Range Resources Stock Looks Expensive After a Good Year (NYSE:RRC)

drnadig/E+ via Getty Images

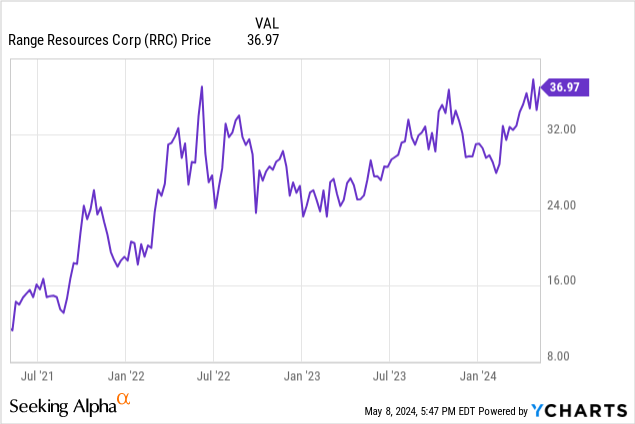

Range Resources Corporation (New York Stock Exchange: RRC), a producer of natural gas and natural gas liquids in the Appalachian region, has experienced significant underperformance in its sector and region. Considering that the stock price and market capitalization have increased by almost 50% compared to a year ago, The minimum dividend is 0.9%, so I downgrade it from a buy to a hold.

Energy investors seeking capital appreciation should monitor Range to find lower cost entry points. As fellow Seeking Alpha contributor Leo Nelissen pointed out, the company’s approval of a $1.1 billion share buyback could also support the stock price.

The company achieved this share and market capitalization increase despite its reserve value falling by two-thirds due to much lower gas prices and the Marcellus gas price in 2023 being so low that some producers halted new production. Range achieved good results in part because: Recovery and Sale Co-produced natural gas liquids.

Scope Resources Q1 2024 Results and Guidance

Range Resources’ net income for the first quarter of 2024 was $92 million, or $0.38 per diluted share.

Cash flow from operating activities for the quarter was $332 million, with capital expenditures of $170 million.

Range produced 2.14 BCF equivalent/day (BCFe)/day, of which approximately 68% was natural gas. Specifically, this breaks down into 1.46 BCF/day of natural gas, 107,300 barrels per day (BPD) of natural gas liquids, and 6700 BPD of oil.

Including the impact of hedging and derivatives settlements, Range’s first quarter ’24 natural gas, NGL and oil price realizations averaged $3.54/mcfe (mcf equivalent). Excluding third-party transportation costs, the average amount realized was $2.05 per mcfe.

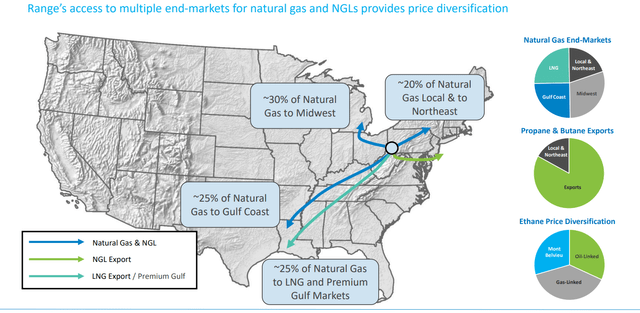

In its investor presentation, Range Resources highlights:

- *Over 30 years of core Marcellus inventory

- *Sustainable free cash flow at affordable prices due to “low capital intensity, liquidity returns and hedging”

- *Diversified domestic and international gas and natural gas liquids markets

- *Net debt decreased from $4.1 billion in 2017 to $1.4 billion in the first quarter of 2024.

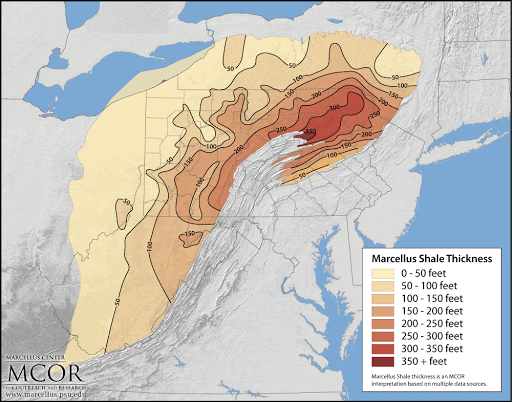

The Range holds 70,000 acres in northeastern Pennsylvania and 440,000 acres in southwestern Pennsylvania.

