Flat month for miners after volatile April

April was a month filled with significant activity and volatility for Bitcoin miners. Much of the month has been spent anticipating Bitcoin’s halving and the launch of Loon, with many analysts and market experts warning of the devastating impact this could have on the mining sector.

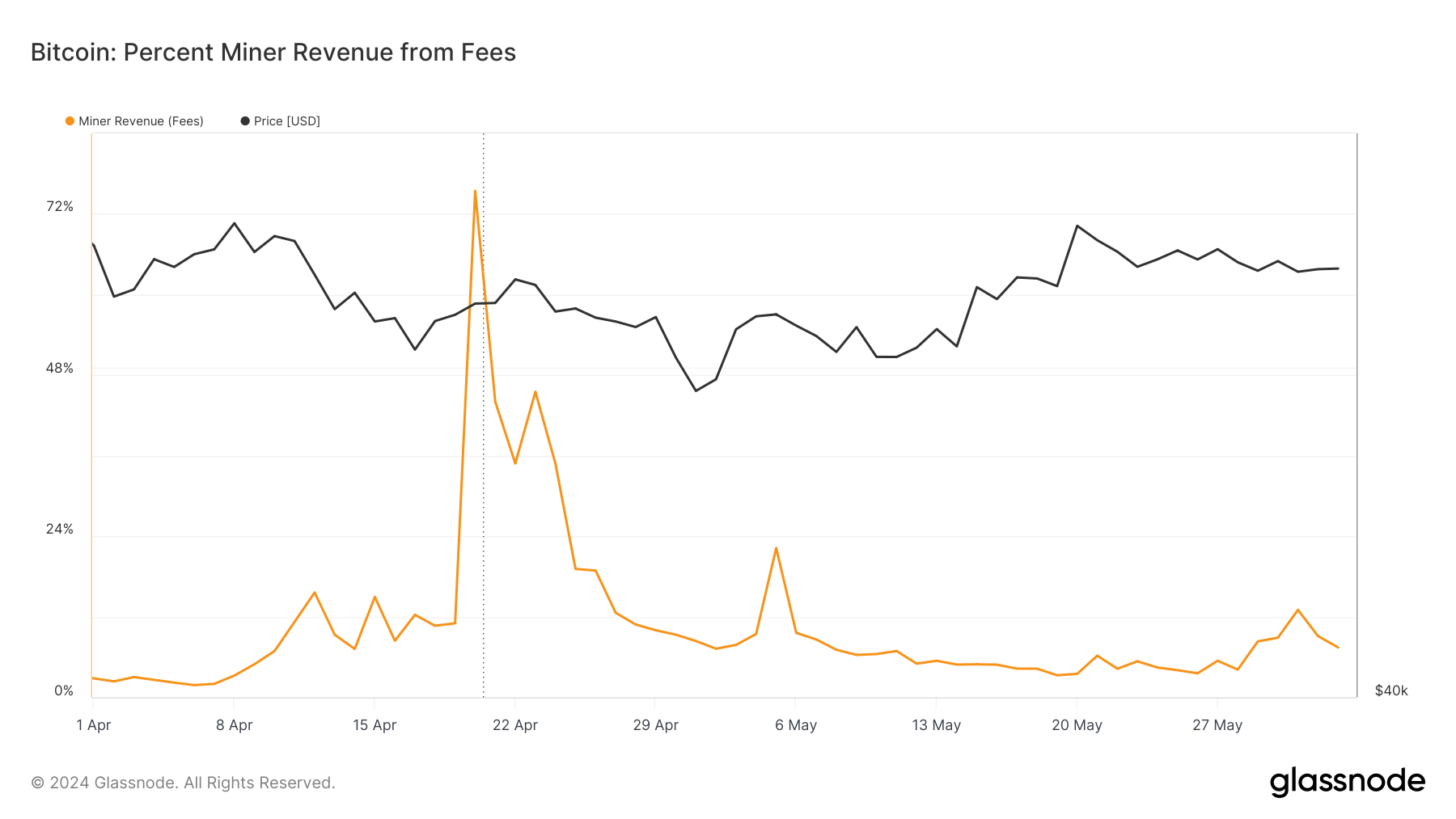

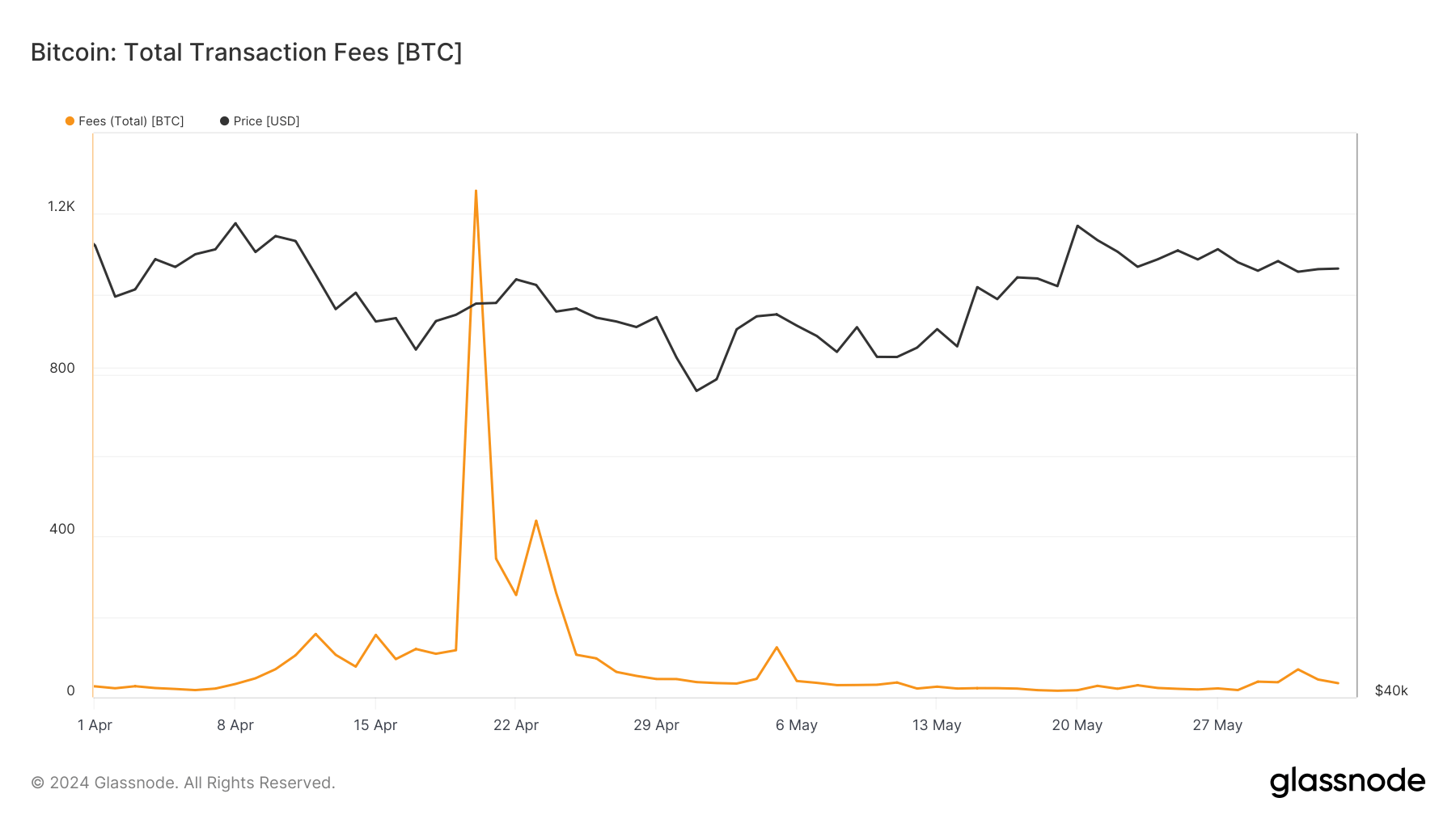

As expected, the combination of halving and runes drove transaction fees and miner revenue to unprecedented levels. A total of 1,257 BTC in fees were paid to miners, accounting for 75.44% of total fee revenue.

By May, the mining industry was experiencing a period of calm and tranquility. Glassnode’s data showed stability across several mining metrics, despite the broader market experiencing significant volatility.

