If this level is broken, the S&P 500 will explode higher | RRG chart

key

gist

- Consumer Discretionary Beat Staples

- Sectors Against Key Resistance Levels

summary

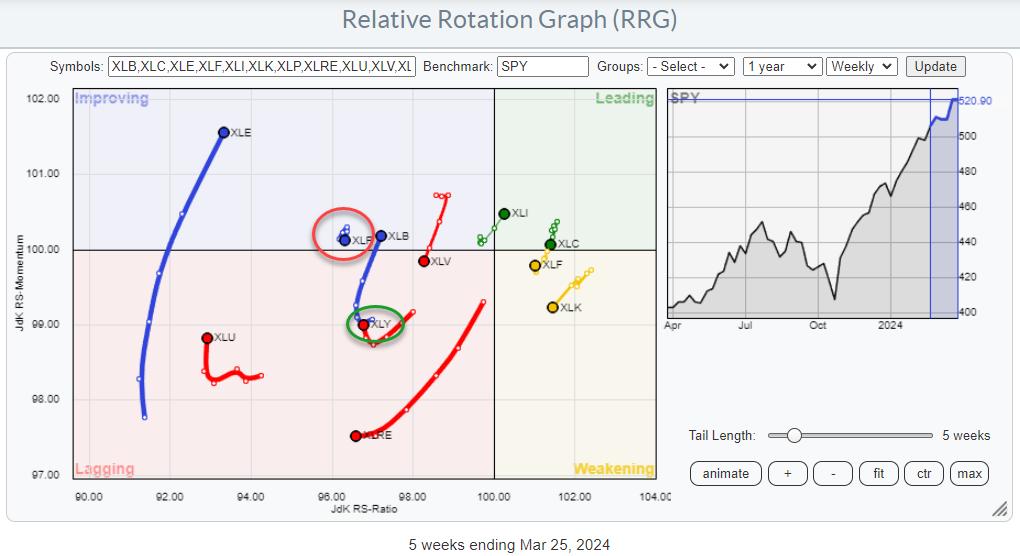

This week’s graph of relative rotation for U.S. sectors primarily shows a continuation of the rotation that took place last week.

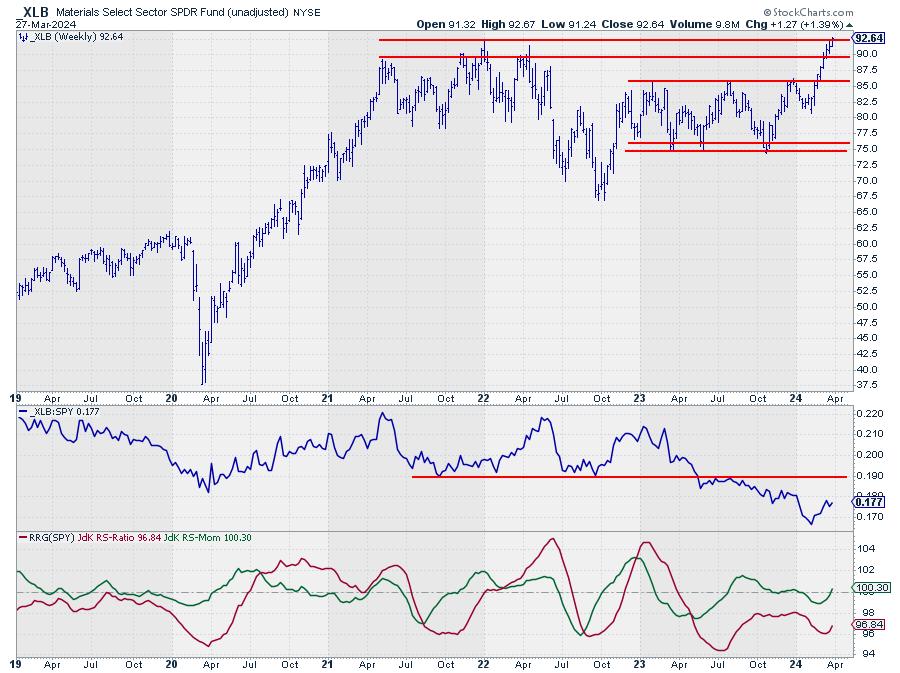

XLB: This is a move from lagging to improving in the direction of strong RRG, which highlights the building of relative strength in the sector.

