Modine Manufacturing: AI Growth Stock Soars More than 250% in One Year (NYSE:MOD)

Jay Studio

Modine inventory increases by more than 250% in one year

Modine Manufacturing Company (New York Stock Exchange: MOD) is a company with a market capitalization of $5.4 billion. Modine specializes in thermal management solutions. Modine has a very diverse business model globally. On the other hand, the US market Our business is growing in Europe and Asia as our main geographical segments. but, Modine is facing an overstock problem. We are participating in the heat pump business in Europe. As a result, this impacted Modine’s Heat Transfer Products segment in the recently reported fourth quarter of the fiscal year. Modine does not expect a significant recovery “until market conditions stabilize and excess inventory is absorbed.”

Nonetheless, Modine stock has benefited from the AI infrastructure upcycle. MOD has seen its total returns surge by over 250% over the past year. As a result, Modine leveraged thermal management solutions for data centers connected to hyperscalers and colocation providers. Accordingly, Modine reported: Data center revenue increased 69% year-over-year, while adjusted EBITDA also increased. As a result, the impact of the sale of non-core and low-margin businesses was mitigated, even though Modine reported a 2.4% year-over-year revenue decline. Nonetheless, Modine increased adjusted EBITDA by 20% year-over-year, highlighting the effectiveness of its 80/20 plan to focus on the highest-potential businesses.

Modine is expanding its data center cooling solutions.

Modine has also expanded its manufacturing capabilities to capitalize on the surge in data center cooling solutions. Modine’s recent “purchase of a 14.6-acre manufacturing site in Bradford, England” is expected to strengthen the company’s ability to increase “production of precision cooling equipment used in the data center industry.” As a result, Modine is expected to help capitalize on the growing demand for data center cooling solutions. Therefore, Modine’s execution ability must be improved to “effectively meet customer demands and ensure timely delivery of precision cooling equipment.”

Modine’s capabilities can also be expanded into liquid cooling through the astute acquisition of TMGcore’s liquid immersion cooling solutions. When Nvidia’s (NVDA) Blackwell AI chips launch next year, adoption is likely to lead to a surge in liquid cooling demand.

As a result, this will strengthen Modine’s position as it expands its portfolio of cooling solutions to gain market share. Modine is also well equipped to handle direct chip cooling, which is expected to be the primary liquid cooling technology deployed in the near term. Super Micro uses (SMCI) direct liquid cooling technology as SMCI builds AI plug-and-play rack server capacity to meet the most advanced next-generation AI computing workloads.

Therefore, the anticipated expansion of new AI data centers and the realignment of standard data centers for AI will be beneficial when considering Modine’s technology roadmap. Modine targets “technologies such as direct chip cooling, single- or two-phase liquid cooling, and immersion cooling.” Executives emphasized that the company’s direct-chip cooling products are “near completion with plans to launch the products to select customers by the end of the fiscal year.”

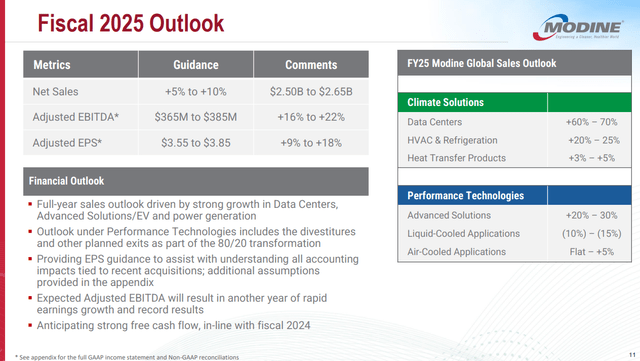

Modine FY2025 Guidance and Comments (Modine documentation)

As a result, the 80/20 strategic reallocation should support Modine’s revenue and profitability sustainability even as it exits underperforming businesses.

Modine’s FY2025 guidance projects continued growth in adjusted EBITDA, with expected growth ranging between 15% and 22%. As can be seen above, data center growth is expected to remain robust with revenue surging between 60% and 70%. Therefore, we believe that Modine’s optimism is justified as the AI upcycle shows no signs of ending.

Should you buy, sell, or hold MOD stock?

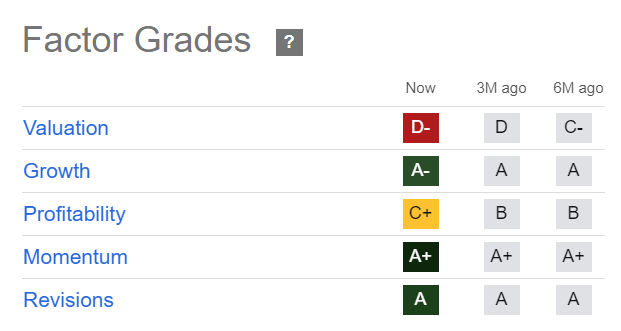

MOD quantity diagram (Look for alpha)

Despite my optimism, MOD is no longer considered attractive. The “D-” rating emphasizes my assessment that the market is already experiencing significant optimism. MOD’s forward-adjusted PEG ratio of 1.25 is approximately 18% below the sector median. Although still at a discount, the valuation fork has noticeably closed.

Additionally, MOD’s future adjusted earnings multiple is more than 75% higher than the sector median, suggesting caution. We wouldn’t rate a red flag to indicate a sell signal, but given the solid growth rating, adding exposure at current levels may seem too aggressive.

However, a sharp decline to digest MOD’s recent optimism could present a more attractive opportunity to add exposure.

Rating: Initiating Hold.

IMPORTANT NOTE: Investors should exercise due diligence and be careful not to rely on information provided as financial advice. Consider this article as a supplement to your required research. Always think independently. Unless otherwise specified, ratings are not intended to establish specific entry/exit times at the time of writing.

I’d like to hear from you

Do you have any constructive comments to improve our paper? Have you noticed a critical gap in our perspective? Did you see something important that we didn’t see? Do you agree or disagree? Please leave your comments below to help everyone in our community learn better!