Emerging Market Links + The Week Ahead (November 6, 2023)

Latin America Risk Report has done another good map visualizing Latin America’s ideological landscape as of Q4 2023. As discussed in a podcast mentioned in out October 3rd post, investors always hope a moderate centralist right candidate will emerge from Latin American elections as ultimately what matters are fiscally responsible policies and the central bank being free to do its job.

However, business friendly Panama is now experiencing protests over a mining contract with a Canadian listed firm. In other words, Panama might be about to swing back in the other direction.

$ = behind a paywall

Note: I am still in Kyoto until this coming Monday. The Tuesday post will likely belater in the week…

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 JingDong-JD (InvestingWithWes Newsletter)

The second bull case is valuation. Even if JD.com (NASDAQ: JD) does not grow at all or show a low growth rate over the next 5 years the company will earn its entire enterprise value($26 billion) in free cash flow over that period. This company is being priced with very low expectations so it would not take a lot for the stock price to move upwards.

The Second bear case is growth. JD has always been a company that has managed to grow its revenue at an astronomical pace but that has changed in recent years.

The Third bear care is competition. The Chinese E-commerce industry is getting very competitive with the likes of PDD Holdings (NASDAQ: PDD) or Pinduoduo, JD and Alibaba (NYSE: BABA) competing for market share. Alibaba dominates in terms of market share followed by JD.

🇨🇳 China Tower (788 HK) (Asian Century Stocks)

China Tower (HKG: 0788 / OTCMKTS: CHWRF)

State monopoly at a forward P/E of 11x and rapidly falling depreciation charges

The company is a state-owned enterprise that owns virtually all telecommunication tower infrastructure in China. It was formed in 2014 when China’s three large telecom operators injected their assets into this entity. They’re also the company’s three largest customers.

The government wanted to reduce the duplication of resources and increase efficiency in the sector. In my view, it also wanted to level the playing field between leading telecom operator China Mobile (HKG: 0941 / 80941 / FRA: CTM) and its weaker competitors China Telecom Corp Ltd (HKG: 0728 / SHA: 601728) and China Unicom (HKG: 0762 / FRA: XCI).

🇨🇳 Transsion closes in on Xiaomi, Oppo with developing-market focus (Bamboo Works)

The Shanghai-listed company’s stock has jumped 73% this year as it consolidates its position as the leading smartphone seller in Africa

Shenzhen Transsion Holdings’ (SHA: 688036) smartphone shipments rose 35% in the second quarter, making it one of the world’s top five smartphone makers for a second consecutive quarter

The company’s Shanghai-listed shares have quadrupled since its 2019 IPO, and are available to international investors via the Shanghai-Hong Kong Stock Connect program

🇨🇳 Hong Kong’s Kingboard sucked Into China’s river of property defaults (Bamboo Works)

The laminates maker’s failure to collect a massive debt owed by Country Garden is raising concerns that many more listed companies may have similar exposure

Kingboard (HKG: 0148) said it has yet to collect 1.6 billion yuan it is owed by struggling developer Country Garden

The Hong Kong-based laminates maker said it sees little chance of collecting the debt, and expects to make a provision for it

🇨🇳 Midea Group (000333 CH): Not That Correlated To China Property (SmartKarma) $

Midea (SHE: 000333) has officially filed for Hong Kong listing last week.

A common pushback against owning the stock is the perception of strong correlation to China property, which is not true in terms of business fundamentals.

The stock is currently trading at 10x 2024E PE compared to an average of 13x over the last 10 years.

🇨🇳 Linklogis deconstructed by China’s slumping property market (Bamboo Works)

Supply chain financing assets processed over the company’s key platforms fell in the nine months to September as real estate companies’ troubles deepened

The total volume of supply chain assets processed by Linklogis (HKG: 9959 / FRA: 0NY / OTCMKTS: LNKLF) two key platforms decreased in the first nine months of 2023, as its customer retention rate dropped

The provider of supply chain financing services has reduced its reliance on real estate companies, but the sector still remains a major customer group

🇨🇳 Golden Heaven Group coasts on major amusement park expansion (Bamboo Works)

The company’s stock has tripled since its April IPO, much of that after it announced plans to build three new regional amusement parks last month

