Hess Corporation and yet-to-be-closed acquisition (NYSE:HES)

Apomares/E+ (via Getty Images)

Hess Corporation (New York Stock Exchange: HES)’s stock price was near its all-time high by the end of 2023, with a market capitalization of nearly $50 billion. The company’s stock price is tied to that of Chevron (CVX).) following the proposed all-stock acquisition deal of Chevron for just over one share per share of Hess Corporation. That would raise the acquisition price to more than $50 billion.

As you can see throughout this article, despite the risks Exxon Mobil (XOM) poses to trading, Hess Corporation stock remains a valuable investment.

ExxonMobil and Guyana

A unique obstacle presented itself after Chevron announced its plans to acquire Hess Corporation. Hess Corporation holds a 30% stake in Exxon Mobil’s massive new development project in Guyana that will soon produce 1 million barrels per day. However, ExxonMobil filed an arbitration suit and merged with the company. Partner CNOOC asserts the right of first refusal on all sales.

The claim is in arbitration and could last until next year. Exxon Mobil has said it has no intention of acquiring Hess Corporation but may be interested in increasing its stake in Guyana. Chevron said it would not proceed with the deal without access to Guyana.

The deal could now last until next year. We expect ExxonMobil to make a strong push for Guyana given the value of its assets and opportunities. How that plays out is yet to be seen, but it’s clear that this is a path the acquisition could close.

Hess Corporation Development

At the same time, the company has continued to leverage its assets.

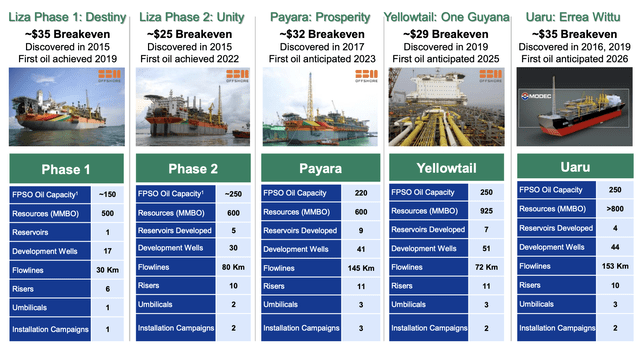

Hess Corporation Investor Presentation

The company’s crown jewel is Guyana. There are five assets above, and a sixth asset worth $13 billion has just been approved, which is estimated to add an additional 250,000 barrels per day of production. Total production will reach 1.3 million barrels per day, but capital costs will take years to calculate. Nonetheless, it is a great asset and the company continues to break even at ~$30 per barrel.

In a $90/barrel oil environment, 1.3 million barrels per day is $80 million in daily revenue, or nearly $30 billion per year.

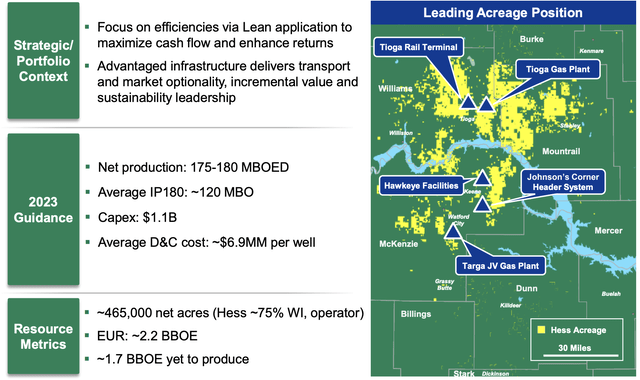

Hess Corporation Investor Presentation

Another key asset is the Bakken shale. It has a production capacity of nearly 180,000 barrels per day and a large operating footprint. There’s $1.7 billion worth of unproduced assets here, so there’s a potential multi-decade asset portfolio here. Acquisitions here could be huge due to synergies with other assets.

These developments are impressive.

Hess Corporation Financial Performance

The company no longer offers decent returns, but here’s some insight into its last earnings.

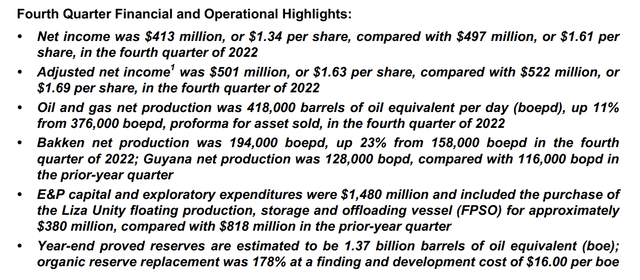

Hess Corporation Investor Presentation

The company had net income of more than $400 million at the end of the year. Contributing production per day was 418,000 barrels, a double-digit increase year-on-year, a significant growth unparalleled in the industry supported by the company’s Guyanese assets. The Bakken continues to account for nearly half of the company’s production and is growing rapidly along with its Guyana assets.

The company continues to spend heavily on CAPEX as it grows in Guyana, but its discovery and development costs are only $16 per barrel and its reserve replacement ratio is nearly 180%. The company is still in a growth phase and generating strong net income, which could lead to high returns.

Hess Corporation and Chevron

Chevron’s market capitalization is just under $300 billion, and when combined with Hess Corporation, its value would be approximately $350 billion.

Hess Corporation Investor Presentation

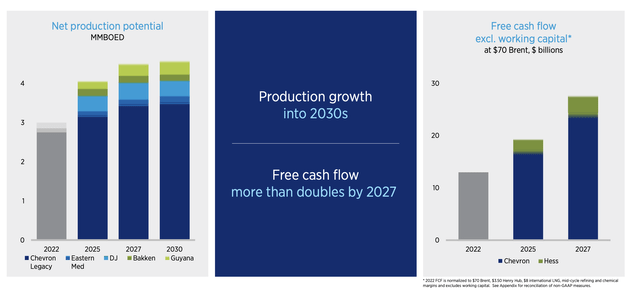

The company expects production to increase from about 3 million barrels per day to more than 4 million barrels per day as Guyana grows. We expect the company’s Guyana production to pass the above projections, with Guyana’s 2027 production alone by Hess Corporation expected to exceed 400,000 barrels per day.

At the same time, the combined company will become a cash flow behemoth. But it does show how expensive acquisitions are. The $50 billion acquisition will increase FCF to $2 billion in 2025 and $3 billion to $4 billion in 2027. This continues to be supported by massive growth in assets. Continued production growth will lead to shareholder returns.

Thesis risk

The biggest risk for our paper is the price of crude oil. The company’s FCF forecast above is for a Brent crude oil price of $70 per barrel, and a $20 per barrel higher price for 600,000 barrels per day of production would result in $4 billion in additional annual cash flow. However, if prices fall significantly, the opposite can be true and take a huge toll on future returns. It’s worth paying close attention to.

conclusion

Hess Corporation is currently being acquired by Chevron, and based on the stock price, the market still thinks the acquisition will close. But at least the acquisition is being delayed. In a worst-case scenario, it may not close at all, or Guyanese assets with enormous long-term growth potential may be sold.

However, the advantage is that Hess Corporation is a strong, stand-alone company. The company expects CFFO to grow to approximately $8 billion at $70 Brent by 2027, generating the $4 billion in FCF seen above. The higher the price, the higher the FCF and 2027E is not the end of the story, Guyana’s growth is expected to continue into the 2030s.

The company has already begun stock buybacks, a smart decision early in its shareholder return strategy. At this time, the market has not yet rewarded significant shareholder returns. Dividends are also expected to increase over time. Nonetheless, with an 8% FCF yield at $70 Brent in 2027 and fast-growing FCF, the company is a strong investment.

Let us know your thoughts in the comments below!