EPR Real Estate Stock: Improved Portfolio and Strong Financials

Molchanov Dmitry

outline

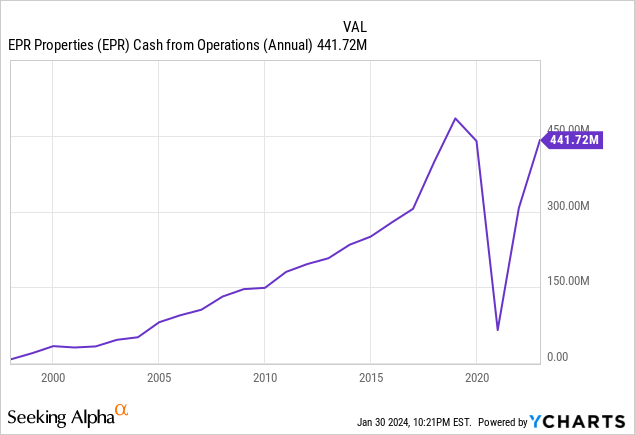

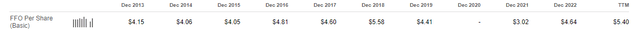

In our previous analysis of EPR properties (New York Stock Exchange:EPR), I discussed how I believed a dividend increase was coming. I still believe that to be true, but I’d like to revisit EPR to discuss any updates. finance. I still like this level of EPR and the monthly dividends are a great bonus. As the experience economy continues to grow steadily every year, REITs are expected to grow sufficiently in the future. The key update here is a move away from the Regal exposure it had previously and an improvement in its finances due to expected interest rate cuts. As we progress through the year and more progress is made in the theater sector, I believe we will see some nice price increases when combined with rate reductions. Lastly, for your information, I think the stock is undervalued. FFO per share. We are currently approaching the same FFO per share as in 2018, but the price is still below our projected $60 per share.

EPR Investor Presentation

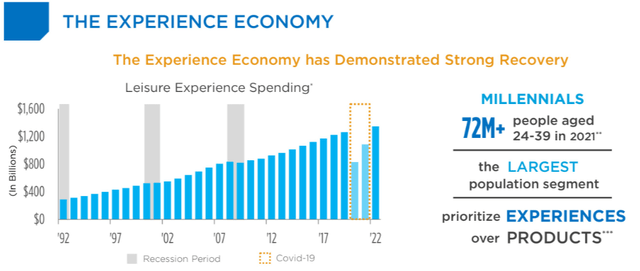

EPR Properties is a leading diversified empirical net rental REIT. I think their business model is very unique because it focuses on experience-driven assets. In my opinion. I think this is a modern take on the typical plaza or shopping mall environment, because these spaces are now being used in more meaningful ways. With total assets of approximately $6.7 billion, distributed across 44 states, we maintain excellent underwriting and investment standards. EPR focuses on cash flow standards at the tenant level to ensure a healthy level of cash cushion.

Portfolio Improvement

EPRs vary depending on location and property type. 93% of the portfolio consists of experience-type properties. The largest part of this consists of theaters, accounting for 39% of the total. This is followed by eating and playing (24%), tourist attractions (11%), and ski resorts (8%). EPR is making active progress in improving and fine-tuning its portfolio. For example, the last quarterly report showed $36.8 million allocated for development and redevelopment projects starting in 2022 and 2023. This brings total investment expenditures to date to $135.5 million.

Significant progress has been made in capital recycling initiatives with regard to fine-tuning. Capital recycling means repurposing existing assets and reinvesting the proceeds into new opportunities. Successfully sold and converted two KinderCare facilities to school use, generating $13.8 million in revenue and approximately $1.5 million in profit. The sale brings a total of three of the five KinderCare stores up for sale, and a purchase agreement has been signed for the fourth store. Additionally, a Cinemex theater in Florida was sold and repurposed for non-theatrical use, resulting in net proceeds of $9 million and a profit of approximately $750,000.

Finally, in a previous article I mentioned how they were making progress to reduce their exposure to Regal as they restructured their finances. As of last quarter’s report, the first of 11 Regals was successfully sold, generating net proceeds of $3.7 million and realizing a gain of approximately $300,000. I expect more theaters to be sold, adding to a nice cash buffer going forward.

finance

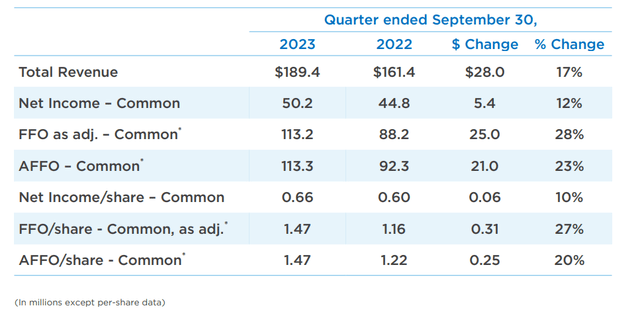

EPR revised its FFOAA outlook to $5.10 to $5.18 per share, an improvement from its previous range of $5.05 to $5.18. It’s a minimal improvement, but we believe this new range is more accurate as Regal Theaters continues to adjust its portfolio. It’s clear that management understands the feedback around high theatrical exposure and the efforts they are putting in will continue to generate additional revenue throughout the year.