Golden Heaven Group (NASDAQ: GDHG) will build three new amusement parks costing nearly 600 million yuan combined, boosting its portfolio by more than 50%

The company’s status as a regional amusement park operator helped it to remain profitable during the pandemic, even as its larger rivals lost money

🇨🇳 Yum China ‘rediscovers’ its fast-food roots in budget-conscious times (Bamboo Works)

The operator of KFC and Pizza Hut restaurants in China has been expanding its price range to tap underserved consumers

YUM China (NYSE: YUMC) reported record third-quarter revenue and adjusted operating profit, which rose 15% and 10% year-on-year, respectively, in constant currency

The company is widening its food prices to capture an underserved segment at the value end of China’s pizza market and expand the lower range of its KFC offerings

🇨🇳 China’s mRNA pioneer Stemirna faces post-Covid reinvention test (Bamboo Works)

The biopharma company that led the way in Chinese mRNA research is battling a wave of lawsuits and financial woes, including court limits on its founder’s spending

Flush with funds from its backers, Stemirna built manufacturing plants that were able to produce up to 400 million vaccine doses a year and put together a sales force for an anticipated surge in Covid demand

But after the pandemic opportunities have faded, Stemirna is rebranding itself as a research and manufacturing partner for the drug industry

🇹🇼 Silergy (6415.TT): The Revenue Could Be Upside Around 17% in 4Q23F. (SmartKarma) $

Revenue was up 14.5% QoQ and down 31% YoY in 3Q23, but it could see an increase of about 17% QoQ and 3% YoY in 4Q23F.

Silergy (TPE: 6415 / OTCMKTS: SLEGF) needs to increase another place to its Foundry source out of China and Taiwan.

The Automotive segment is expected to show significant growth and is likely to reach double digits by the end of 2024F.

🇯🇵 Saizeriya (7581 JP): Best Pick For Asia/China Restaurant Space (SmartKarma) $

I continue to believe that Saizeriya (TYO: 7581) is the best pick for gaining exposure to Asia/China restaurant space.

Saizeriya has a very clear business strategy and focus: price. The founder Yasuhiko Shogaki made it clear that price always comes first, and everything else second.

Looking ahead, the runway for growth in China is huge. The company is currently only in 3 cities for a total of 373 stores as of end-FY23 year ending August.

🇰🇷 Concerns About A Major Accounting Fraud at Kakao Mobility (SmartKarma) $

It was reported in numerous local media in Korea that FSS is investigating Kakao (KRX: 035720) for a potential accounting fraud.

There are suspicions that Kakao Mobility may have artificially inflated its sales from 2020 to 2023 to enhance the value of the company prior to its IPO listing.

Given that the regulators are unlikely to make a final decision on this matter until next year, this is likely to be negative on both Kakao Mobility and Kakao Corp.

🇰🇷 SK Hynix. DRAM To The Rescue (SmartKarma) $

SK Hynix (KRX: 000660) reported Q323 revenues of 9.066 trillion won, up 24% QoQ but still down 17% YoY

Net income was -2.185 trillion won, a 27% improvement on the losses in the prior quarter.

While DRAM has turned profitable, NAND remains stubbornly loss making and is likely to remain so for the foreseeable future

🇰🇷 Korea Small Cap Gem #26: LF Corp – A Deep Value Play and the Lee Hyori Effect (SmartKarma) $

Lf Corp (KRX: 093050) is the 26th company in our Korea Small Cap Gems series.

LF Corp is one of the leading apparel companies in Korea which has a market cap of 411 billion won. LF Corp is trading at 0.3x P/B and 4x P/E.

A key near-term catalyst is better than expected sales of the Reebok branded apparel that are promoted by the pop icon Lee Hyori.

🇰🇷 LS Materials IPO Valuation Analysis (SmartKarma) $

Our base case valuation of LS Materials IPO is target price of 6,628 won per share, which is 21% higher than the high end of the IPO price range.

We estimate LS Materials to generate sales of 155.5 billion won (down 4% YoY) and 197.2 billion won (up 26.8% YoY) in 2024.

LS Materials is one of the largest players globally in the large-size ultracapacitors, which stabilize power supply and are used to replace and supplement primary batteries and lithium-ion batteries.

