Michael Milken says the Fed won’t move too early and risk massive inflation like it did in the 1970s.

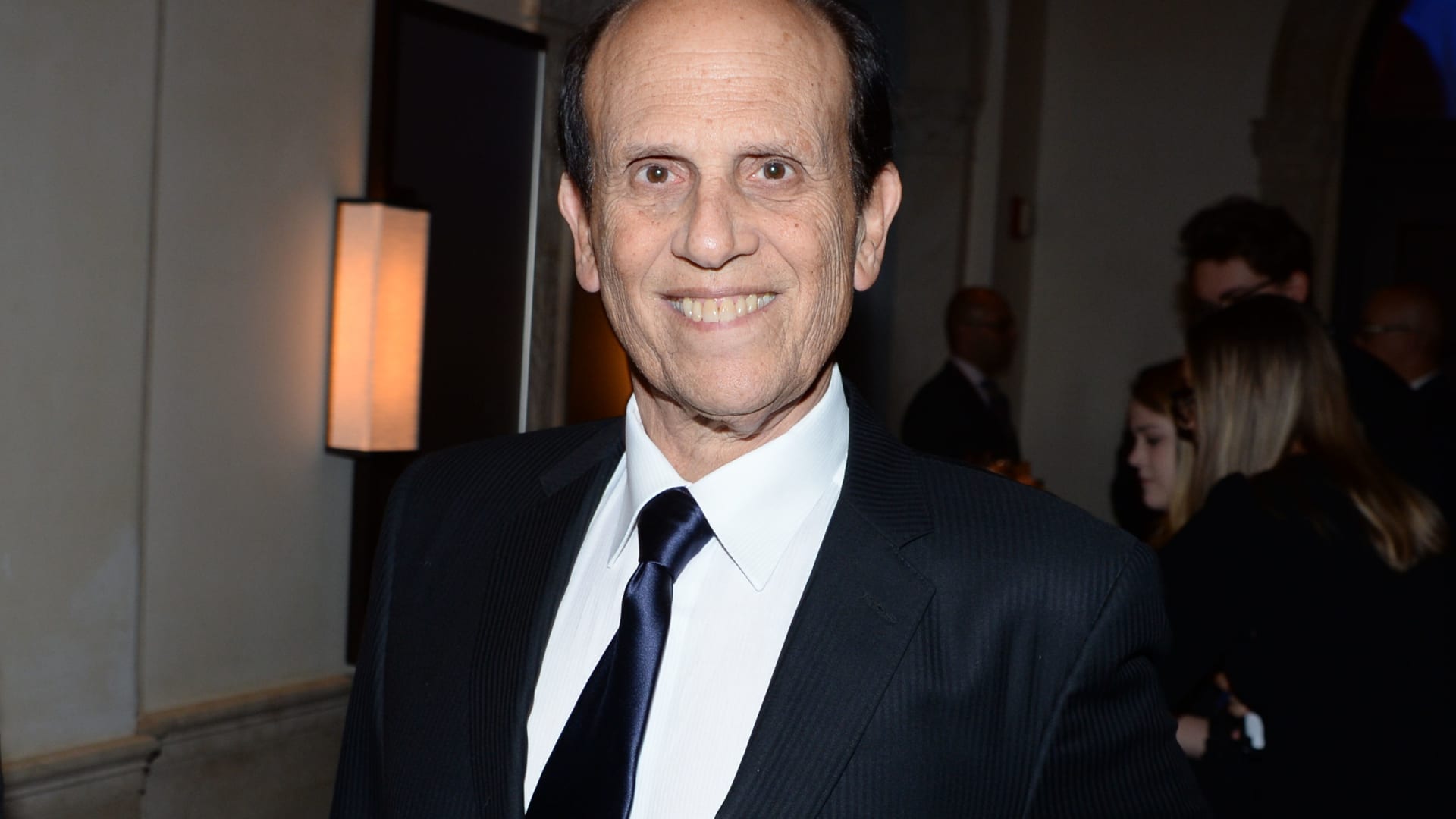

Michael Milken attends the Prostate Cancer Foundation’s Daniel’s Dinner at the Daniel’s on November 19, 2019 in New York City.

Paul Brunozzi | Patrick McMullan | getty images

Renowned investor Michael Milken says history suggests he expects the Fed to move monetary policy slowly.

In fact, the Milken Institute founder expects central banks to make sure inflation is under control before they start cutting interest rates to avoid a repeat of the 1970s, when inflation soared into double digits, Milken said on CNBC’s “Last Call.” On Monday. He was speaking at the Hope Global Forum in Atlanta.

“As you know, history repeats itself in many different ways.” Milken said. “In the ’70s, the Fed moved too early. Yes, we got out of ’74, ’75, ’76, but by the end of the ’70s we had massive inflation again and interest rates rose overnight to 21%.”

“So right now, I think the Fed is going to make a little bit of a lapse in discipline to see what happened today,” Milken added.

Inflation and interest rates were at their peak in the early 1970s before the Federal Reserve rolled back its policies. However, this stop-and-go approach ultimately failed to quell the price rise.

Federal Reserve Chairman Jerome Powell is scheduled to announce the central bank’s latest monetary policy decisions Wednesday afternoon, when investors will scan his comments for signs of when the central bank is expected to start cutting interest rates.

In the 1980s, Milken was known as the king of junk bonds. The financier was an early pioneer of leveraged buyouts and pleaded guilty in 1990 to securities fraud and tax violations. In 2020, he received a pardon from President Donald Trump.

–CNBC’s Yun Li contributed reporting.