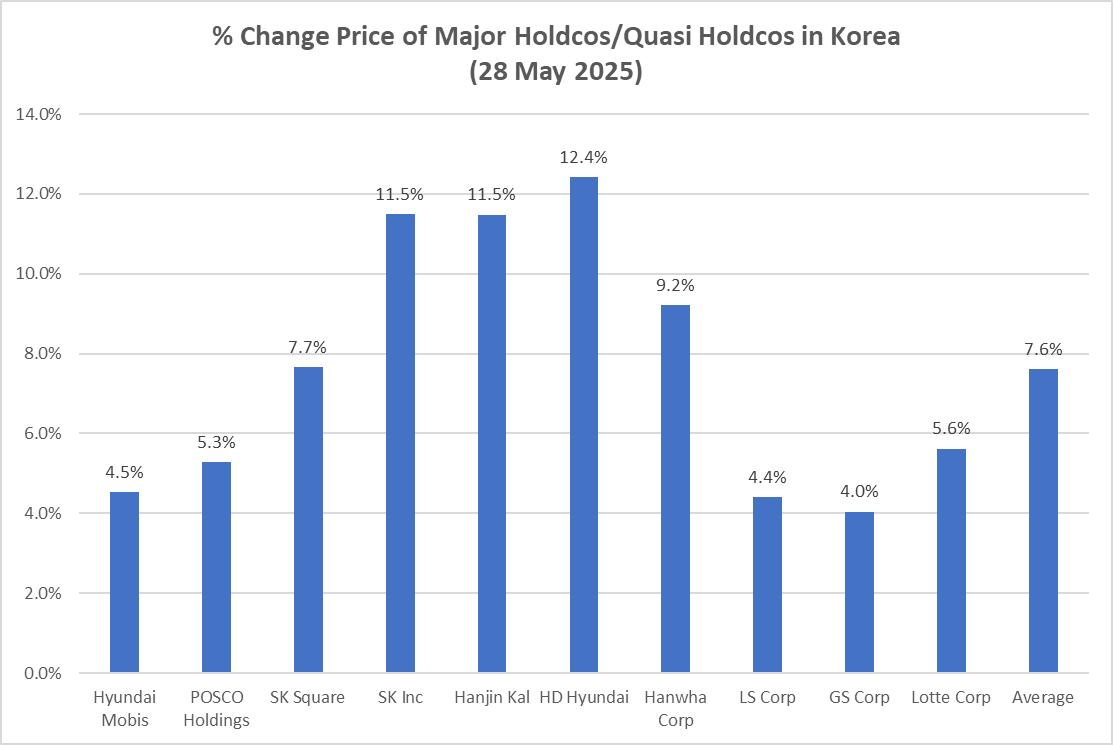

🇰🇷 Biggest One Day Move in Higher Share Performance YTD in 2025 for Major Korean Holdcos Today – Why? (Douglas Research Insights) $

In this insight, we provide five major factors that may have caused higher share price movements (up 7.6%) of 10 major Korean holdcos/quasi holdcos today.

This is the best one day share price performance on average for these stocks so far in 2025.

Emphasis on improving corporate governance by both leading Presidential candidates and potential mandatory cancellation of treasury shares are among the five major factors.

🇰🇷 3 Major Criteria of Fundamental Stock Screen for Major Korean F&B Companies (Douglas Research Insights) $

🇰🇷 HD Hyundai: Will It Increase Ownership Stake In HD Korea Shipbuilding & Offshore Engineering? (Douglas Research Insights) $

🇰🇷 HYBE to Sell Its 9.4% Stake in SM Entertainment to Tencent Music in a Block Deal Sale (Douglas Research Insights) $

On 27 May, HYBE (KRX: 352820) announced that it will sell its 9.4% in SM Entertainment Co Ltd (KOSDAQ: 041510) (2.21 million shares) for about 243 billion won (US$145 million) to Tencent Music Entertainment Group (NYSE: TME).

HYBE’s sale of its stake in SM Entertainment is expected to take place on Friday (30 May) after the market close through an after hours block deal trade.

The block deal sale of SM Entertainment by HYBE to Tencent is likely to have a negative impact on SM Entertainment’s shares mainly due to large share price discount (15.3%).

🇰🇷 Korea Small Cap Gem #35: Aurora World (Douglas Research Insights) $

Aurora World Corp (KOSDAQ: 039830) is best known for its plush toys (Palm Pals and YooHoo & Friends). It is increasingly trying to leverage its toy character brands to expand into digital contents.

What makes Aurora World so interesting is its excellent fundamentals and deeply discounted valuations relative to The Pinkfong Company (IPO in 2H25) and SAMG Entertainment.

Aurora World generated more than 80% of its sales in overseas markets including the United States, U.K., and Hong Kong.

🇰🇷 Initial Thoughts on The Pinkfong Company IPO (Creator of the Baby Shark Brand) (Douglas Research Insights) $

In this insight, we provide our initial thoughts on The Pinkfong Company IPO which is expected to be completed in KOSPI in 2H 2025.

The Pinkfong Company is the creator of the Baby Shark brand. Its original “Baby Shark Dance” is the most viewed Youtube video ever (15.9 billion views as of May 2025).

The Pinkfong Company’s valuation was more than 1 trillion won in 2021 (Series B investment round).

🇰🇷 Dowoo Insys IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of (ultra-thin glass (UTG) for the display industry / foldable smartphones) Dowoo Insys is target price of 40,667 won per share, which is 27% higher than the high end of the IPO price range (32,000 won).