🇸🇬 3-in-1: GRAB + Uber + Ride-Hailing Industry Primer (Value Investing Substack) $

“Think of Mobility & Deliveries businesses as breakeven Group CAPEX — Advertising could be where the actual profit is made, and it hasn’t even gotten started yet.”

Uber Technologies, Inc (NYSE: UBER) shares have gained +75% YTD – is GRAB’s turn next?

In This Report: The comprehensive Grab Holdings Limited (NASDAQ: GRAB) equity research primer that you’ve been waiting for — with all the necessary numbers for valuation

🇸🇬 Maxeon Solar: A Speculative Buy With A Bright Spot In The Global Solar Landscape (Seeking Alpha) $

Maxeon Solar Technologies (NASDAQ: MAXN)‘s diversified product range and global market presence have positioned it well in the expanding solar photovoltaic market, particularly in the Asia-Pacific region.

Despite a 9% QoQ and 46% YoY revenue increase in Q2 2023, contractual issues with SunPower led to a Bank of America rating downgrade from Buy to Neutral.

Expansion of the Albuquerque facility and strategic shift toward Commercial and Industrial sectors aim to bolster Maxeon’s market position amid changing demand dynamics.

The acquisition of Solaria’s sales channel assets plus the Department of Energy loan application underscores the company’s strategic moves to mitigate operating and financial challenges.

My valuation model suggests a “Buy” rating with a $7.90 price target for MAXN, although I acknowledge it as a speculative buy due to numerous market uncertainties.

🇸🇬 Maxeon: Strong Technology But Challenging Financials (Seeking Alpha) $

Maxeon Solar Technologies (NASDAQ: MAXN) has leading solar technology but faces near-term headwinds that warrant caution.

The company operates on thin margins and a heavy debt burden, making profitability elusive.

Recent slowdown in financial results and disputes with major customer SunPower add to the uncertainty.

🇸🇬 Karooooo Ltd. Increases Focus On Cartrack Division In Asia (Seeking Alpha) $

Karooooo Ltd. (NASDAQ: KARO) reported top-line revenue and operating income growth in its FQ2 2024 financial results.

The company offers telematics services and a used car trading platform.

Management’s focus on Southeast Asia may take time to generate results due to the slow recovery in China, potentially negatively affecting the region.

I remain on Hold for Karooooo Ltd. but with an eye to improved revenue growth prospects ahead.

🇨🇱 Enel Chile: Inexpensive Choice With Reliable Dividends (Seeking Alpha) $

Enel Chile (NYSE: ENIC) a subsidiary of Enel SpA (BIT: ENEL), has been executing its energy transition plan, with a significant shift towards renewable energy sources, making up around 76% of its energy generation.

The company’s strategy focuses on sustainable growth in renewables, strengthening its balance sheet, and delivering value to shareholders through dividends, even in the face of recent macroeconomic challenges.

Enel Chile’s stock shows attractive valuation multiples compared to peers, and it has the potential to provide consistent and appealing dividends with a minimum payout of 50%.

🇧🇷 Petrobras preferred stock: Still cheap (AlmostMongolian)

Petrobas (NYSE: PBR / PBR-A / BVMF: PETR4)

Gradually re-rating while paying big dividends

The administration is not a big worry for me. I thought the discount would start to narrow as the market sees it’s not that bad and it has. We have the Lula administration and this was the stock price last time Lula was in power.

🇨🇴 Almacenes Éxito: Low Earnings Let Down An Otherwise Strong Company (Seeking Alpha) $

ADRs of Colombian grocer Almacenes Exito Sa (NYSE: EXTO) have seen a 26% increase in price since August, with a big jump seen two weeks ago.

A stake sale at elevated valuations has encouraged investors. The retailer, with a strong presence in Colombia and Uruguay, has good sales growth as well, supporting the valuations.

However, its net income is wanting. And even considering optimistic earnings estimates for 2023, it’s forward P/E is high.

🇧🇷 BHP aims to settle over Brazil dam disaster (FT) $ 🗃️

🇲🇽 Qualitas after Q3 (searching 4 value)

See: Quálitas Controladora (BMV: Q): A Potential NAFTA and Mexico Nearshoring Play

strong growth, pressured UW profit, CR peaking?

