Nestlé Stock: Downgraded (OTCMKTS:NSRGY) as Near-Term Outlook Is Very Uncertain

Anpa

investment action

When I last wrote, I recommended a Buy investment opinion on Nestlé (OTCPK:NSRGY). This is because I believed in the value of the famous Nestlé brand, which has a strong equity value. I also believed there was an improvement. Sales volume and gross margins will boost the stock price in the near term. However, considering the stock price and 4Q23 performance, I think my view was too optimistic at this point. Based on our current outlook and analysis, we recommend a Hold rating. I believe the short-term outlook is too uncertain to invest today. Prices are expected to reverse downward, volume resilience is not as strong as expected, and internal execution issues are added, making investment difficult. In the short term, valuation pressures are expected to continue.

examine

Nestlé’s FY23 performance fell short of expectations. The company missed its full-year 2023 real internal growth (RIG) target and suffered weak margins in 2H23. EPS was also about 2% below consensus estimates. According to the reported numbers, 4Q23 revenue was 2.4% below consensus estimates. The disappointing RIG performance was driven by sequential declines in growth across Europe (-2.8%), Greater China and North Asia (-6.7%). On a full-year basis, the business also reported weaker-than-expected EBIT, which was 1.3% below consensus expectations.

NSRGY’s latest report was a powerful wake-up call to me that even the strongest brands are affected by economic cycles. Recall that management’s mid-term comparable guidance was for 4-6% growth (sustained beyond FY25). But they are now targeting growth of “around 4%” for FY24. and Don’t expect a wide range around 4%. In my view, this guide effectively tells us that NSRGY will now “pay the price” to enjoy strong price increases over the next 12-18 months. It’s worth noting that management uncovered this. They noted that price normalization was evident in 2023 and that this trend would continue in the coming quarters. RIG is expected to return to pre-COVID-19 levels during 2024, with cadence expected to be weighted towards 2H24. This means that in the short term, RIG could be much worse than expected in 1H24. This is especially true with continued consumer spending trends and shorter trading days by one day.

My expectations for a volume recovery may not materialize either, which is a huge blow to my bullish outlook. Signs of deals towards private brands appear to be increasing, and this trend is expected to continue as consumers continue to keep their budgets tight due to a persistent inflationary environment. One piece of evidence to support my argument is that management said Middle Eastern and Asian consumers continued to feel aversion to global brands throughout the fourth quarter, and this continued into the first quarter of 2024. Another worry about low prices and weak volumes is the potential for a surge in raw material prices due to the Red Sea crisis. Although executives have said that the situation on a global scale is much better than in 2021 despite some stress on freight transport, I don’t think anyone (or any entity) can be sure that larger conflicts won’t arise from here. /22. The U.S. government has repeatedly called for a ceasefire, but the conflict is still ongoing. My worries may not come true, but this is a risk every investor should consider in the near term.

In addition to top-line and margin pressures due to macro factors, it was also very disappointing to see management messing up internally. The impact of IT integration on Nestle Health Science is more severe and will take more time to fix than initially stated. The full resolution of the resulting supply constraints is expected only by the end of the first half of 2024, as opposed to the end of 2023 in the previous guidance. This makes the entire first half of the year even more ambiguous.

Lastly, I don’t think it’s difficult to convince our readers that while the NSRGY brand is strong, many of the categories in which it operates are unhealthy and could create a headwind to growth like the GLP-1 trend. It continues. During good times, when businesses were growing and stock prices were rising, the market paid little attention to these declines. However, now that the narrative has changed, including price pressure, weak volume growth recovery potential, and internal execution errors, long-term growth concerns related to GLP-1, which are a bigger topic now than in the past, are putting more pressure on the stock price. ‘ evaluation.

evaluation

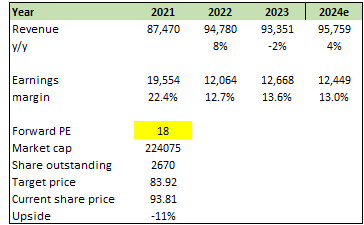

author’s work

I believe the NSRGY share price is worth CHF84 in the short term. My view is that FY24 will be under significant pressure due to price inversions and a weak consumer spending environment. Although our management policy is to recover in the second half of the year, we have a very conservative view that the sluggish situation will continue throughout this year. Therefore, we assume 4% growth in FY24, adding a discount to management’s FY24 guidance (6-8% growth). We are also assuming that margins will be lower than the midpoint of our FY24 guidance due to higher raw material price pressures due to the Red Sea situation. Overall, the near-term outlook is very uncertain and we do not believe there will be upward pressure on valuation until NSRGY shows a recovery in growth. with Margins improved and clear progress was made on IT integration issues.

final thoughts

NSRGY was downgraded to a hold rating. Recent performance and revised guidance for FY24 demonstrate significant near-term uncertainty. Notably, NSRGY missed its FY23 growth and margin targets, and management now expects growth of around 4% in FY24. Price normalization, which takes effect in 2023, is likely to continue and potentially hinder volume recovery. Consumer behavior, coupled with tight budgets and a possible shift toward private label brands, pose additional concerns. The ongoing Red Sea conflict risks rising raw material prices and further squeezing margins. Complexity also arises from internal issues, such as delays in resolving IT integration issues. Given these combined factors, NSRGY’s near-term outlook is highly uncertain.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.