We used an EV/EBITDA multiple of 14.9x to value the company, which is 10% premium to the comps’ valuation multiples in 2024.

The decline in operating margin remains one of the biggest risk factors on the company. Its major customers such as Samsung Display are putting increasing pressure to reduce its prices.

🇰🇷 Initial Thoughts on the Karrot (Danggeun) IPO (Largest Used Goods E-Commerce Platform in Korea) (Douglas Research Insights) $

Danggeun (Karrot) is the largest used goods e-commerce marketplace in Korea. There have been some local reports that the company could complete its IPO as early as 2025.

In the private market, some shares of Karrot were put up for sale recently, and the valuation of the company ranged 2.5 trillion won 2.7 trillion won.

The company has tremendously scaled up its business in the past couple of years, in terms of sales and profits.

🇲🇾 GEN Malaysia posts US$12mln profit in 1Q, despite revenue decline (GGRAsia)

Global casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) reported a MYR51.9-million (US$12.2-million) profit in the first quarter, up 41.5 percent from a year earlier, it said in a Thursday filing to Bursa Malaysia.

The firm recorded adjusted earnings before interest, taxation, depreciation, and amortisation (EBITDA) of MYR737.2 million for the first three months of 2025, 12.7-percent higher than in the prior-year period.

“This was primarily due to net unrealised foreign exchange translation gains of MYR50.4 million on the group’s U.S. dollar-denominated borrowings,” stated the company.

🇵🇭 Jollibee: Empire-Building Behavior Led To Underperformance Of This Should Be Wonderful Business (Seeking Alpha) $ 🗃️

-

🌐 Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY) – Foreign & local fast food/restaurant brands in the Philippines & abroad (Chowking, Greenwich, Red Ribbon, Mang Inasal, etc.). 🇼

🇸🇬 Big Shifts Ahead: 5 SGX Rule Changes That Could Reshape the Market (The Smart Investor)

These changes could signal more inflows and listings in due course.

Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), or SGX, has seen a flurry of delistings in recent months while the initial public offer (IPO) pipeline remains dry.

In the first five months of this year, there was only one IPO – that of Vins Holdings (SGX: VIN) on Catalist.

At least 16 companies are on the delisting timetable as of the first week of May, with these 16 having been either delisted, confirmed their delisting dates, or announced plans to exit the stock market.

Investors should note that the Monetary Authority of Singapore formed an equity markets review group last August to recommend measures to stimulate and revitalise the equity market here.

In the same vein, SGX has proposed regulatory changes to shift towards a more disclosure-based regime and also to ease the requirements for companies to list their shares here.

We go through five of these potential changes.

1. Less prescriptive disclosures

2. Streamlining mainboard IPO qualitative requirements

3. Streamlining mainboard IPO quantitative requirements

4. Removal of SGX Watch-List

5. Reducing public queries to avoid alarm

🇸🇬 Keppel’s Investor Day 2025: 5 Things Investors Should Note (The Smart Investor)

The asset manager is advancing on its long-term growth strategy by targeting multiple growth pillars.

Several blue-chip stocks, including Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) and CapitaLand Investment Limited (SGX: 9CI), have hosted Investor Day sessions which you can read about here and here, respectively.

Next in line is Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF), which released its Investor Day 2025 slides earlier this week.

Keppel’s previous Investor Day 2024 was released in August last year, and this update provides the latest financial targets for the asset manager.

Here are five aspects of the group’s Investor Day that investors should learn about.

Aiming for S$200 billion of FUM

Accelerated asset monetisation

Infrastructure project growth

Sustainable urban renewal (SUR)

AI-ready data centres

🇸🇬 5 Temasek-Owned Singapore Blue-Chip Stocks for Your Buy Watchlist (The Smart Investor)

Temasek Holdings is renowned for being a steady and long-term investor.

The global investment firm has 13 offices in nine countries with a total portfolio value of S$389 billion as of 31 March 2024.

Temasek boasts a solid performance track record, logging a 20-year total shareholder return (TSR) of 7% as of 31 March 2024.

With 53% of its portfolio’s value allocated to Singapore, here are five Singapore blue-chip stocks that Temasek owns that you can consider adding to your watchlist.

DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) is Singapore’s largest bank by market capitalisation.

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) provides ground handling and catering services for airlines and also operates central kitchens that prepare food for corporations.

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering, or STE, is a technology and engineering company that serves customers in the aerospace, smart city, and defence sectors.

Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel is Singapore’s largest telecommunication company (telco), providing a range of mobile, pay TV, and broadband services.

Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF) provides engineering solutions to the global offshore, marine, and energy industries.

🇸🇬 5 Singapore Companies Plumbing To Their 52-Week Lows: Are They Worth a Second Look? (The Smart Investor)

These five stocks’ share prices may have hit their year-low, but they could represent bargains waiting to be picked up.

Riverstone Holdings (SGX: AP4) manufactures nitrile and natural rubber clean room gloves as well as premium nitrile gloves used in the healthcare industry.

Japan Foods (SGX: 5OI / TYO: 2599) is a Japanese restaurant chain operating 78 restaurants in Singapore under brands such as Ajisen Ramen, Osaka Ohsho, and Menya Musashi.

Sim Leisure Group (SGX: URR) is a designer, developer, and operator of theme parks such as ESCAPE theme parks and KidZania in Singapore and Malaysia.

Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF), or FLCT, owns a portfolio of 114 properties spread out across Singapore, Australia, the UK, Germany, and the Netherlands.

Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, is an industrial REIT with a portfolio of 180 properties across eight countries.

🇸🇬 5 Singapore Stocks Growing Their Top Line: Why Investors Shouldn’t Look Away Now (The Smart Investor)

🇸🇬 Sea: Navigating Competition And Capitalizing On Fintech (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇮🇳 NIFTY Index Outlook (With an Eye on Zomato’s Passive Selling Starting…) (Smartkarma) $

🇮🇳 Linde India (LINDEINDIA IN): High-Quality Compounder Riding India’s Industrial and Steel Growth (Smartkarma) $

Linde India Ltd (NSE: LINDEINDIA / BOM: 523457) plans to double gas capacity to 20,000 TPD by FY27 with ₹32 bn capex, including new ASUs for Tata Steel Ltd (NSE: TATASTEEL / BOM: 500470).

FY25 PAT rose 5% despite a 10% revenue dip, driven by margin gains and cost efficiency.

Trades at over 80× P/E FY27, appears justified by annuity-like cash flows from critical long-term contracts with top steelmakers.

🇮🇳 NALCO (NACL IN): Record FY25 Profit; Alumina-Led Fall Likely Priced In, Execution Remains Key Risk (Smartkarma) $

NALCO (National Aluminium Co Ltd (NSE: NATIONALUM / BOM: 532234)) has guided for alumina realizations around $400/t in FY26, with earnings further impacted by delays in ramp-up of its 1 MTPA alumina expansion project.

Q4 FY25 results were strong, but earnings outlook has weakened significantly with the steep drop in alumina prices.

Valuations appear inexpensive on FY27 earnings at 5x EV/EBITDA, however peristent delays in capacity rampup is concerning.

🇮🇳 Zen Technologies Q4 FY25 Update: Record Performance & Strategic Expansion (Smartkarma) $

Zen Technologies Limited (NSE: ZENTEC / BOM: 533339) reported record-high quarterly and annual financial performance in Q4 & FY25, surpassing internal guidance for the year. Strategic acquisitions in naval simulation, drone components & robotics completed.

The strong financials and acquisitions significantly diversify capabilities and market reach, positioning Zen to capitalise on increasing defence spending and evolving warfare needs.

Performance exceeds expectations, reinforcing confidence in Zen’s indigenous technology leadership and growth trajectory, despite potential short-term order inflow volatility.

🇮🇳 Kuantum Papers Q4 FY25 Update: Navigating Headwinds, Betting on 50% Expansion & Realisation Turnover (Smartkarma) $

Kuantum Papers Ltd (NSE: KUANTUM / BOM: 532937) reported stable Q4 FY25 volumes but lower revenue/profit YoY amidst industry headwinds, while progressing on a significant capacity expansion by 50%.

The company demonstrated margin resilience despite challenging raw material(wood) and import dynamics with expectation of price surge by 6-7% in next 6 months.

Ongoing capex project of INR 735 crores is on track for completion by Mar-26 where purchase orders worth INR 540 crores already issued, remaining in final stages.

🇮🇳 InterGlobe Aviation Limited Q4 FY25 Update: Record Quarter Driven by Demand and Strategic Expansion (Smartkarma) $

Interglobe Aviation Ltd (NSE: INDIGO / BOM: 539448) reported record quarterly PAT and crossed $10 billion in annual revenue for the first time and recommended a dividend after five years.

Capacity significantly expanded in FY25 and plans continue, adding aircraft, routes, and widebodies for international growth. On consolidated basis, management guides early double digit growth in FY26.

Geopolitical events like India-Pak war caused booking dips and flight delays.

🇮🇳 Deepak Fertilizers Q4 FY25 Update: A Specialty Play, Ready for the Mega Run (Smartkarma) $

Deepak Fertilisers & Petro (NSE: DEEPAKFERT / BOM: 500645) reported robust Q4 and full-year FY25 results, crossing INR 10,000 crores in revenue and doubling PAT year-on-year for FY25.

The strong financial outcomes validate the company’s strategy of aligning with India’s growth story and transitioning from commodities to higher-margin specialty products.

Improved financial health, reduced net debt, and strategic capex nearing completion position DFPCL for future growth and potentially higher profitability despite near-term segment-specific pressures.

🇮🇳 Sarda Energy (SARDA IN): Power-Led Transition with Re-Rating Potential (Smartkarma) $

Sarda Energy & Minerals Ltd (NSE: SARDAEN / BOM: 504614)’s near-term growth will be driven by the full-year contribution from SKS Power, boosting earnings visibility.

The business mix is shifting structurally from steel to power, which now contributes over 60% of EBIT. Low leverage at <1x EV/EBITDA is a positive.

The recent weakness in spot power prices is seen as temporary; at 15x FY27 EV/EBITDA, the stock offers strong upside.

🇮🇳 Pair Trade Signal: LIC Housing Finance (LICHF IN) Long Vs. Canara Bank (CBK IN) Short (Smartkarma) $

The Canara Bank (NSE: CANBK / BOM: 532483) vs. LIC Housing Finance Ltd (NSE: LICHSGFIN / BOM: 500253) Price-Ratio has deviated more than two standard deviations from its one-year average, presenting a potential relative value opportunity.

The relative value opportunity can be implemented through stocks, derivatives, or as relative over-/underweights in a long only context.

