Is Verizon a buy after the +28% rally? (NYSE:VZ)

DNY59

Formerly Verizon Communications Inc. (NYSE:New York Stock Exchange: VZ) In January 2024, we re-rated it a buy after falling into a classic bear trap. Nonetheless, we believed that timing the market was impossible, especially given the extreme pessimism at the time.

The moderation of capital expenditures in 2024 and the resulting improvement in free cash flow generation could see management continue to pay dividends while achieving net debt to EBITDA targets over the next few years.

This article discusses why we maintain a Buy rating despite VZ’s impressive recovery of +28.5% since its low in October 2023, triggering a correction in the net dividend yield from a high of 8.55% in October 2023 to 6.62% at that time. I will do it. writing.

Sentiment surrounding telecom stocks has already improved significantly compared to the past. After several months, we believe VZ’s dividend investment case remains solid.

Despite the recent rally, the VZ dividend investment thesis remains compelling

Since VZ is scheduled to report its FQ1’24 earnings call on April 22, 2024, readers may actually want to temper their expectations about free cash flow generation.

That’s because, similar to rival AT&T (T), in addition to higher promotional incentives, the expected cost of wireless equipment is higher as consumers typically upgrade their devices during the holiday season in the previous quarter.

For reference, VZ reported large free cash flow generation of $2.3 billion in the first quarter of 2023, $5.6 billion in the second quarter of 2023, $6.7 billion in the third quarter of 2023, and $4.1 billion in the fourth quarter of 2023, which is This was primarily due to the company’s unpredictable wireless equipment costs. They are $6.4 billion, $5.7 billion, $6.3 billion, and $8.2 billion, respectively.

The reason for this caution stems from a similar misunderstanding that occurred to T previously. This is based on the market’s overreaction, which estimates that the carrier missed $1 billion in free cash flow generation in the first quarter of 2023. Four weeks after the earnings release, it fell -23%.

T ultimately hit its 2023 free cash flow guidance of $16 billion thanks to generating $4.2 billion in the second quarter of 2023, $5.2 billion in the third quarter of 2023, and $6.4 billion in the fourth quarter of 2023, but the stock It is painfully clear that we have not yet achieved our goal. By the time of writing, it is back to its pre-revision trading range.

Accordingly, VZ management provided promising FY2024 guidance for Adjusted EBITDA growth of +2% YoY, Adjusted EPS of $4.60 (-2.3% YoY due to higher cash taxes), and approximate Free Cash Flow generation of $20.2 billion. (+8% YoY) A somewhat bumpy situation is expected in the mid-year compared to the previous quarter.

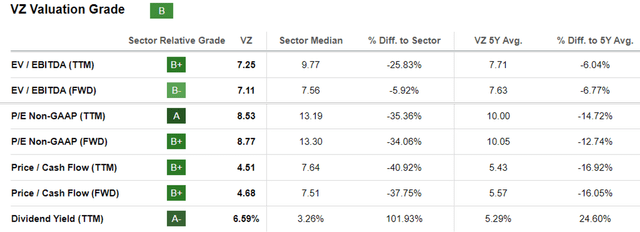

VZ evaluation

pursue alpha

Combining VZ’s massive long-term debt of $137.7 billion (-2.1% YoY/ +36.7% from fiscal 2019 levels) with single-digit growth prospects results in VZ’s FWD EV/EBTIDA valuation of 7.11x and its FWD P/E valuation of 7.11. I can understand why it’s a pear. Discounted 8.77x.

This compares to the five-year average of 7.63x/10.05x and the industry median of 7.56x/13.30x. The same was observed for T at 6.45x/7.46x and Comcast (CMCSA) at 6.63x/9.48x, meaning that VZ is not alone in the generally debt-heavy telecom business.

And again, we believe VZ’s discounted level provides opportunistic investors with an opportunity for dollar-cost averaging as the dividend remains stable.