Range Resources Investor Presentation

macro

The big early surge in U.S. liquefied natural gas (LNG) has subsided as Russian gas exits European markets.

The bigger problem is US policy. Europe and Asia are still seeking LNG supplies, but the Biden administration has halted licensing for all new LNG export terminals in the United States. Gas prices in the Marcellus have recently fallen so low that some producers have decided whether to stop production. Complete a new well.

Today’s lower gas prices increase the demand for gas as a fuel for power generation. Gas can compete with coal, but produces fewer emissions. Little is known about the fact that the closure of U.S. coal plants provides more support for natural gas prices, as coal has long been a competitor to natural gas for power generation.

In the power sector, there is growing recognition that gas is a better backup to intermittent renewables than coal or nuclear due to its quick turn-off and turn-on characteristics. (Some grid experts recommend 1.1:1 redundancy of gas generation for solar and wind power to ensure grid stability.)

Another key factor: As artificial intelligence applications within data centers deliver more power, natural gas and nuclear (and possibly coal) power plants will meet the increased demand for power generation for 24/7 demand.

U.S. Gas Prices, Production and Demand

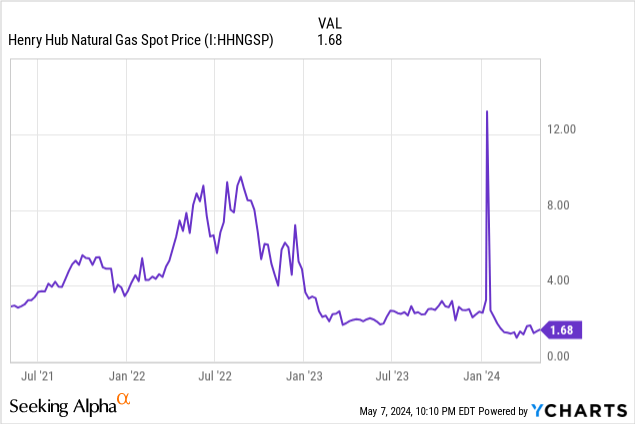

On May 8, 2024, natural gas futures for June 2024 delivery at Henry Hub, Louisiana were priced at $2.19/MMBTU.

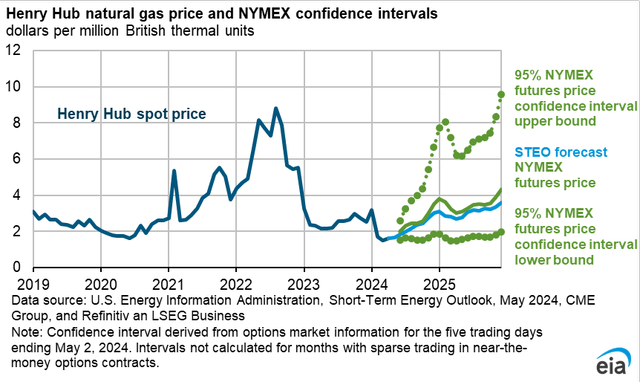

EIA expects Henry Hub gas prices to average about $3/MMBTU by the end of 2025 and notes an overall upward trend. The 5-95 confidence interval for year-end 2025 is $2/MMBTU and $9.50/MMBTU. Both are shown in the second graph below.