Quálitas Controladora (BMV: Q) is currently a 7.7% position for me (not low for EM), and I feel comfortable holding the stock, though at 2.9x P/B they are not screamingly cheap. Since it is always easier to list and see the positives if a stock is trading higher everything is to be taken with a grain of salt!

🇲🇽 Volaris Stock Beaten Down As It Navigates Through GTF Challenges (Seeking Alpha) $

Volaris (NYSE: VLRS) reported Q3 results with missed EPS but beat revenue estimates.

The company adjusted its full-year guidance due to issues with the Pratt & Whitney geared turbofan.

Volaris plans to redistribute capacity to international routes and negotiate compensation for grounded aircraft.

🇲🇽 FEMSA Undervalued Despite Ongoing Excellence Of Execution (Seeking Alpha) $

Fomento Economico Mexicano SAB de CV (NYSE: FMX) performed well in the third quarter, including double-digit volume growth from Coca-Cola FEMSA and mid-teens same-store sales growth in its core OXXO operations.

The company’s capital return plans and potential entry into the U.S. convenience store market are areas of interest for investors, but details have been slow to arrive.

FEMSA’s retail operations, particularly Oxxo, have significant growth opportunities in Mexico, Brazil, and other Latin American countries, as well as the U.S.

Today’s price gives too little credit to the quality and growth potential of this leading Mexican consumer business.

🇵🇪 Cementos Pacasmayo: Decent Q3 Results As Cement Demand In Peru Remains High (Seeking Alpha) $

The company’s revenues went down by 6.7% in Q3 2023 while its EBITDA rose by 3.2% thanks to the completion of a new kiln at the Pacasmayo plant.

In my view, the EBITDA margin could surpass 26% in 2023 as clinker production from the new facility ramps up.

Cement demand in Peru remains above pre-pandemic levels and it seems low GDP growth is having a muted effect at the moment.

With cement demand remaining resilient, I continue to think Cementos Pacasmayo (NYSE: CPAC) should be trading at above 8x EV/EBITDA.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China’s Age of Malaise (The New Yorker)

Party officials are vanishing, young workers are “lying flat,” and entrepreneurs are fleeing the country. What does China’s inner turmoil mean for the world?

🇨🇳 China’s wave of ministry-level leadership shakeups rolls on in October (Caixin) $

Seven out of the 26 ministry-level departments of China’s State Council have experienced a reshuffle of top officials since March, when the country elected a new slate of cabinet members, with four of the adjustments taking place in October alone.

On Tuesday, deputy party secretary of Shandong province Lu Zhiyuan was shown as the top party official of the Ministry of Civil Affairs on the ministry’s website, replacing Tang Dengjie, who was recently appointed party secretary of Shanxi province.

🇨🇳 China signals tighter Communist party control of financial sector (FT) $ 🗃️

🇮🇳 Foreign investors sell Indian stocks at fastest daily pace in a year (FT) $ 🗃️

🌍 Gaza conflict shakes Middle East economies (FT) $ 🗃️

🌎 Mapping Latin America’s ideological landscape – Q4 2023 (Latin America Risk Report)

🇵🇦 Copper, the Canal, and Chaos. Panama is Proving Its Global Relevance. (Calvin’s thoughts) $

At the time of writing, I am back at my home in Chiriqui province, where we have had no fuel deliveries due to the ongoing protests for that entire time. Until today, even food shipments from the main agricultural regions of the country (the mountains that surround me) were largely blocked. Only due to the brave actions of local mayors and farmers have district level roads been cleared. The Panamerican highway that links the city to the food producing regions near Costa Rica remains blocked in several key choke points where there is only a single bridge over a river. The situation remains quite tense. Just last night, Panama’s largest union said that they would not back down until the Supreme Court of the country invalidates First Quantum’s mining contract.

From a financial perspective, I hope some of you were able to benefit from my call out to get out of (or short) First Quantum (TSE: FM / FRA: IZ1 / OTCMKTS: FQVLF) stock.

