NVDY: Why 106.68% Distribution Yield Is Not Enough (NYSEARCA:NVDY)

MStock Studio/E+ via Getty Images

that much YieldMax NVDA Option Income Strategy ETF (NYSEARCA:NVDY) is intended as an income product. Managers generate profits by replicating cover call positions. The distribution rate of return is very high, but I am not sure. High enough. Whether it’s an interesting product largely depends on your predictions about the stock’s trajectory.

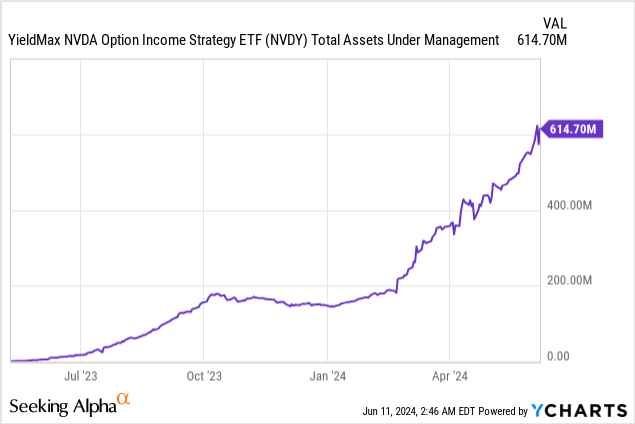

My interest in this space goes beyond this single fund. I am curious to what size these single-name derivative ETFs will grow. Is it possible to create incorrect prices in the derivatives market?

In the case of Nvidia Corporation (NVDA), I’m the least worried about that happening because it’s the most active single-name options chain. It’s not even close. However, the assets of these products are ballooning and that will become a problem at some point. This fund and others like it sell very short-term options. The options market is not like that. It’s usually as deep as the stock market. Think about all the different strike prices and expiration dates.

The fund’s expense ratio is 1.01%. This is a high level for a U.S. large-cap ETF. In this case, you are only exposed to one company.

However, the cover call strategy is not easy to implement. If you want to try it yourself, you’ll have to trawl through option chains and compare prices every day. It may make sense to outsource this and spend your time more productively elsewhere.

The fund is advertised with a payout ratio of 106.68%.

This is the annualized return if the recently declared distribution was obtained and has not changed. Returns depend primarily on the sell call premium collected and can vary widely. The distribution table below shows how the distribution moves by month.

NVDY distribution (maximum yield)

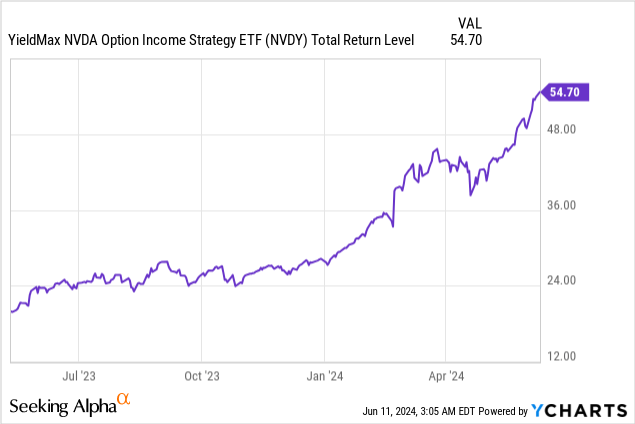

Shares rose to $54.70.

If you thought it would be advantageous to sell short-term covered calls, you would be content to buy this product and accept the expense ratio. I like that when two things are true. 1) There is a lot of speculative demand for calls. 2) The downside is probably minimal.

I think 1) is likely true, but I’m a bit more concerned about 2).

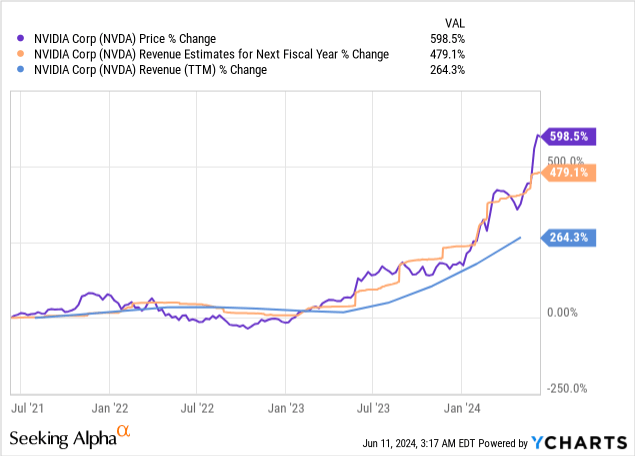

Nvidia is jumping a lot and getting a lot of attention, but actual revenue growth and increased revenue estimates are slightly behind the stock price. Market participants expect much more growth to come.

