Nexus Industrial REIT: 8.5% Yield Will Soon Be Fully Covered (OTCMKTS: EFRTF)

EyeEm Mobile GmbH/iStock via Getty Images

introduction

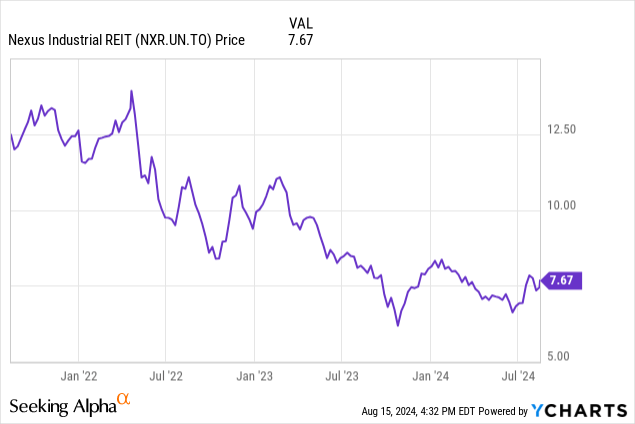

It’s been almost a year since we last discussed Nexus Industrial REIT (OTC: EFRTF).TSX:NXR.UN:CA), I think it’s time to post an update on this Canadian industrial REIT. Since the last article was posted, Over the past few months, the stock has become too cheap to ignore, so I started a long position at an average price of just under C$7 per share. The current dividend is Not fully covered by AFFOI expect this to change by the end of this year (or at the latest, H1 2025). In Q2, REITs have already grown AFFO nicely QoQ and I expect AFFO to grow as well, given expected lease spreads and new assets coming online, funding costs are also expected to peak.

important QoQ financial performance improvement

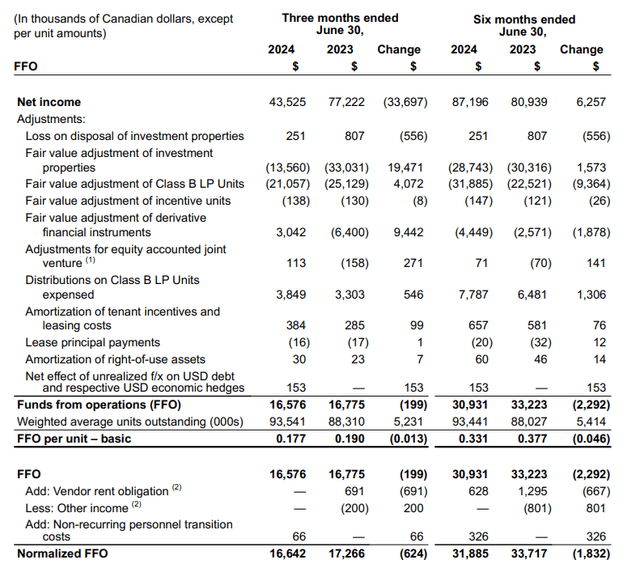

As every REIT investor knows, the net income generated by a REIT is of little importance, as FFO and AFFO are more important metrics. I prefer to use AFFO, as this Canadian metric also includes capital expenditures for maintenance of the property.

Looking at the FFO breakdown, the starting point was net income of C$43.5M, significantly lower than the C$77.2M in Q2 last year, with a significant portion of the difference being due to lower fair value adjustments for investment properties. The second reason for the lower net income was higher interest expense of C$3.6M. As you can see below, reported FFO was C$16.6M, with normalized FFO being slightly higher.

Nexus Investor Relations

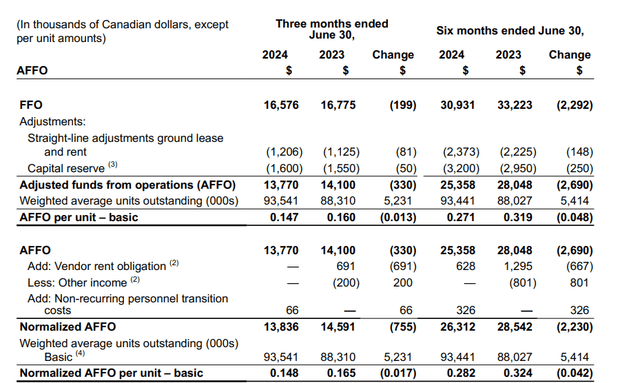

Since I am more interested in the AFFO performance of the REIT, I quickly moved on to the AFFO analysis. As you can see below, there were two factors to consider, resulting in AFFO of C$13.8M on both a normalized and reported basis. This represents an AFFO of just under C$0.15.