This Insight provides a target return and discusses trade setup and risk management strategies.

🇱🇰 Sri Lanka publishes draft bill as it inches closer to setting up gaming regulator (GGRAsia)

The draft bill to establish a Gambling Regulatory Authority in Sri Lanka was gazetted on Tuesday under the directive of the country’s President Anura Kumara Dissanayake, in his capacity as minister of finance, planning and economic development.

Once approved in the nation’s parliament, the draft bill will come into effect as the Gambling Regulatory Authority Act.

Sri Lanka’s Cabinet of Ministers had approved in late April the draft bill, according to a government statement.

🇸🇦 Saudi Arabia unveils offshore securities business licence (The Asset) 🗃️

Scheme part of efforts to further open financial markets to international investors.

Saudi Arabia’s Capital Market Authority ( CMA ) has launched a public consultation on its proposed regulatory framework for an offshore securities business licensing scheme.

The scheme is part of the kingdom’s capital market reforms, aimed at gradually opening its financial markets to international investors. The reforms have attracted substantial global institutional interest, with foreign holdings reaching 423 billion Saudi riyals ( US$112.8 billion ) by the end of 2024.

🇹🇷 TAV Airports: A Toll Bridge In The Sky (Seeking Alpha) $ 🗃️

🇿🇦 South Africa’s Crumbling, Corrupt Electricity Monopoly (Asianometry) 29:27 Minutes

In January 2025, ESKOM, South Africa’s electricity monopoly, announced its first round of load-shedding in over ten months. Load shedding basically meaning rolling blackouts to prevent the grid from collapsing. 2024 had been a good year (relatively). Just 83 days of load-shedding. Not too bad after 332 days in 2023, and over 200 days of power cuts in 2022. ESKOM is one of South Africa’s biggest companies. It is also arguably its most important. And it is in shambles. In this video, the story of a state-owned electricity monopoly that triggered an energy crisis.

🇿🇦 Not Worth Owning Tencent Through Naspers (Seeking Alpha) $ 🗃️

🇿🇦 South Africa’s Banks Brace For Fallout From U.S. Rift (Seeking Alpha) $ 🗃️

🇵🇱 CD Projekt: AI Catalyst Poised To Slash Development Cycles And Boost Margins (Seeking Alpha) $ 🗃️

🇵🇱 Dino Polska Continues Smart Growth Strategy In Poland (Seeking Alpha) $ 🗃️

🌎 Adecoagro Trades Cheap, But Lacks Near-Term Catalysts (Seeking Alpha) $ 🗃️

-

🇦🇷 🇧🇷 🇺🇾 Adecoagro Sa (NYSE: AGRO) – Luxembourg HQ’s agro industrial company that produces & manufactures food & renewable energy. 3 segments: Farming; Sugar, Ethanol & Energy; & Land Transformation. 🏷️

🌎 MercadoLibre: Massive Growth Curve Ahead (Seeking Alpha) $ 🗃️

🇦🇷 Argentina takes baby step toward financial order with pricey $1 billion debt auction (Reuters)

Yield at auction beats expectations, signaling investor caution

Argentina’s reserves target with IMF seen as challenging

Argentina’s first major bond sale in seven years, a $1 billion offering with payments in pesos, is a clear sign that global investors are regaining their faith in a country recently mired in triple-digit inflation.

But the nearly 30% yield, higher than many expected, showed a high level of apprehension remains.

🇦🇷 Lithium Argentina: Deeply Undervalued And Strong Production Outlook (Seeking Alpha) $ 🗃️

🇦🇷 Bioceres Q3 2025 Illustrates The Financial Challenges And A Distressed Argentinian Market (Seeking Alpha) $ 🗃️

🇦🇷 Banco BBVA Argentina: Forced To Face The Real Economy In Milei’s Era (Seeking Alpha) $ 🗃️

🇦🇷 Banco BBVA Argentina Capitalizes On Macroeconomic Stabilization And Gains Market Share (Seeking Alpha) $ 🗃️

🇦🇷 Grupo Supervielle: A Great Bank In A Bad Neighborhood (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇦🇷 IRSA: Resilient Fundamentals And Long-Term Growth Potential (Seeking Alpha) $ 🗃️

🇦🇷 Central Puerto Positioned For Growth Amid Volatility (Seeking Alpha) $ 🗃️

🇧🇷 Ambev S.A.: How Are They Dealing With Competitive Market Dynamics & Other Risks? (Smartkarma) $

Ambev S.A.’s (Ambev (NYSE: ABEV)) recent financial disclosures provide a mixed picture for investors, underscored by a strong start to 2025 but tempered by broader economic challenges.

The company reported a robust top-line performance for the first quarter of 2025, with revenues rising by high single digits and EBITDA growing by double digits, despite nominal volume growth of just 0.7%.

This performance signifies healthy operational efficiency and strategic execution across various business pillars, though the flat net income reflects substantial tax comparisons from the previous year.

