Right Tail Capital Q4 2023 Investor Letter

Avalon_Studio

Have you ever felt a connection to someone that you never met? Maybe you feel like you know the person and would hit it off if your paths crossed.

That’s how I think of Charlie Munger, former Chairman of Berkshire Hathaway (BRK.A, BRK.B) who passed away in November at the age of 99.

He espoused many ideals that I find inspiring, both in investing and in life. I’ll start by sharing a few of my favorite Munger quotes1.

- Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Systematically, you get ahead, but not necessarily in fast spurts. Nevertheless, you build discipline by preparing for fast spurts.

- In my whole life, I have known no wise people who didn’t read all the time — none, zero.

- The big money is not in the buying and selling but in the waiting.

- It’s such a simple idea. It’s the golden rule, so to speak: You want to deliver to the world what you would buy if you were on the other end. There is no ethos, in my opinion, that is better for any lawyer or any other person to have. By and large, people who have this ethos win in life and they don’t win just money, not just honors. They win the respect and the deserved trust of the people they deal with, and there is huge pleasure in life to be obtained from getting deserved trust.

- The fundamental algorithm of life – repeat what works.

- I had a roommate in college who was and is severely dyslexic. But he is perhaps the most reliable man I have ever known. He has had a wonderful life so far: an outstanding wife and children, chief executive of a multi-billion-dollar corporation. If you want to avoid a conventional, main culture, establishment result of this kind, you simply can’t count on your other handicaps to hold you back if you persist in being reliable…

- Munger then reflected on this quote 20 years later, when Poor Charlie’s Almanack was first published: If anything, I now believe even more strongly that 1. Reliability is essential for progress in life and 2. while quantum mechanics is unlearnable for a vast majority, reliability can be learned to great advantage by almost anyone.

Charlie Munger’s ethos has been sprinkled into each of Right Tail’s letters. We’ve discussed Berkshire Hathaway annual meetings, the impact of reading, the power of patience, and the importance of allowing great businesses and time to compound our wealth over time. These are familiar concepts that guide us.

I admire Munger’s desire to improve over time – in fact, it’s one of the inspirations for the name Right Tail. He had so many good, simple, yet powerful insights about the powers of getting a little better each day. Reading voraciously is one way to do it. I also practice this self-discipline in exercise, meditation, and eating healthy. These habits help me do a better job for you.

In addition to discipline, patience is incredibly important in compounding. Charlie has many great lines on patience. After finding a good investment, he liked to practice “sit-on-your-(butt)” investing. I discussed patience in this year’s second quarter letter2 and how fighting the urge to act can lead to powerful compounding. Businesses with high and sustainable returns on incremental capital bought at fair prices should outperform over time. As a reminder, Right Tail’s goal is to compound wealth and generate excellent after-tax returns over multi-year periods.

I often admire those who can communicate wisdom in a few words. Charlie was direct. Charlie was concise. Repeat what works. I find this incredibly helpful in investing. There are so many mistakes one can make in investing. If we are honest with ourselves and communicate openly, we have a better shot at recognizing when a company is not performing to plan. Hopefully, we can be a bit more like Charlie and say and do the things that seem right rather than getting caught in a value trap or selling a winning company too early.

Further, Charlie shared his wisdom. He was a teacher. He simplified his learnings for our benefit. I similarly enjoy learning with and helping others. Charlie’s actions will instruct us for ages to come.

PORTFOLIO ACTIVITY: SELLING CHARLES SCHWAB IN SPRING 2023

Some of Right Tail’s larger investment decisions this year involved moving on from an investment. Charlie would say, don’t avoid mistakes because they are inevitable. Instead, focus on repeating what works.

Notably, I sold Charles Schwab (SCHW) in March. Now that some time has passed, I’ll share how I approached the decision. In March, Charles Schwab stock declined ~25% during the banking challenges that crippled First Republic Bank (OTCPK:FRCB) and Silicon Valley Bank (OTCPK:SIVBQ). Schwab has some similarities in that it is a bank (investing idle cash in their customers’ accounts allows them to charge less for other products and services) and had invested in bonds during the low interest rate years that would be worth less if Schwab needed to liquidate today. Also, Schwab clients were leaving less cash in their accounts favoring higher interest alternatives that were a more expensive cost of funds for Schwab. However, Schwab had many positives relative to the troubled banks such as limited uninsured deposits and sticky assets. For example, investment advisors such as Right Tail, who have custody at Schwab, have limited options. It would be a hassle (though quite doable) to switch to a different custodian (and I would absolutely make the change if I thought it was in the best interest of our investors). I carefully considered the pros and cons. Something had changed in that I had always considered Schwab to be a beneficiary of rising interest rates – now the company was rooting for lower rates in the intermediate term. I thought Schwab may have to raise capital to deal with their short-term liquidity challenges (they indirectly raised capital by pausing their stock repurchase program). I also thought regulators may ask more of Schwab as an important institution that no one wants to fail. Positively, I was still rooting for Schwab and thought they’d continue to be a blue-chip brokerage firm that would likely keep taking share over time.

Ultimately, I felt my time and energy would be better spent trying to find the next great Right Tail investment than trying to untangle Schwab. I sold the stock in the mid-to-high $50s and used the proceeds to add to our existing positions that I felt best about. I estimate that owning Schwab reduced our returns by less than 100 bps since inception and ~250 bps for 2023.