EIA

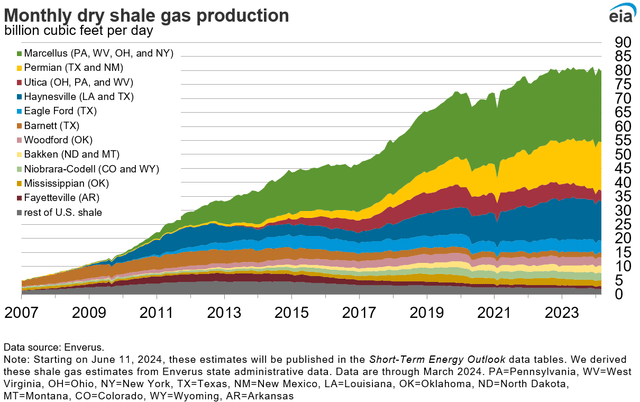

Total U.S. dry natural gas production for the week ending May 1, 2024 was 99.2 BCF/D.

April 2024 Appalachian gas volumes (green Marcellus and rusty Utica) are estimated at 36.2 BCF/d, equivalent to approximately 36% of April U.S. gas production of 100.2 BCF/d.

EIA Natural Gas Week

The map shows the Marcellus formation.

Penn State Marcellus Outreach and Research Center

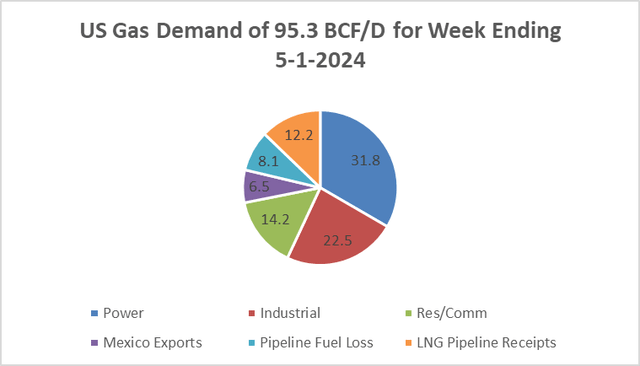

For the week ending May 1, 2024, U.S. natural gas demand totaled 95.4 BCF/D. It varies throughout the year depending on the weather.

Natural Gas Weekly and Starks Energy Economics, LLC

natural gas liquid

NGLs (ethane, propane, and butane) are used to make, heat, and dry ethylene, an important petrochemical building block. Range has also seen significant price increases due to NGL production.

reserve of scope resources

Range Resources’ total proven reserves at the end of 2023 are 17.4 trillion cubic feet equivalent (TCFe), divided into 10.9 TCF of natural gas, 1 billion barrels of natural gas liquids, and 42.9 million barrels of crude oil and condensates.

proven developed The reserves were 11.0TCFe, approximately 63% of the total.

As predicted in my report on Range last year: (and everyone else with gas reserves), 2022 gas prices are so high that the price component of the 2023 reserves bill, i.e. the overall 2023 reserves value, is lower.

As of December 31, 2022, Range’s PV-10 holdings were $24.5 billion. The value of PV-10 at the end of 2023 is At $7.8 billion, it is less than a third of its 2022 value.

Competitors

Range Resources is headquartered in Fort Worth, Texas. Poor gas price economics have held back the Appalachian natural gas sector for years, but several other companies, including Antero Resources (AR), Chesapeake (CHK), CNX (CNX), Coterra (CTRA), EOG (EOG) and the new Utica also still remains. Utica Combo also includes Combo Play, EQT (EQT), National Fuel Gas (NFG), Ovintiv (OVV), Spanish company Repsol (OTCQX:REPYY), and Southwestern Energy (SWN), which Chesapeake was trying to acquire.

In addition to the companies mentioned above, other companies in the Utica Combo include several private companies and Gulfport Energy (GPOR).

Appalachian natural gas is disadvantaged compared to natural gas from Louisiana, Texas, and Oklahoma due to Appalachian and Mid-Atlantic pipeline takeout constraints to meet Gulf Coast industrial, power, Mexican export, and LNG export demands. However, if the 2 BCF/D Mountain Valley Pipeline begins operations in late May (pending FERC approval) as expected, this bottleneck will be alleviated somewhat. As gas prices have fallen so low over the past few months, some companies have also halted Appalachian production.

As America’s large Permian Basin matures, most of its production will be gas and related gases rather than oil, which will also put downward pressure on prices. Already, Permian-related gas (produced alongside more valuable oil) is driving down gas prices because the marginal price is effectively zero.

rule

On May 1, 2024, Institutional Shareholder Services will assume overall governance of Range Resources. excellent 1 has subscores of Audit (1), Board of Directors (2), Shareholder Rights (1), and Compensation (2). On the ISS scale, 1 represents low governance risk and 10 represents high governance risk.