As I wrote in the highlights of the recent NVIDIA Earnings Call, growth is likely to continue in the short and medium term.

…This is nothing new to anyone, but growth prospects remain strong.

The company is running and there is demand. The story remains the same and the dream lives on. Judging from the earnings call, the supply-demand story sounds very solid, at least in the short term. State spending has not yet caught my attention, but it could be a relatively modest but sustainable source of revenue…

The problem is that if growth is disrupted, you could face a very sharp downturn. Nvidia is a momentum stock. Momentum stocks are known for big gains and scary downturns. According to AlphaArchitect:

Empirical studies of cross-sectional (long-short) momentum have shown high returns, but investors have also experienced significant downsides. Momentum exhibits both high kurtosis and negative skewness. Since 1926, there have been several brief but persistent momentum breakdowns with very negative returns. For example, from June to August 1932, the Momentum Portfolio fell about 91%, followed by a second decline from April to July 1933. Another notable collapse occurred in the first decade of this century (see chart below).

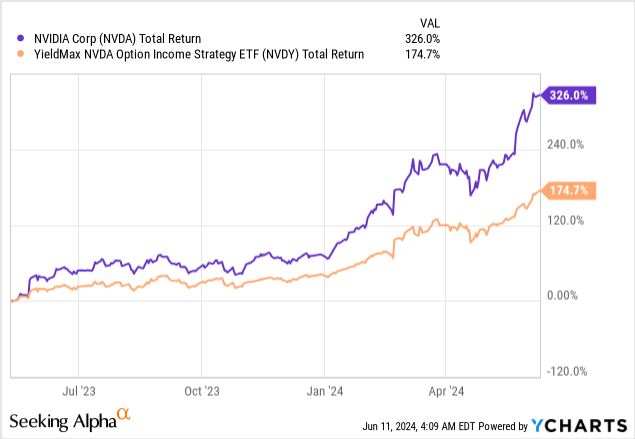

Based on the questions I receive about these call-writing ETFs, it seems clear that most investors understand that they will underperform if the underlying assets soar. After all, if Nvidia sells you a base currency and the price goes up a lot, that currency is costing you a lot of money. Since you also own the underlying asset (or in this case a synthetic version of the underlying asset), you just miss out on the upside of that stock.

What happens if Nvidia goes into decline?

This is much less clear to many people. This is not surprising, as there is no simple answer. Typically, the premium received for selling a call option is relatively small compared to the stock price. If there is a quick and sharp decline, NVDY is not expected to significantly outperform NVDA.

If there is a large pullback with more upside and downside over a longer period of time, NVDY is likely to perform significantly better. If the volatility of the stock is high, the option premium increases. This helps NVDY because it sells mechanically. As volatility subsides, the premium follows its trajectory with some lag. Because the drawdown takes a little longer, the premium adds up. effect; Disadvantages are alleviated.

However, rapid downturns and sharp upturns can have very bad consequences. Premiums aren’t really cushioning the downturn, while option selling is limiting the recovery.

As far as I can tell, the YieldMax NVDA Option Income Strategy ETF has mostly underperformed Nvidia Corporation stock because its fundamentals are surprisingly strong and its strength and performance have surprised option sellers.

Personally, I have no intention of buying NVDY anytime soon. There is a high possibility that speculative call buying will be active (positive for this product). I am much more likely to buy a covered call product thinking the odds are higher and the call buyer is a speculator rather than a market maker.

The problem is that this is at least somewhat justified. The underlying story doesn’t seem likely to break in the near term (see recent Nvidia article), and it’s a strong momentum stock. By definition, momentum stocks are skyrocketing pretty hard. This becomes a problem when the product forces a call sale. The ideal entry is when momentum (and call premium) is very high but will decrease in the future. It’s like expecting a quiet, flat trajectory ahead.

One thing that disappoints me even more here is that Nvidia is executing a 10:1 stock split, which could increase interest in options speculation. Contracts may become too large for a small trader to diversify their options portfolio. This technical adjustment addresses potential limitations. Moreover, Seeking Alpha reported that the split may increase the likelihood of Dow inclusion. As of now, I would rather buy NVDA than NVDY.