🇧🇷 StoneCo: Still Undervalued And Poised For More (Seeking Alpha) $ 🗃️

🇧🇷 PagSeguro: Back On Its Feet But Playing Catch-Up (Seeking Alpha) $ 🗃️

🇧🇷 Vale: Betting On Buybacks And Relevant Upside (Seeking Alpha) $ 🗃️

🇧🇷 More Than Iron – Vale’s Strategic Pivot To Critical Metals (Seeking Alpha) $ 🗃️

-

🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Braskem: A New Shareholder Specializing In Turnarounds Could Be The Trigger (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: The Neobank Mastering Growth Through Operational Excellence (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: The Misunderstood Quarter (Seeking Alpha) $ 🗃️

🇧🇷 Cosan: A Cheap And Powerful Way To Invest In Brazil’s Core Sectors (Seeking Alpha) $ 🗃️

🇧🇷 COPEL Q1: More Dividends Are Coming (Seeking Alpha) $ 🗃️

🇨🇱 Banco de Chile: A Safe Spot In A Turbulent Market With A 6.7% Dividend Yield (Seeking Alpha) $ 🗃️

🇨🇴 Deep Value In Oil: GeoPark’s 9% Yield And NAV Discount (Seeking Alpha) $ 🗃️

-

🌎 GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) – Leading independent Latin American oil & gas explorer in Colombia, Ecuador, Chile & Brazil. 🏷️

🇲🇽 Grupo Aeroportuario del Pacifico: Successfully Navigating Some Choppy Airspace (Seeking Alpha) $ 🗃️

🇲🇽 Vista Energy: Price Is In The Past, But The Company Is Already In The Future (Seeking Alpha) $ 🗃️

-

🇦🇷 🇲🇽 Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s – Mexico HQ’d. Main asset in Argentina is the largest shale oil & shale gas play under development outside North America. 🏷️

🇵🇦 Bladex: Growing Nicely, But In Riskier Economies (Seeking Alpha) $ 🗃️

-

🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🇵🇪 ‘Scratch the earth, there’s gold!’: Small miners, big firms and armed gangs fight over Peru’s mineral wealth (The Guardian)

🇵🇪 Cementos Pacasmayo’s Region Shows Growth, But The Name Is Still A Hold (Seeking Alpha) $ 🗃️

🇻🇪 Comments on US policy toward Venezuela – May 2025 (Latin America Risk Report)

The Hawks vs the Transactionalists

Special Envoy Ric Grenell flew to Antigua, negotiated a 60 day extension of the Chevron Corp (NYSE: CVX) license in return for Venezuela accepting more deportation flights and handing over a US Air Force veteran being held hostage by the Maduro regime. OFAC also dropped sanctions against a few corrupt Venezuelans who were involved in laundering regime profits.

Secretary of State Marco Rubio announced on Twitter that the current Chevron license would end on 27 May (today). No new license has been announced yet, but the rumor published by Bloomberg over the weekend is that the US will end the current license and issue a more narrow license that allows Chevron to continue only minimal maintenance operations.

🌐 Nebius: Rally Occurred Overly Fast, Reversing Momentum May Be Painful (Rating Downgrade) (Seeking Alpha) $ 🗃️ (?)

🌐 Nebius Is Still Undervalued After The Surge (Seeking Alpha) $ 🗃️

🌐 Nebius: AI Excellence In Motion (Seeking Alpha) $ 🗃️

🌐 Nebius Is Worth The Risk (Technical Analysis) (Seeking Alpha) $ 🗃️

🌐 Nebius: Yet Another Good Quarter (Seeking Alpha) $ 🗃️

🌐 Nebius: AI Scaling Right On Track (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