🇬🇾 A Record Oil Gusher Infuses Tiny Guyana With Wealth and Worries (WSJ) $ 🗃️

See: CGX Energy (CVE: OYL / FRA: GXCN / OTCMKTS: CGXEF): A Speculative Guyana Oil Small Cap Stock

The South American country has become the next energy powerhouse, bringing jobs, rib-eye steaks—and a jarring new reality

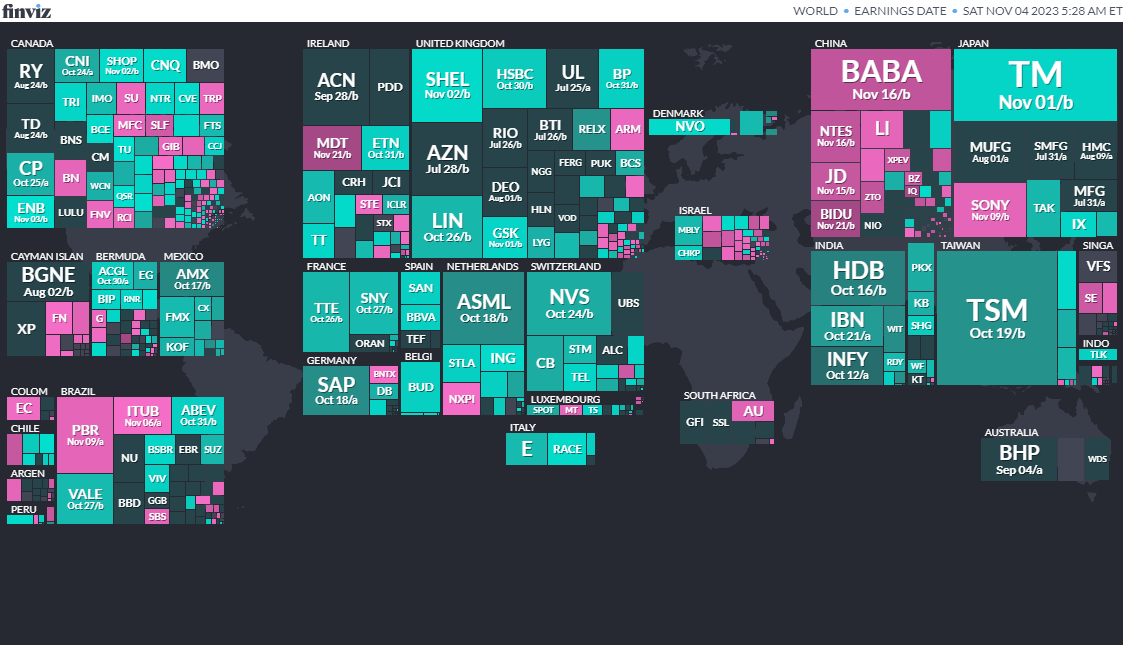

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

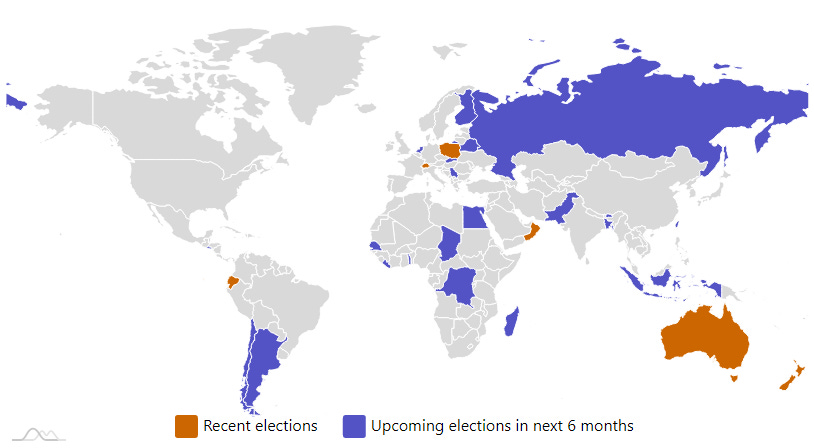

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Argentina Argentinian Presidency Nov 19, 2023 (d) Confirmed Oct 22, 2023

-

Egypt Egyptian Presidency Dec 10, 2023 (d) Confirmed Mar 26, 2018

-

Chile Referendum Dec 17, 2023