XLC: Stable inside the leading quadrant of the short tail.

XLE: This adds a long new segment to the tail, pushing it further into the improvement quadrant of the highest JdK RS-Momentum readings in the universe.

45: This indicates a stable relative uptrend that is inside the bearish quadrant but experiencing a brief pause in the very short tail.

XLI: This is currently moving away from the center (benchmark) of the chart and pushing towards the leading quadrant in the direction of strong RRG. This means that relative strength is improved.

XLK: This week the tail is accelerating from the negative RRG and heading into the lagging quadrant, which calls for (more) caution in the tech sector.

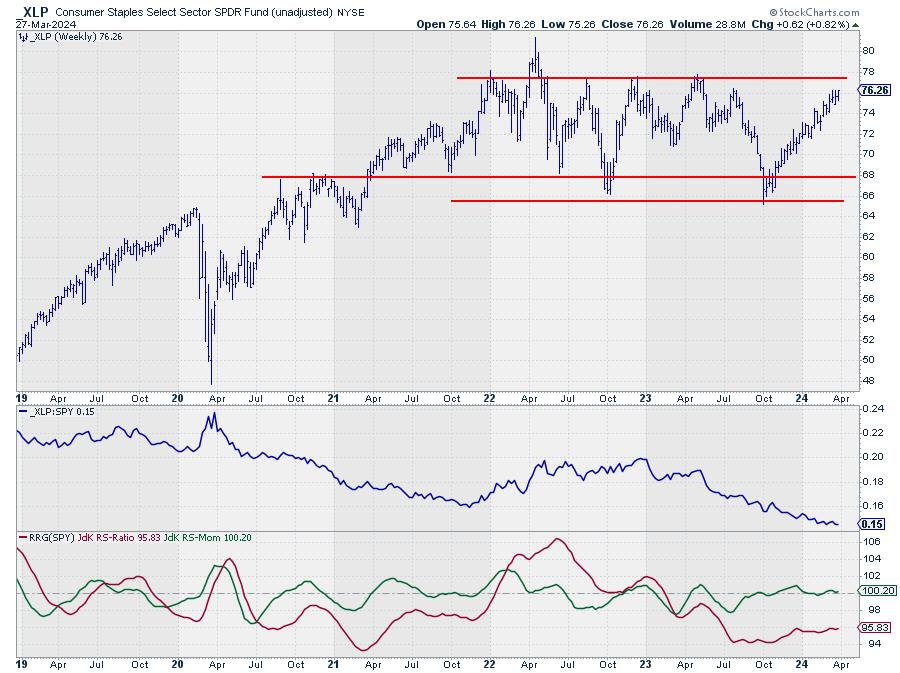

XLP: This remains stable at just above 100 on the JdK RS-Momentum scale to the left of RRG. Relative strength is slowly decreasing.

XLRE: The raw RS line has fallen below the horizontal support, which will likely result in lower new accelerations and push the XLRE tail deeper into the trailing quadrant.

XLU: The tail has gained relative momentum this week, but relative strength has not yet emerged. This means it is more of a temporary movement. This makes sense because XLU has the lowest RS ratio readings in the universe.

XLV: The tail is not improving and is crossing back into the lagging quadrant. As the raw RS-Line falls below horizontal support, relative weakness is expected, causing XLRE to lag further.

XLY: This begins to slowly improve inside the lagging quadrant. This is not yet a positive RRG direction.