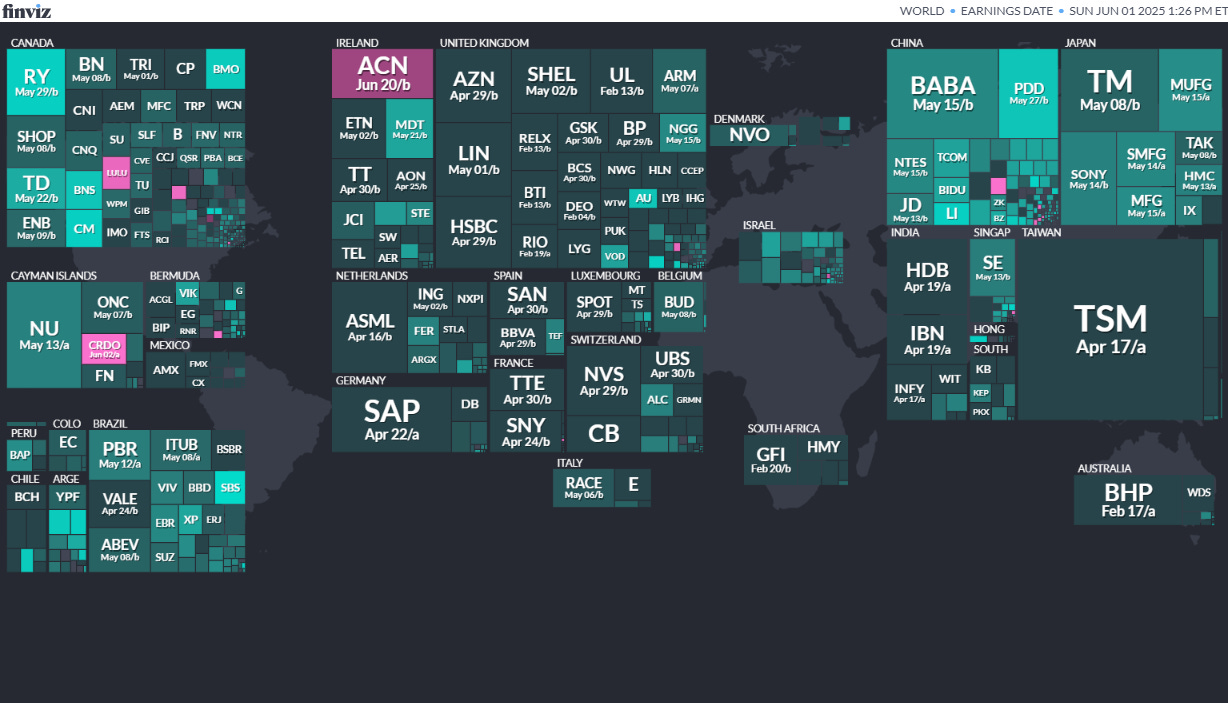

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

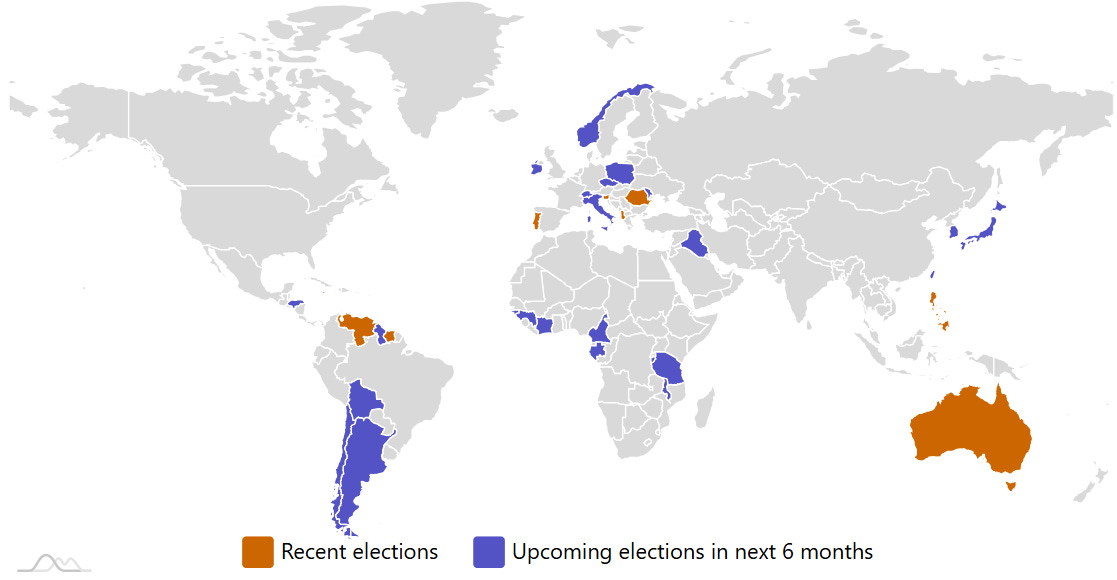

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

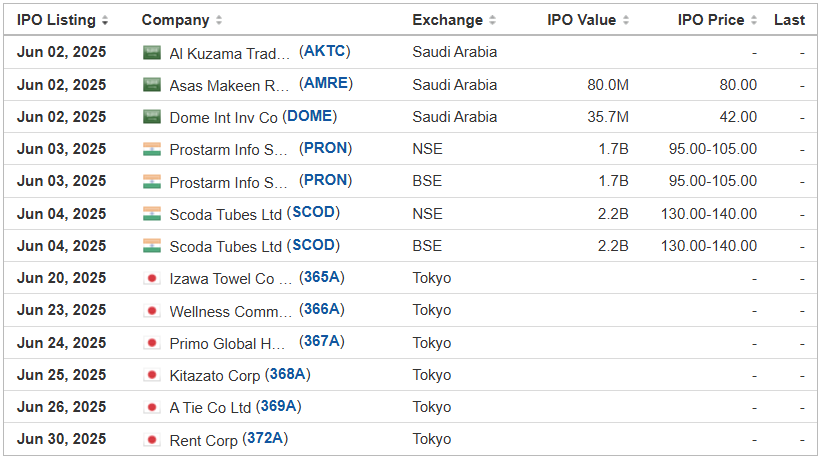

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

ALE Group Holding Limited ALEH D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-6.00, $7.5 mil, 6/9/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: D. Boral & Company (formerly E.F. Hutton) is the sole book-runner. Background: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Dalu International Group Ltd. DLHZ Revere Securities, 1.5M Shares, $4.00-6.00, $7.5 mil, 6/9/2025 Week of

We provide property management services as well as real estate leasing services in China. (Incorporated in the Cayman Islands)

We are an integrated property management services and commercial operation services provider, and we operate a real estate leasing business in Chengdu, the capital city of Sichuan Province, China.

With an operating history of two decades, our PRC subsidiaries have been focusing on providing property management services to owners, developers and occupiers of residential and commercial properties in Chengdu. Our PRC subsidiaries have accumulated extensive experience in the property management services sector. In addition, to drive our value growth and diversify our revenue streams, we also provide a variety of commercial operation services, primarily consisting of brand planning, market research and positioning consultancy, tenant sourcing and management, marketing and business support to owners and developers of commercial properties, and (we) engage in real estate leasing business.

We are a well-known property management brand in Chengdu, having undertaken property management and related services for well-known projects in some of the most prosperous commercial areas, such as the fashion center of Chengdu and one of the most popular pedestrianized shopping streets, Chunxi Road, and South Renmin Road in Chengdu’s central business district.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended September 30, 2024.

(Note: Dalu International Group Ltd. is offering 1.5 million shares at a price range of $4.00 to $6.00 to raise $7.5 million, according to its F-1 filings with the SEC.)

