Readers who bought technology during the selloff should pay close attention to the following factors:

cancer

When trading you need a plan

Last week, I suggested to readers that the FOMC announcement on Wednesday was likely to cause markets to sell off. Buy and Sell at FOMC Meeting, Stay With Tech. Now I expect readers to wonder what will happen next. This week’s economic numbers are fairly quiet. On Friday, the University of Michigan Consumer Expectations will be released. I don’t remember that being a big market driver, except when there was a big upside compared to last month. So let’s think about it.

Factors are related to technical and economic data, including market psychology.

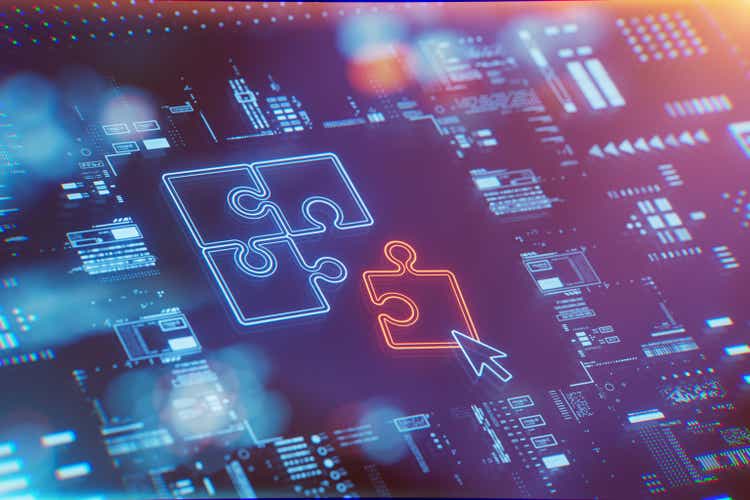

Let’s deal with the technical aspects first. Below is SPX, the S&P 500 index. Typically, the SPX, not the Dow Jones Industrial Average, is used as the primary indicator for stocks. General press. Anyway, below is the 6-month SPX from Yahoo Financial.

yahoo finance

The purple line starting at the bottom left and extending below the blue is the 50-day moving average. You can see that SPX (blue line) is well above that. That means we had three months of inflation through April, and the markets didn’t like it. We can see that the stock has risen sharply this week, with the 50-day moving average sitting just below 5130. We closed at 5127.79. Either traders stopped right there because they knew the 50-day moving average was right there, or it’s also where a lot of overhead resistance appears. .

Stock charts are all about price tracking, so every squiggly curve on the SPX represents not only the price, but also the individuals who would buy at that price and most likely get their money back. The horizon is at 5150, which in my opinion is a sign that we are in an uptrend again. A break above providing resistance is still needed, but a break above the 5150 level would feel much more bullish. So why am I optimistic? I will edit it. Why am I optimistic enough to say I’m staying in tech? I think we’ll go a little higher, but I think the big tech companies will see more upside.

In this article and the previous one I was talking about trading, so at some point you make a profit from your trading. I think the rewards outweigh the risks as long as some upward momentum is maintained.

Powell said exactly the right thing on Wednesday, and on Friday the employment numbers were lackluster.

Market participants appear to have been relieved that Chairman Powell did not consider a rate cut in 2024. Some economists also said Powell should at least discuss raising interest rates. I think Powell will be in trouble for going very hawkish and vaguely reminiscing about calls for pain and the so-called “Jackson Hole” that I mentioned in a previous article.

After all, the stock market hates the unknown and craves visibility. Maybe that’s why I like the idea that there will be a rate cut at some point. As long as it stays there, the market is happy. So after the rate decision, Powell was relieved, saying the Federal Open Market Committee would need to see more data, but markets were happy when he assured them that current rates were sufficiently restrictive and that there would be a rate cut.

And when the perfect April Jobs report came out on Friday, I wondered if Jobs knew it wasn’t going to go his way. SPX – Stock prices surged, with the S&P 500 up 1.26%, recovering all of this week’s losses and gaining 28 points compared to the previous week. Not to be outdone, Nasdaq rose 1.99%, up 230 points from the previous week’s closing price. With this kind of jump, we could see some consolidation on Monday, but I believe we could also see the best stocks moving higher below the index.

Next week might be fine, but next week we might see another selloff.

Once again, PPI will be measured on May 14th and CPI on May 15th at 8:30 AM. Hope for the best and prepare for the worst. I think there will be some relief as consumers appear to be rebelling against higher prices due to the performance debacle at Starbucks (SBUX) and the loss of profits at McDonald’s (MCD) as an example. Perhaps the more price-sensitive among us are rejecting higher prices, but I think this is the start of a trend.