random beaten staples

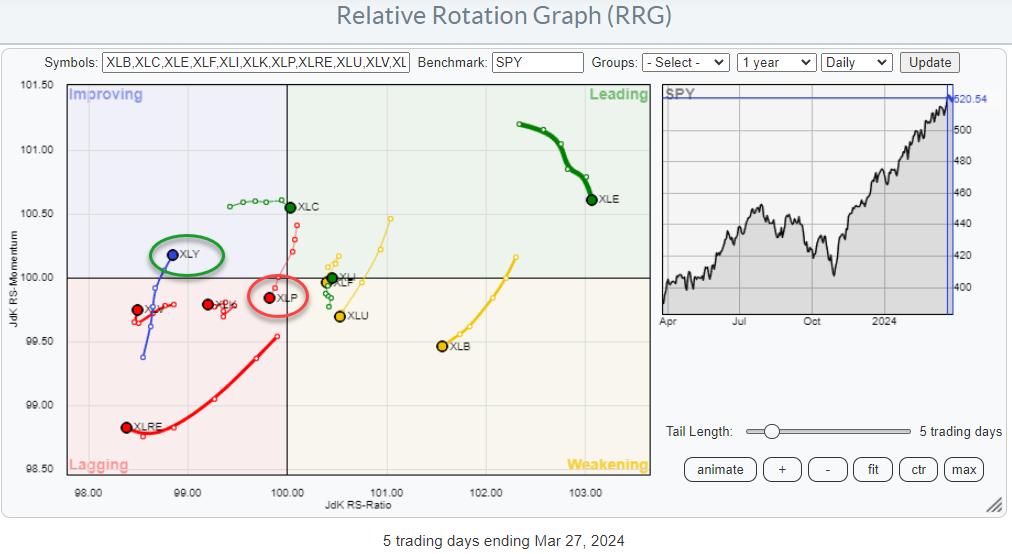

One interesting observation from the RRG above is that the Consumer Staples sector (XLP) is slowly losing popularity, while the Consumer Discretionary sector has started to gain relative momentum within the lagging quadrant and is now starting to rise again.

Zooming in on that relationship using daily RRG, it becomes clear that this rotation is now gaining traction.

In relative terms, let’s assume that discretionary major stocks are not a feature of bear markets.

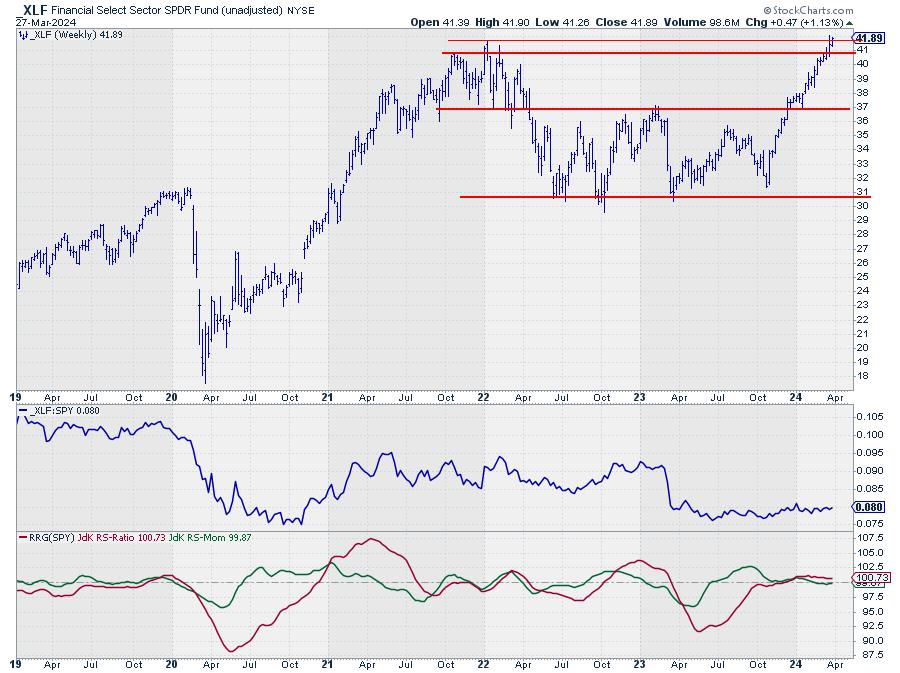

Sectors Against Key Resistance Levels

Another thing that caught my eye is that many sectors are pushing through or getting close to key resistance levels. This includes defensive sectors such as staples and utilities. Healthcare has already broken higher standards.

It’s not over until it’s over. A clear break above overhead resistance levels by these sectors is likely to provide fresh fuel to further fuel the rally.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more