Delixy Holdings Ltd. DLXY Bancroft Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 6/9/2025 Week of

We trade crude oil and oil-based products, including fuel oils, gasoline, additives, gas condensate, in Southeast Asia and East Asia. (Incorporated in the Cayman Islands)

We are principally engaged in the trading of oil related products, which can be broadly categorized into (i) crude oil and (ii) oil-based products such as fuel oils, motor gasoline, additives, gas condensate, base oil, asphalt, petrochemicals and naphtha (heavy gasoline), in Southeast Asia and East Asia..

We have the financial capability to provide our customers with financing alternatives and credit terms

We are able to provide our customers with credit terms of up to 90 days by leveraging our strong balance sheet position as well as short term credit facilities available to the Group. Our ability to extend these advantageous credit terms to our customers allows us to cater to the diverse needs of our customers across multiple countries and to provide them with the financial flexibility they may require for their business operations. As of the date of this prospectus, the amount outstanding with respect to these credit facilities is zero.

We have an experienced management team with strong relationships across our value chain.

Our management team headed by our Executive Chairman, Chief Executive Officer and Executive Director Mr. Xie, has decades of trading experience and experience in oil trading as well as in the oil industry generally, including oil refining and logistics. We also maintain strong relationships with our suppliers, storage facilities providers and fleet and logistics providers, and are able to effectively service our clients and ensure a reliable supply of crude oil and oil-based products.

We have robust and strong risk management and internal controls capabilities

We believe that the ability to manage risk is one of our key strengths. Risk management is a core function under the supervision of our senior leadership structure. Our sound risk management practices have contributed to our positive performance through the volatile market environment in recent years and have helped to mitigate earnings volatility.

We are strategically located in Singapore, Asia’s refined products trading hub.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Delixy Holding Corp. is offering 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million, according to its F-1/A filings. Of the 2.0 million shares in the IPO. Delixy Holdings Ltd. is offering 1.35 million ordinary shares and the selling shareholders are offering 650,000 ordinary shares.)

FG Holdings FGO American Trust Investment Services/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 6/9/2025 Week of

We are a holding company whose Hong Kong subsidiaries run a FinTech platform that provides mortgage loan brokerage services. (Incorporated in the British Virgin Islands)

We offer – through our operating subsidiaries – a FinTech platform for mortgage loan brokerage services available through private credit and banks. The company gives borrowers mortgage application simulation and access to several mortgage loan options from various lenders.

Since our inception in 2019, FG Global has helped match 528 borrowers with more than $906 million in loans. That loan volume includes $401 million for the fiscal year that ended June 30, 2024.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: FG Holdings filed its F-1 on Nov. 18, 2024, and disclosed the terms for its small-cap IPO: 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million. Background: FG Holdings submitted confidential IPO documents to the SEC on Dec. 28, 2023.)

Happy City Holdings Limited HCHL Dominari Securities/Pacific Century Securities/Revere Securities, 1.0M Shares, $5.00-7.00, $6.0 mil, 6/9/2025 Week of

(Incorporated in the British Virgin Islands)

We are a restaurant operator that runs three all-you-can-eat hotpot restaurants through our wholly owned operating subsidiaries in Hong Kong. We have been in the restaurant services industry serving the Hong Kong market for over 5 years, which is a relatively short operating history compared to some of our established competitors. Our restaurants serve all-you-can-eat Thai and Japanese hotpot to our customers under the brand names “Thai Pot (泰金鍋)” and “Gyu! Gyu! Shabu Shabu (牛牛殿堂日式火鍋放題)”. As of the date of this prospectus, we operate three restaurants located in the Tsuen Wan District in the New Territories, the Mong Kok District in Kowloon, and the North Point District on Hong Kong Island.

For the years ended August 31, 2024, and August 31, 2023, our revenue was generated from providing food and beverage to customers in our restaurants in North Point, Mong Kok and Tsuen Wan.

We give customers set time limits for dining.

Note: Net income and revenue are in U.S. dollars for the year that ended Aug. 31, 2024.

(Note: Happy City Holdings Limited filed its F-1 on March 17, 2025, and disclosed the terms for its small-cap IPO: The company is offering 1.0 million shares at a price range of $5.00 to $7.00 to raise $6.0 million, if priced at the mid-point of its range.)

Kandal M. Venture Ltd. FMFC Dominari Securities/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 6/9/2025 Week of

(Incorporated in the Cayman Islands)

Through FMF, our operating subsidiary, we are a contract manufacturer of affordable luxury leather goods with our manufacturing operations in Cambodia. We primarily manufacture handbags, such as shoulder bag, crossbody bag, tote bag, backpack, top-handle handbag, satchel, and other smaller leather goods, such as wallets. Our customers are well-known global fashion brands that are headquartered in the United States.

With our craftsmanship and extensive knowledge of the leather goods manufacturing process, our product engineers convert our customers’ vision and design into leather goods products. Our products are primarily affordable luxury products that are made of leather and/or other materials.