Of course, the softening in this April’s jobs report is a sign of some slowdown. This should be reflected in the CPI, and perhaps the PPI for oil has also fallen meaningfully. Fuel is not included in the core CPI, but it affects all costs. Ultimately, I think it might be wise to cut back on transactions this weekend and hold on to some cash instead. You can also set up a hedge on Monday or Tuesday using put options.

So here’s why I think the Fantastic Five or Super Six should perform a little higher.

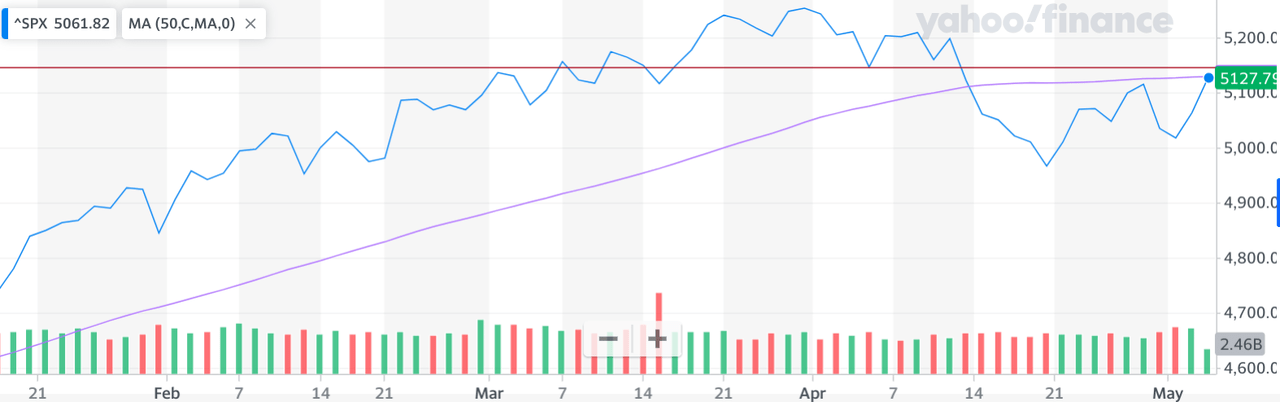

Let’s take a look at three tech stocks I’m trading. The first is NVIDIA (NVDA). Let’s use a 3-month chart.

TradingView

There are two concepts here: One is the bullish formation of “cup and handle” and the other is cautious movement. This is a prediction of how much the stock price will rise. The difference between the two horizontal lines is approximately 115 points. I’m not going to add it to the top horizontal line, which starts measuring at 877, because it’s too big. Remember, NVDA hasn’t reported earnings yet. This massive sale has brought some skepticism, so I think there’s reason to get some buyers this week.

I also want to say that I don’t believe NVDA will hit 100 this week. “Measured Move” has no immediacy, it is an estimate rather than a hard and fast level, especially since you have chosen the line to measure on the chart. One thing is certain: for NVDA to fall to $760, many individuals would have to sell their shares at a much lower price than NVDA is currently paying. I think some people, especially money managers, want to come back in.

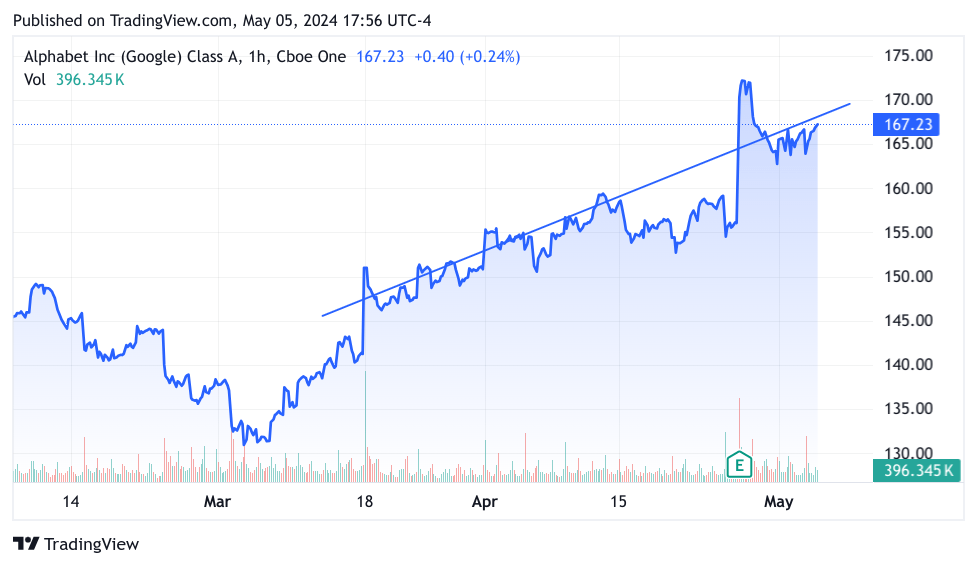

Next on the list is Alphabet (GOOGL), which produced a very good earnings report.