Deleveraging of the telco with a balance sheet that is likely to improve net debt-to-EBITDA ratio from 2.88x reported in Q4 2023 to 2.83x reported in Q4 2023, based on annual dividend obligations of ~$11 billion. You can see it accelerating. FQ4’22, 2.07x for FQ4’19, target ratio is 1.75x to 2x.

The majority of the tailwind is due to VZ’s capital spending adjustments, with 5G capex up to $23 billion (+13.8% YoY) in FY2022, driven further by management’s continued capital and network efficiencies.

At the same time, market analysts only expect 6G to be introduced by 2030, implying that telcos’ capex may slow over the next few years, allowing management to maintain dividends while deleveraging.

Rather, VZ continues to hint at significant growth ahead, with quarterly net addition targets of approximately 350K, thanks to its aggressive rollout of C-band spectrum that is fueling the expansion of its fixed wireless access business.

As of March 2024, the company had already achieved more than 3 million fixed wireless access customers, well ahead of its original 2025 target of 4.5 million customers at the midpoint.

Additionally, VZ’s new mobile plan, myPlan, launched in May 2023, naturally generating new growth with higher ARPA and lower churn thanks to increased flexibility for consumers and exclusive streaming partnerships with leading media companies.

Now, as seen in the relatively promising FY2024 guidance, it is clear that the “management reorganization” has delivered big results, driven even more so by the increased attractiveness/value surrounding its bundled mobile and fixed wireless products.

So, is VZ stock a buy?Sell or Hold?

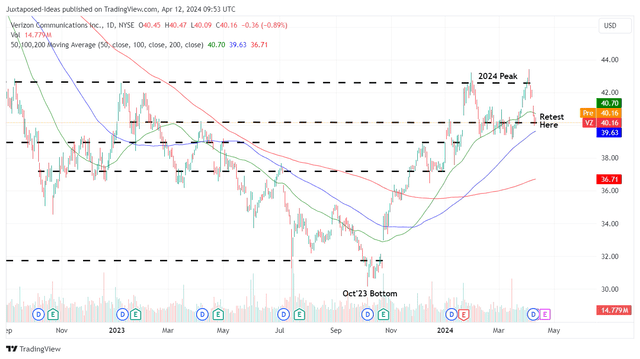

VZ 1 year stock price

trading view

Currently, VZ appears to have good support at $40, although it has failed to break the 2024 peak of $42 twice.

As with dividend stocks, we believe the key metric for an entry point will be the forward yield, which has been adjusted from a high of 8.55% in October 2023 but currently sits at a decent figure of over 6.62%, consistent with our previous article.

Compared to the U.S. Treasury’s yield of between 4.52% and 5.39%, we still find VZ’s generous yield attractive. This is especially true as markets have priced in a Fed rate cut in 2024, with the EU central bank signaling the first cut by June 2024.

At the same time, we agree with Seeking Alpha Quant’s C rating on Dividend Safety Rating, which stems from management’s promising earnings guidance for growth in both adjusted EBITDA and free cash flow for fiscal 2024.

As a result of its strong dividend investing thesis, we maintain a Buy rating on VZ stock, but we do not have a specific entry point as it will depend on the individual investor’s dollar-cost averaging and portfolio allocation.

With VZ’s rally since its October 2023 lows outperforming T by +28.5% to +14.1% and the broader market by +19.2%, readers can position their entry point on a moderate downtrend for an improved margin of safety.

It goes without saying that anyone holding US-based telecom stocks here, including VZ, might want to monitor Lead Cable’s discussions with regulators. Because a solution has not yet been reached and telecom companies still have work to do. We will cover the cost of proofreading.

Investors may also note that there may be consideration of this matter at the Annual General Meeting of Shareholders on May 9, 2024, and the BellTel Retirees Association may present a ballot proposal to conduct a comprehensive, independent study.

Pessimistic developments could trigger another painful correction, potentially leading to huge capital losses.