Our Competitive Strengths

We believe the following competitive strengths differentiate our operating subsidiary from its competitors:

• Having long-term and strong business relationships with renowned global fashion brands but we cannot assure continued good relationships with them, and they are not obligated in any way to continue placing orders with us at the same or increasing levels, or at all;

• Having long-term collaborative relationships with our suppliers but their services are susceptible to fluctuations in pricing, timing, and quality, and we have limited control over their operations and compliance with regulations as we do not have long-term contracts with them;

• Having extensive understanding of leather goods manufacturing process, up-to-date machinery and efficient management resulting in competitive pricing while maintaining quality and high efficiency; and

• Having experienced management team with extensive knowledge of the leather goods manufacturing industry where we operate but we cannot assure the retention of key executives and personnel necessary to maintain or expand our business, and the loss of any member of our management team could negatively impact our business plan and expansion.

Our Strategies

We aim to accomplish our business objective, further strengthen our market position and continue to be a competitive manufacturer of leather goods by pursing the following key strategies:

• Broadening our customer base by expanding our geographical market reach to other key markets, including the European markets but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results;

• Enhancing our production capacity but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results; and

• Establishing a new design and development center for enhancing our product development capabilities but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results.

Corporate History and Structure

KMV is a holding company registered and incorporated in the Cayman Islands, and is not a Cambodian operating company. As a holding company with no material operations, we conduct our core business operations in Cambodia through our operating subsidiary, FMF.

On April 5, 2017, FMF is the Group’s key operating subsidiary and was established under the laws of Cambodia to engage in the business of leather goods manufacturing. FMF’s skilled craftsmanship and high-quality manufacturing capabilities are the cornerstones of the Group’s operations and reputation, allowing us to attract business from leading global brands. Customers issue letters of authorization directly to FMF which grant FMF the right to produce and export leather goods using their trademarks, and they frequently visit the production site of FMF located in Cambodia to inspect orders and conduct quality checks. PFL was incorporated under the laws of Hong Kong on November 3, 2016 as a trading company for the Group’s material procurement and customer invoicing.

Note: Net income and revenue are in U.S. dollars (converted from Cambodia’s currency) for the 12 months that ended March 31, 2024.

(Note: Kandal M. Venture Ltd. trimmed its small-cap IPO’s size to 2.0 million shares – down from 2.8 million shares originally – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its F-1/A filing dated Feb. 18, 2025.)

(Note: Dominari Securities and Revere Securities are the new joint book-runners, replacing the original book-running team of Cathay Securities and WestPark Capital.)

Vantage Corp. (Singapore) VNTG Network 1 Financial Securities, 3.3M Shares, $4.00-5.00, $14.6 mil, 6/10/2025 Tuesday

We are a shipbroker that connects ship owners with charterers. Our focus is on dirty petroleum products, petrochemicals, biofuels and vegetable oils. (Incorporated in the Cayman Islands)

We have three subsidiaries, namely Vantage BVI, Vantage Singapore and Vantage Dubai. Vantage BVI is a wholly owned subsidiary of the issuer, Vantage Cayman; and both Vantage Singapore and Vantage Dubai are wholly owned by Vantage BVI.

We were founded in 2012 by five seasoned shipbrokers with a mission of providing exceptional shipbroking services. We commenced operations with a team of over 20 specialists proficient in their various roles in the tanker markets which involves trading different types of oil and petrochemical products through vessel transportation, including clean petroleum products (“CPP”) and petrochemicals. Over the years, we underwent significant growth and evolution, expanding our shipbroking services to cover dirty petroleum products (“DPP”), biofuels and vegetable oils. Additionally we established a sales & projects team, a research/strategy team and an IT team. We have expanded to over 50 dedicated professionals as of May 2024, with offices in both Singapore and Dubai.

We specialize in providing comprehensive shipbroking services, including operational support and consultancy services, tailored to the tanker markets. Rooted in our expansive network and decades of collective experience within the marine sector, we have emerged as a trusted intermediary, facilitating transactions between shipowners and charterers across diverse segments of the tanker market, and ensuring smooth logistical flow for cargo deliveries to timely demurrage and claims settlements.

Our suite of shipbroking services is designed to optimize outcomes for our clients, offering a holistic approach to addressing their needs and objectives. As a pivotal link between oil companies, traders, shipowners, and commercial managers, we deliver a range of services including: identifying market opportunities and information for our clients, recommending interested parties (shipowners and cargo owners) to each other, advising interested clients on strategies on vessel deployment or fleet mix, specifications and capabilities, facilitating contract negotiations, ensuring smooth logistical flow, as well as resolving issues that arise during the execution of chartering agreements.

Our Industry

The global shipbroking market was valued at $1.56 billion in 2022, with the oil tanker sector (excluding gas carriers) valued at $422 million. The oil tanker shipbroking sector is poised to grow at a CAGR of 3.32% between 2022-2027. According to the 2023 Shipbroking Market report by Technavio, the European and Asia Pacific shipbroking market collectively account for about 81% of the global shipbroking market.

Note: Net income and revenue are in U.S. dollars for Fiscal Year 2024, which ended March 31, 2024.

(Note: Vantage Corp. filed an F-1/A dated Nov. 20, 2024, in which it disclosed its proposed symbol “VNTG” and the terms for its IPO: The company is offering 3.25 million shares at a price range of $4.00 to $5.00 to raise $14.63 million. Background: Vantage Corp. filed its F-1 for its IPO on Oct. 9, 2024, with estimated initial proceeds of about $16 million. Vantage did not disclose a proposed stock symbol in its F-1 filing.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

04/02/2025 – Goldman Sachs India Equity ETF – GIND

-

03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

-

02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

-

02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

-

02/14/2025 – GMO Beyond China ETF – BCHI

-

02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

-

01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

-

01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (June 2, 2025) was also published on our website under the Newsletter category.