Additionally, capex is expected to be in the range of $200.0M-$300.0M. FFOAA per share was $1.47, beating analysts’ average estimate of $1.39. As previously mentioned, this additional capex is not surprising as the company’s cash position is swelling due to theater sales.

Total revenue was an impressive $189.4 million, a significant increase compared to $172.9 million in the second quarter and $161.4 million in the year-ago quarter. Operating expenses for the quarter totaled $104.6 million. One of the best things reported last quarter was that we collected $19.3 million in deferred rent from cash-based customers, which we recorded as additional revenue. EPR successfully collected more than $150 million in rent and interest deferred due to the pandemic. This strengthens our confidence that its balance sheet is trending in a positive direction and is in line with its prospects for further growth from here.

Dividends and Valuation

Based on the recently announced monthly dividend of $0.275, the current dividend yield is just over 7%. The dividend here is fairly safe, with a payout ratio of just 64%. Although dividend growth has been lacking, we expect this to turn around in the near future. Consensus estimates call for the annual dividend to increase from $3.30 per share to $3.34 per share.

EPR Investor Presentation

The average price target on Wall Street is 48.85%. This represents a modest upside of 8.7%. However, when you combine this with the high dividend yield of 7%, you’re looking at a potential return of 15% per year. I think this makes sense since there are several other indicators here that can signal undervaluation.

For example, the current P/AFFO is 8.78x. This makes it almost 40% undervalued compared to its industry’s average P/AFFO of 15.03x. Once things start to align in their favor, they feel comfortable starting a position here. Lower interest rates and increased profitability make people buy them. The four-year dividend yield average is 6.57%, so the price can be expected to rise somewhat once the expected interest rate cut occurs.

I think the fair value is around $60 per share, with expected earnings growth of 4% per year. This is a reasonable expectation as interest rates are low and this level of growth was achieved prior to the pandemic. FFO per share in 2018 was 5.58x. The price range at the time was $60-$70 per share. We expect it to rise again to these levels as FFO per share approaches these same levels. Now that the pandemic is over and the macro environment is shifting in their favor, I think this is more than possible.

pursue alpha

Lower interest rates are generally considered beneficial for REITs because they lead to lower borrowing costs. This can lead to increased profitability and increased shareholder dividends. With 4.5x interest coverage, 3.8x fixed charges coverage and 4.5x debt service coverage, EPR is flush with cash and there are no signs that its dividend is in jeopardy.

risk profile

EPR Properties’ performance is intricately tied to consumers’ willingness to allocate discretionary income to the travel and leisure experiences that form the core of the company’s experience assets. Theatrical exposure has caused some people to stop investing in EPR, which is understandable. Now that services like Netflix (NFLX) are so easily and inexpensively available, I don’t go to the theater as often as I used to.

The assumption is that lower interest rates will help increase spending in the economy. It is possible that rate cuts will not occur as expected in March 2024 and consumer spending will remain somewhat tight. I think it’s important to pay attention to how the Fed’s announcements play out in the coming months. At the very least, I’m confident that EPR will survive another rough patch, as it maintains a solid liquidity position with $137 million in cash on hand. They have a 99% unsecured debt portfolio with a fixed interest rate that does not mature this year.

takeout

As we re-evaluate EPR Properties, the company’s financial resilience and strategic moves highlight its potential for continued growth. Portfolio improvements, including successful capital recycling initiatives such as the repurposing of KinderCare locations and Cinemex theaters, demonstrate that EPR is making progress to increase the quality of its portfolio.

They also demonstrated strength with revised FFOAA (funds from operations adjusted for affiliate income) outlook per share, impressive revenues, and pre-collection of deferred rent. The combination of a solid dividend yield of over 7%, potential share price upside, and undervaluation indicators makes EPR an attractive investment. Despite the inherent risks associated with consumer spending on experiential assets, EPR’s diverse portfolio and strong liquidity provide the foundation for navigating economic uncertainty. While monitoring factors such as interest rate cuts and consumer spending trends are important in the near term, EPR’s strategic positioning suggests that it is well-poised for future growth and income generation.