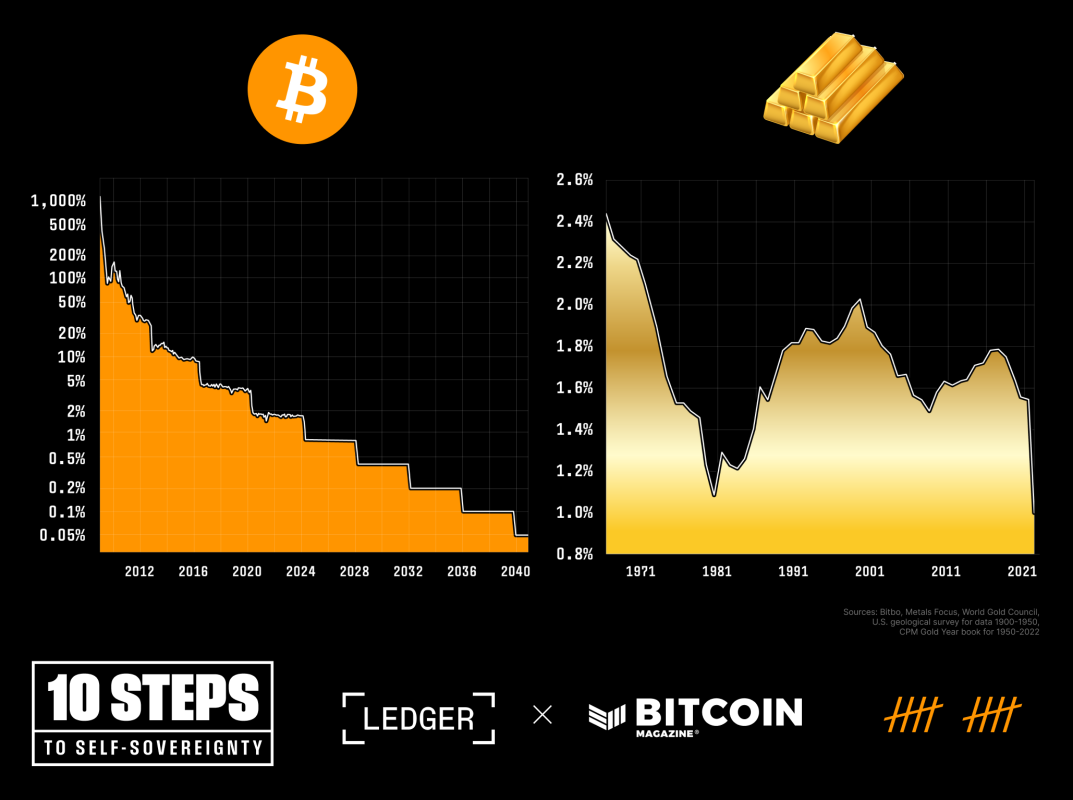

Quality Money: Bitcoin will become scarcer than gold halving

Bitcoin Halving: Gold Is On Borrowed Time

Bitcoin’s annual inflation rate is poised to fall below that of gold, the classic store of value, for the first time since its inception. A Bitcoin block height of 840,000 will halve the annual supply of Bitcoin, reducing the annual inflation rate from 1.7% to 0.85%. In comparison, gold supply is estimated to increase by 1-2% per year depending on technological changes and economic conditions.

To date, Bitcoin has experienced three halving events.

November 28, 2012: Bitcoin’s block subsidy was reduced from 50 BTC per block to 25 BTC per block.

July 9, 2016: The second Bitcoin halving reduced the block subsidy from 25 BTC per block to 12.5 BTC per block.

May 20, 2020: The third Bitcoin halving reduced the block subsidy from 12.5 BTC per block to 6.25 BTC per block.

The upcoming fourth Bitcoin halving is expected to occur on April 20, 2024 EDT, which will reduce the new Bitcoin supply per block from 6.25 BTC to 3.125 BTC. This epoch, which lasts 210,000 blocks or approximately 4 years, will increase Bitcoin supply by 164,250 BTC (from 19,687,500 to 20,671,875). This is only 328,124 Bitcoins short of the maximum supply limit of 21 million Bitcoins.

