Karak has a ‘good chance’ of becoming the next EigenLayer after the EIGEN airdrop disappointment.

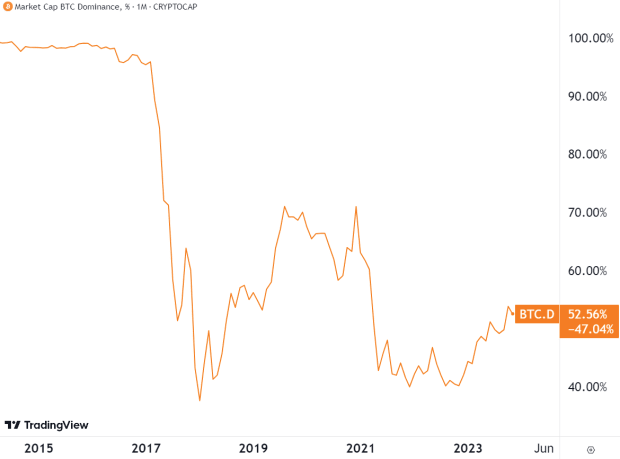

Emerging Ethereum re-staking protocol Karak’s Total Value Locked (TVL) has increased by more than 25% in the past week to over $440 million, and industry experts believe it could start to erode EigenLayer’s market share.

Following the disappointment of the EigenLayer airdrop, Karak has a “good opportunity” to become the next large-scale re-staking protocol, said Anndy Lian, an intergovernmental blockchain expert and author. NFTs: From zero to hero. He told Cointelegraph:

“Karak supports a wider range of assets for re-staking, including ETH, LST, LRT, stablecoins, LP tokens, and wrapped Bitcoin. This diversity could attract a broader user base looking for more options beyond ETH.”

Early April, Karak closed The $48 million Series A funding round brings the company to a valuation of over $1 billion, meaning there’s more upside potential. In comparison, EigenLayer has a valuation of $15.7 billion, making it the largest resale protocol on Ethereum.

Related: Cryptocurrency to Reach 1 Billion Users by the End of 2025 — Analyst

TVL may fall due to EigenLayer airdrop disappointment

On April 29th, EigenLayer released a white paper on the upcoming EIGEN token. The paper banned several jurisdictions from the upcoming airdrop, including the United States, Canada, and several African and Asian countries.

This decision drew widespread criticism from the cryptocurrency community. Pseudonymous cryptocurrency trader Jay commented on X on April 29 that this could be a significant opportunity for Karak. post:

“I think Eigen gave Karak a golden opportunity.”

According to Lian, EigenLayer’s decision to ban airdrop participants in major cryptocurrency jurisdictions could lead to a decline in TVL as stakers look for more profitable alternatives. He said:

“Farmers and stakers who were eagerly anticipating the EIGEN airdrop may now look to alternative platforms or protocols. Some may choose to reallocate their assets to other DeFi projects that offer more comprehensive airdrop opportunities.”

Related: EigenLayer faces potential yield crisis

According to Ran Neuner, cryptocurrency analyst and host of the Crypto Banter podcast, EigenLayer is a venture capitalist (VC) scam aimed at attracting liquidity from ordinary retail investors. He wrote on April 30, post:

“Early-stage VCs enter early with small valuations. Retail will enter the $15 billion+ market. Initially low cyclical highs (fully diluted valuations) – let’s rob more retailers…

Neuner argued that the ban on airdrops in major non-banking jurisdictions, along with the decision to keep airdropped EIGEN tokens locked until the team decides, primarily benefits early-stage VC investors.

“Any retail investor who buys this in the first three years will be punished.”

Related: Lido Finance accelerates the growth of DeFi by securing 1 million validators.