Insiders own 2.5% of the stock. As of April 15, 2024, the percentage of shares sold short was 9.0%.

Range Resources’ beta is 1.88. It’s much more volatile than the overall market, but that’s true for independent gas producers.

As of December 31, 2023, the five largest institutional shareholders representing index fund investments consistent with the overall market are T. Rowe Price (16.1%), Fidelity/FMR (14.6%), Vanguard (9.7%), and BlackRock. (9.3%) and State Street (4.3%).

T. Rowe Price, BlackRock, and State Street (but not Fidelity or Vanguard) are signatories to the Net Zero Asset Managers initiative. $57 trillion in assets We are limiting hydrocarbon investments through our commitment to achieve net zero reconciliation by 2050. Or sooner.

Financial and inventory highlights for scoped resources

Based on Range’s closing stock price of 36.97 shares on May 8, 2024, its market capitalization is $9 billion, up about 50% from a year ago.

The 52-week price range is $24.61-$38.25 per share, with the closing price being 97% of the 52-week high and one-year target of $38.21 per share.

Range’s trailing twelve months (TTM) return on assets and equity is 7.3% and 13.5%, respectively. Trailing 12-month EPS is currently $2.00 for a price-to-earnings ratio of 18.5.

Analysts’ average estimates for 2024 and 2025 EPS are $2.34 and $3.47, respectively, resulting in a future P/E range of 10.7 to 15.8.

TTM operating cash flow was $835 billion and leveraged free cash flow was $29 million.

As of March 31, 2024, the company had debt of $3.545 billion and assets of $7.372 billion, slightly easing Range’s debt-to-assets ratio from 52% a year ago to 48% now. (# in 1Q24 report)

Among the liabilities, current liabilities are $625 million and senior liabilities are $1.76 billion.

The debt to EBITDA ratio is 1.6.

Range Resources pays a small dividend of $0.32 per share for a dividend yield of: 0.9%. Approval for repurchase of remaining inventory 1.1 billion dollars.

The average analyst rating is 2.1, or “Buy”, from 34 analysts.

Notes on evaluation

The company’s book value per share is $15.77, approximately 40% of the market price, suggesting positive investor sentiment.

With an enterprise value (EV) of $10.6 billion, Range’s EV/EBITDA ratio is 8.7, below the preferred maximum of 10 or less and in bargain territory.

So overall, Range Resources is

- *Market capitalization 9 billion dollars,

- *Corporate Value $10.6 billion;

- *Reserved as PV-10 value $7.8 billionand

- *Balance Sheet Asset Value: $7.4 billion.

positive and negative risks

Investors should consider natural gas and natural gas liquids prices and demand expectations (particularly in Appalachia, where takeout capacity is limited despite expected additions from the Mountain Valley Pipeline) as the factors most likely to impact Range.

Other risks are political and regulatory. In particular, the Biden administration, bankers, including three of Range’s largest institutional investors, and several East Coast states that are Range’s natural markets remain committed to a zero-hydrocarbon competition stance. Moreover, the Biden administration has halted permitting for new LNG export terminals, a sector that had promised significant growth in gas demand.

The growing demand for natural gas as a power generation fuel for data centers and AI growth is positive. Additionally, as U.S. coal plants close, coal as a competitive fuel for power generation becomes a less important factor in the United States.

Recommendations for Scope Resources

Range Resources is a Marcellus gas production company that looks at the positive side of liquids production and boasts excellent governance scores. Like its Marcellus competitors, Range will see a price reduction when the 2 BCF/D Mountain Valley Pipeline begins operations in late May as planned. This is subject to FERC approval.

Due to the low dividend yield, we do not recommend Range Resources Corporation stock to dividend-seeking investors.

Investors focused on capital gains may want to wait for a lower cost entry point. I’m downgrading Range Resources from Buy to Hold after the stock rose significantly last year.

I own stocks.

scope resources

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.