~94% of total #Bitcoin Supply has now been issued and halving is in 11 days 🙌

Digital scarcity at its best 🚀 pic.twitter.com/fjbLs1tq7r

— Bitcoin Magazine (@BitcoinMagazine) April 8, 2024

timeless gold

One criterion often used to emphasize its store-of-value function is that the value of an ounce of gold matches the price of a “fancy men’s suit” over time. This principle, known as “the ratio of gold to a decent suit,” dates back to ancient Rome, where the finest toga was said to cost the equivalent of an ounce of gold. Even after 2,000 years, the amount of gold you pay for a high-quality suit is still comparable to the price of an ancient Roman toga.

Gold has remained remarkably faithful to its holders over the years – providing a great men’s suit – but the shiny yellow metal has its challenges.

For example, the cost of verifying or analyzing gold requires that the gold be dissolved or dissolved in solution. This is certainly a challenge for anyone looking to purchase everyday household items as a store of value that they have worked hard to sell.

Additionally, the cost and cumbersome nature of transporting and storing gold itself led to the demise of the gold standard. Certificates of deposit were historically redeemable in gold, but the underlying instruments were often recollateralized, leading to the infamous “Nixon Shock” in 1971 when the United States left the gold standard entirely.

This is not to mention the risks that arise from securing physical gold, and the physical nature of gold once again demonstrates the risk and responsibility it poses in performing its function as a currency. Executive Order 6102 comes to mind when then-President Franklin Delano Roosevelt banned the “hoarding of gold coins.” This highlights the unique challenge of securing precious metals appropriately and privately to store value.

Is Bitcoin Transitioning from Speculation to Safe Haven?

Initially considered a speculative asset due to its rapid price fluctuations in its early days, Bitcoin is increasingly being adopted as a store of value. Investors today recognize its potential value and superior quality as a monetary asset. Bitcoin represents the discovery of digital scarcity while also offering a variety of use cases that go far beyond those of precious metals.

As such, Bitcoin has become a significant force in the economy in just 15 years, reaching a market capitalization of $1.4 trillion on March 13, 2024.

This growth cannot be uniformly attributed to the fact that Bitcoin meets the requirements of a better store of value than gold, but it is certainly promising. This “magic internet currency” continues to grow rapidly, with gold’s market capitalization estimated at $15.9 trillion.

The Monetary Characteristics of Gold: Made Digitally Perfect

Scarcity: Bitcoin has a limited coin supply of 21 million, making it resistant to the arbitrary inflation and market-driven supply of precious metals that plague traditional currencies.

Durability: Bitcoin is a purely data-driven, immutable form of money. Digital ledger systems use proof-of-work and economic incentives to resist all attempts to change them, preventing unexpected catastrophic tail risks and ensuring they remain a reliable store of value over time. Given their informational nature, the ability to store Bitcoin despite counterparties’ attempts to prevent this is another positive monetary attribute.

Immutability: Once a transaction is confirmed and recorded on the Bitcoin blockchain, it is incredibly difficult, if not impossible, to change or reverse it. This immutability, derived from the geographical distribution of the Bitcoin node and miner network, is an important characteristic. This ensures that the integrity of the ledger is maintained and transactions cannot be tampered with or forged. This is especially important in an increasingly digital world where trust and security are paramount concerns.

conclusion

Bitcoin’s emergence as a predictable, non-inflationary, and easily transferable monetary instrument has contributed to its recognition as a store of value among Bitcoin holders. With the upcoming halving, scarcity will surpass that of gold for the first time and serve as a wake-up call for market participants looking to avoid a delay in the currency’s decline.

There are no certainties in life, especially in investing, but the near certainty that Bitcoin provides through its decentralized nature and its ability to maintain the integrity of its 21 million supply cap will continue to drive adoption one block at a time. We are promoting it.

Gold performed well. But with halving approaching, now is Bitcoin’s time to shine.