GOOGL reported $80 billion, beating estimates by nearly $2 billion and also comfortably beating GAAP revenue. In addition, GOOGL will pay dividends for the first time in its history, which will also attract new investors. If that wasn’t enough, they announced $70 billion worth of stock buybacks. So, yes. I ignored the exclusive trial. We won’t hear the verdict for weeks or months. I traded on GOOGL for a long time during the sell-off. Let’s look at the 3-month chart again.

TradingView

This chart is very simple and I am using option leverage so I don’t need many points to get good returns and the trend is higher and I don’t think it will go up in 2018. In order for this deal to last long, I think GOOGL needs to be valued higher than it is now. A lot is happening right now, including better growth and higher profitability from Google Cloud and AI. I would spend the day staying for 4-5 more points. If a sell-off occurs next week, you can participate again in the next round.

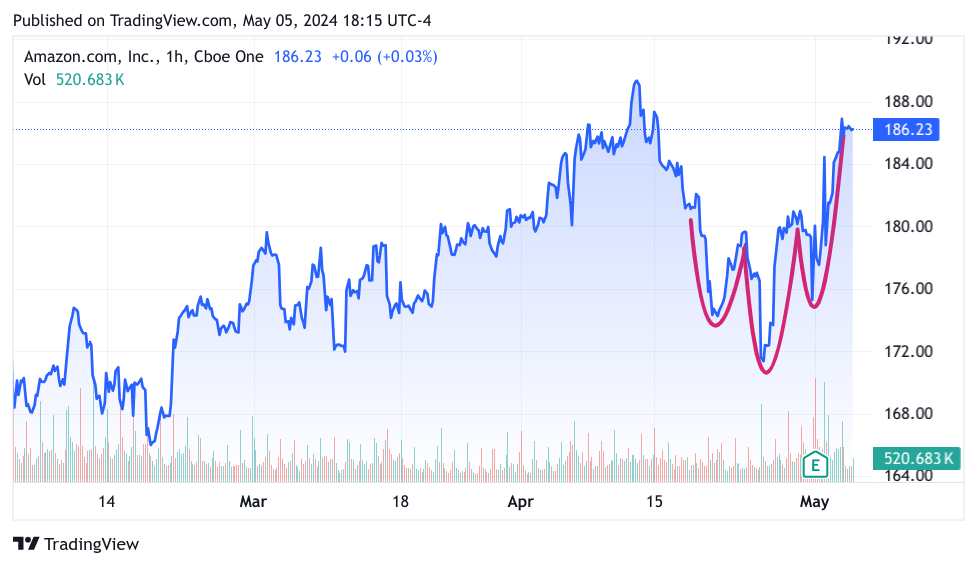

Lastly, there is Amazon (AMZN), which has been profitable and performing well.

TradingView

The inverse head and shoulders are very optimistic. The way the formation is reaching higher levels tells us that AMZN is very likely to break new highs as well.

To summarize: I believe there is a very good chance that Tech Titans, including Apple (AAPL), will reach even greater heights. I would like to highlight that many market participants have sold this stock and believe they are underweight this name. NVDA and GOOGL both saw sharp declines in April, as did AAPL. Many participants will want to return to these names and will begin doing so starting this week. Perhaps Monday will show some hesitation and, barring any new news, such as geopolitical news, all bets will be off. But it’s always risky.

The above is what I am thinking out loud about trading. If you are investing or stock trading and would like to maintain your current position prior to this article, think about it. I’m trading very short-term here, PPI and CPI could be good for stocks, or employment numbers could be low and the market might decide to ignore them.

So, if you plan to keep trading for a few months, that might be okay too. I believe stocks will rise over the long term. If you are a long-term investor, be sure to stay invested. I am writing about my specific situation. If that matches your situation, great. If not, you’ve probably found something interesting here.

Since I have spent a lot of time trading, I will list some stock investments: ASML Holding (ASML), Intuit (INTU), Meta Platforms (META), and ServiceNow (NOW). This week has been difficult for everyone, so I’ve added some positions.

Okay, good luck everyone…