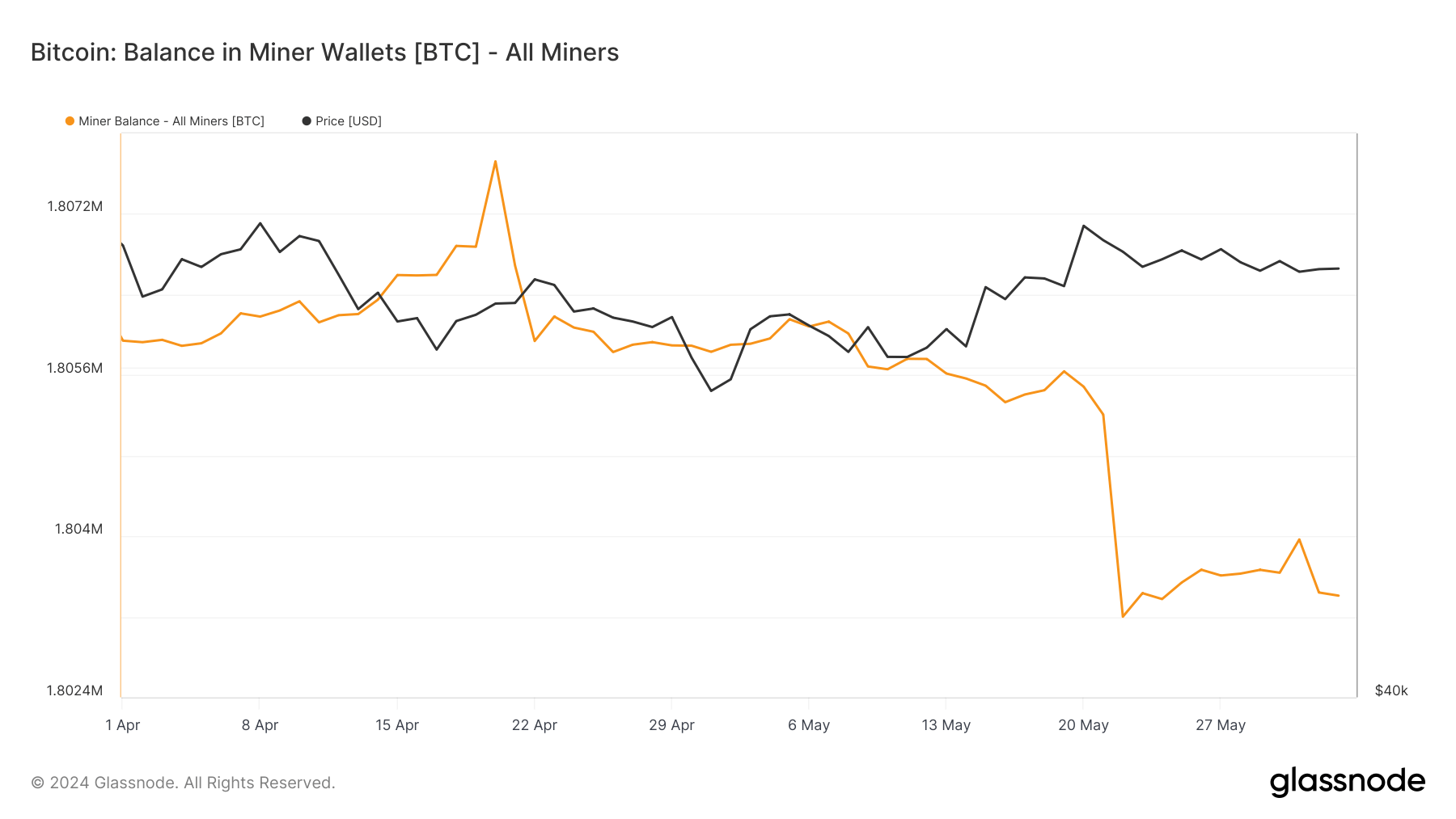

The amount of BTC held in miners’ wallets soared vertically on April 20, surpassing 18.07 million BTC. However, this surge was short-lived as miners offloaded most of their newfound profits. The balance returned to 18.05 million BTC by the end of April and remained stable throughout May. By June 3, it had slightly decreased to 1.803 million BTC. This balance stability shows a period of balance and a decrease in activity compared to April. This indicates that miners are not aggressively selling off their holdings or accumulating new coins significantly, preferring instead to hold positions and only cover operating costs.

Transaction fees, an important indicator of miner revenue and network activity, also reflected these changes. The explosive fee increase was short-lived, reaching 1,257.71 BTC on April 20, before dropping to 253.93 BTC on April 22, and further falling to 16.35 BTC in the second half of May. By June 2nd, fees had risen slightly to 35.13 BTC, but this was still far from the highs seen in April. This fee reduction can largely be attributed to the waning interest in Runes and the overall decline in network congestion and transaction volume.