Nexus Investor Relations

As you can see above, AFFO per share is C$0.017 lower than Q2 last year, but there is a significant sequential improvement as H1 AFFO was C$0.282. With Q1 AFFO being C$0.134, the C$0.148 in Q2 is a significant positive move.

Using Q2 results, the stock is currently trading at about 13x normalized AFFO. That doesn’t sound cheap, but there are two factors Nexus Industrial REIT investors should keep in mind.

The dividend hasn’t been paid yet, but Nexus is on the right track.

And these two factors are coupled with the expectation that Nexus’ dividend will be covered in the next few quarters. As a reminder, Nexus currently pays a monthly dividend of C$0.0533 against an annualized dividend of C$0.64, but with an annualized AFFO per share of C$0.59 (based on Q2 results), the payout ratio is still over 100%.

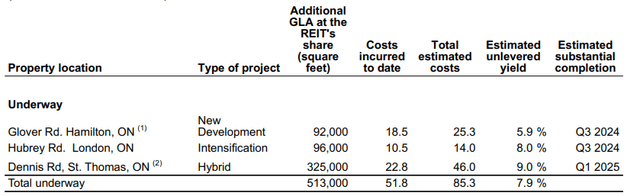

However, I believe this will soon change. Two new assets are due to be completed this quarter, with a third expected to be ready in Q1 2025. As you can see below, the REIT is expecting a 7.9% yield on these assets, which equates to an annualized cost of C$6.75M based on a total cost of C$85.3M to completion.

Nexus Investor Relations

Assuming the remaining C$34 million of capital expenditures are fully funded with debt at an average cost of 6%, we estimate that marginal interest expense accretion to completion will be approximately C$2 million, the assets will add C$6.75 million in NOI and contribute approximately C$4 million to net income. This equates to approximately C$0.045 per share, and once these three new properties are completed, annual AFFO will increase to C$0.635 per share, very close to the current distribution of C$0.64 per share per year.

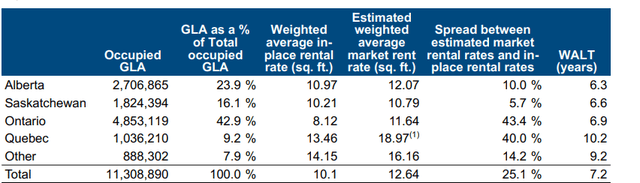

Second, we expect that releasing existing assets will also contribute positively to the bottom line. As you can see below, there is a 25% gap between current rents and market rents.

Nexus Investor Relations

Applying this to our existing portfolio would increase our NOI by approximately C$27M. Of course, with a 7.2 year WALT, it will take time to go through the renewal cycle, but I wanted to focus on key markets that need to be renewed in the next 18 months.

For example, in Alberta, the REIT is required to release 61,643 sq ft this year and nearly 225,000 sq ft next year. While Alberta’s spread won’t contribute much this year (around CAD$70,000 per year), I’m more interested in the 225,000 sq ft that renews in 2025. At current market rates of around CAD$12, that would be a whopping 40% upside in 2025, and would add CAD$800,000 in additional rental income in 2025. Ontario would also be interested in the 700,000 sq ft that renews in 2025 while the market rate is more than 50% above current rents. Releasing Ontario at a 10% discount to current market rents would add about CAD$2 million to the bottom line. And these two markets alone would fully fund the dividend in 2025.

Investment theory

The main risk to the investment thesis is the cost of debt. The average cost of debt is currently around 4.20% and while this could increase, I think the worst is over. Since the Bank of Canada has started lowering interest rates, the “shock” to low-cost debt (the mortgage portfolio is only paying 3.39%) will be very gradual, as Nexus will only have to refinance about C$191M of mortgage debt between now and the end of 2026. That C$191M has an average cost of debt of about 3.5%, so the increase in interest expense will only amount to a few million dollars per year. The credit facility is already more expensive than the mortgage debt, and I don’t expect a sudden shock there. That said, I think it will be able to absorb the impact of higher interest rates by increasing rents and renewing leases in 2026 at a higher rate. Additionally, the REIT is in the process of selling C$110M of assets, with the proceeds going to repay its (most expensive) debt.

So I started a long position in Nexus Industrial REIT. I have an allergy to REITs that pay dividends that are not fully guaranteed, but I expect Nexus to be in a position to lower its dividend yield to less than 100%. I am long Nexus and would be willing to add to that position if there is weakness.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these securities.