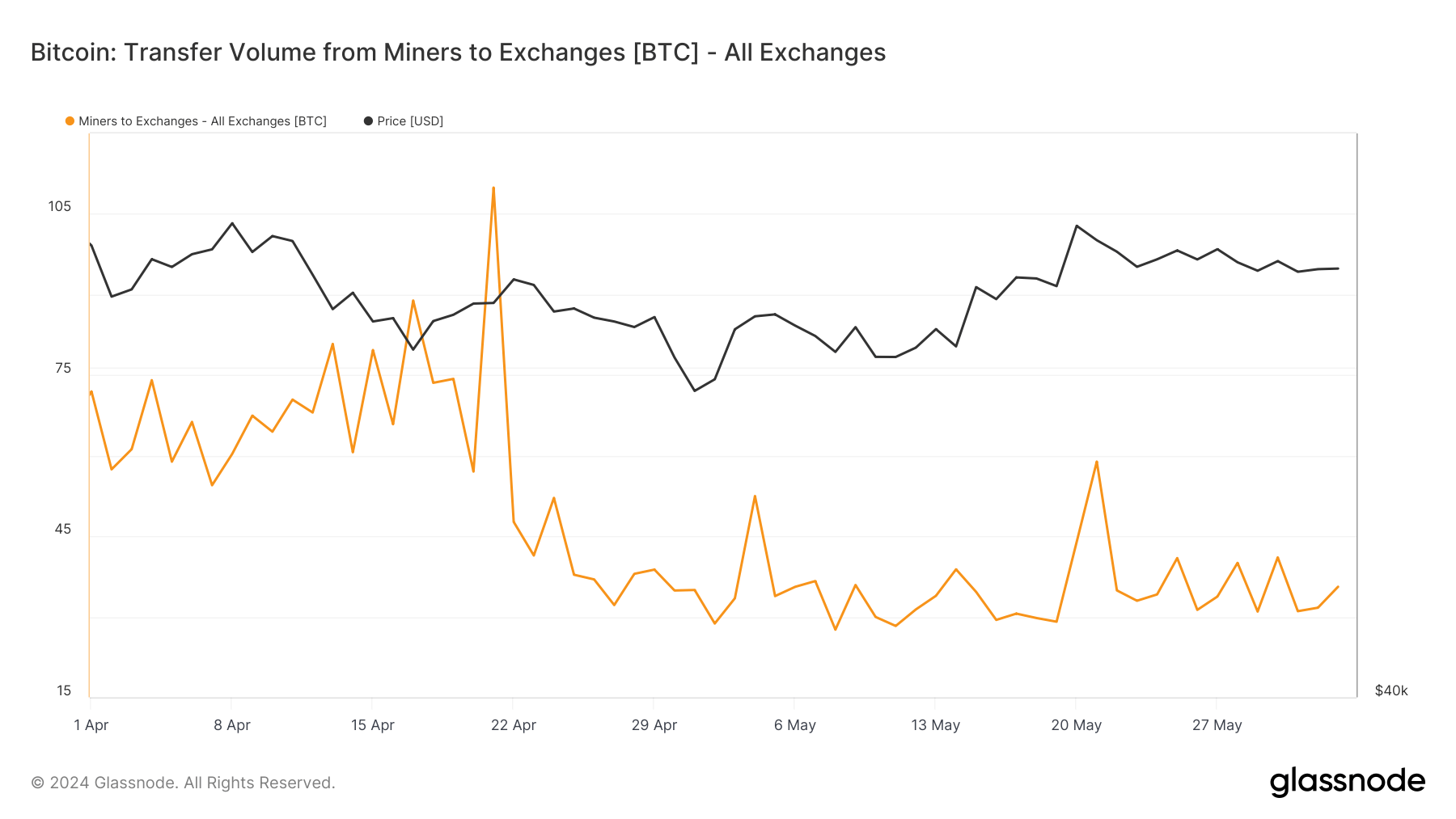

Analyzing the transfers made by miners to the exchange shows how calm May is. In early April, there were 71.95 BTC transferred, which decreased to 57.03 BTC on April 20th and then continued to decline, reaching 29.08 BTC on May 19th. This indicator remained relatively stable at 34.90 BTC on May 22nd and 35.59 BTC on June 2nd. The movement of BTC from miners to exchanges suggests that miners are not under pressure to liquidate their holdings.

The net flow of coins in and out of a miner’s address summarizes the overall sentiment and activity. Net flows in April were very volatile, peaking at 848.35 BTC on April 20th and then plummeting to -748.18 BTC on April 22nd. May displayed more relaxed dynamics, with net inflows of 187.24 BTC and significant outflows of -2,007.13 on May 19th. On May 22nd BTC settled at -31.15 BTC by June 2nd. This suggests sporadic selling pressure, but not at a level that would indicate panic or a bearish outlook.

This contrasts with the volatility seen in the Bitcoin price over the past month. While the market reacted to the price swings with typical volatility, miners adopted a more cautious approach, potentially signaling confidence in Bitcoin’s long-term prospects. This cautious approach by miners can be interpreted as a sign of stability and maturity in the mining sector, where short-term price fluctuations have less impact on operating strategies.

Going forward, the relative stability of miner balances and declining transaction fees suggests that miners are anticipating a period of consolidation and potentially preparing for future price increases. The low level of BTC transfers to exchanges indicates that miners are not under immediate financial pressure and can hold onto their assets and profit from higher prices in the future.

These indicators may also suggest that network activity and trading volume may remain subdued unless prompted by a significant market event or technological advancement. This could lead to lower transaction fees and potentially lower miner profits unless offset by a significant rise in the price of Bitcoin.

The post Flat Month for Miners After Volatile April appeared first on CryptoSlate.