2023 PERFORMANCE DISCUSSION

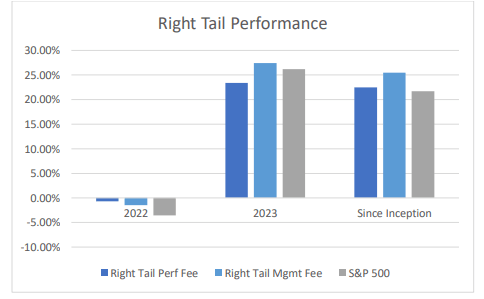

I’m pleased that our investments have grown significantly in 2023 and since inception in May 2022. Right Tail’s portfolio grew 29% before fees in 2023. Net performance for performance fee investors grew ~23.4%, while management fee investors grew ~27.4%. This is a bit different than last year, where Right Tail’s portfolio declined slightly and performance fee investors did not pay a fee. Broader market indexes like the S&P 500 also had a good year, rising ~26.2% 3. Since inception, Right Tail’s net performance is 22.5% for performance fee investors, 25.5% for management fee investors, and 21.7% for the S&P 500.

Right Tail’s stock picking has been strong with our stocks growing ~32.7% this year. Holding ~10% in money market funds for most of the year lowered our net performance. However, I did not want to rush into investments, and earning ~5% on a cash alternative has been a reasonable alternative.

I strive to get better and improve as an investor. I do not want to inflate the significance of these results in this wealth-compounding marathon, but I am pleased that Right Tail has gotten off to a strong start and outperformed the market. Right Tail’s long-term perspective continues to be one of our greatest foundations, and I look forward to continuing to build Right Tail’s track record in the years to come. I also enjoy providing additional value. Being thoughtful around taxes, a steady hand during volatile markets, and a sounding board for other investment decisions are other ways I hope to benefit you.

FAVORITE BOOKS AND PODCASTS OF THE YEAR

To honor Charlie Munger, here are a few of my favorite books from this year.

What I Learned About Investing from Darwin4 by Pulak Prasad. I love how Pulak relates investing in great companies to several observations in evolution. This book is so well done that you don’t have to love investing or evolution to derive some serious value from reading it.

Working5 by Robert Caro. This book pairs nicely with the documentary Turn Every Page6 which focuses on Caro’s multi-decade partnership with editor Robert Gotlieb. Each year, I try to reread a few of my favorite books, and Working falls into this bucket. I walk away feeling like I know Robert Moses and Lyndon Johnson. His research methods also apply well to investing. Being a great listener, asking open-ended questions, and meticulously hunting for sources can help illuminate the companies or industries we’re trying to understand.

Also here are a few timeless podcast episodes that I have listened to repeatedly:

Lastly, Munger also advised “Be alert for the arrival of luck.” I am certainly lucky to know you and am thankful that you continue to root for Right Tail. May we all approach 2024 with the diligent preparation that Munger would be proud of and be alert for the serendipity that comes our way.

Jeremy Kokemor

Right Tail Capital

1 Most of these quotes are found in Poor Charlie’s Almanack. The book can be bought or listened to for free at https://press.stripe.com/poorcharlies-almanack

2 https://www.righttailcapital.com/_files/ugd/9593df_6143b8b86c1a46c9b232c0d65e624c2f.pdf

3 Subtracted 9.5 bps of annual fees from S&P 500 total return in line with SPY ETF fees.

4 What I Learned About Investing from Darwin

5 Working

6 Turn Every Page: The Adventures of Robert Caro and Robert Gottlieb

DISCLAIMER

This review (the “Review”) is being furnished by Right Tail Capital LLC (“Right Tail” or the “Firm”) for informational purposes only. This Review does not constitute an offer to sell, or a solicitation, recommendation or offer to buy, any securities, investment products or investment advisory services offered by the Firm (the “Offering”). Any offer or solicitation may only be made to prospective eligible investors by means of an Investment Advisory Agreement and Form ADV, which contain a description of the material terms relating to the Offering, including the numerous risks involved. This Review is being provided for general informational purposes only.

Right Tail Capital (“Right Tail”) is registered as an Investment Adviser with the states of Virginia and Louisiana. Interested parties should read Right Tail’s Forms ADV I and II, available at adviserinfo.sec.gov.

Certain information set forth in this Review is based upon data, quotations, documentation and/or other information obtained from various sources believed by the Firm to be reliable. No representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. This report and others posted on www.RightTailCapital.com are issued without regard to the specific investment objectives, financial situation, or needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold a company’s stock.

Predictions, forecasts, estimates for markets should not be construed as recommendations to buy, sell, or hold any security — including common stocks, bonds, mutual funds, futures contracts, and exchange traded funds, or any similar instruments. Investment strategies managed by Right Tail involve a significant degree of risk, and there can be no assurance that the strategy’s investment objectives will be achieved or that significant or total losses will not be incurred. Nothing contained herein is or should be relied upon as a promise, representation or guarantee as to the future performance of Right Tail’s strategies. Past performance is not indicative of future results.

Images, graphics, logos, and other designs used in the Review are believed to be in the public domain. A reasonable, but not exhaustive, effort has been made to verify that such images, graphics, logos, and designs are not protected under copyright. However, if any party feels that this Review is in breach of copyright law, it should immediately contact the Firm.

Performance data for the Right Tail Portfolio is based on the advisor’s brokerage account which was invested beginning on May 16, 2022. This performance figure has not been audited by any third party. Individual account performance will vary depending on a variety of factors, including the initial date of investment, inflows/outflows, account size, fee class, tax considerations, and transaction costs. Please see your individual account statement(s) for actual account balances and performance.

Performance comparisons to benchmarks such as the S&P 500 Index and the SPDR S&P 500 ETF Trust (“SPY Index ETF”, “SPY”, or “S&P 500 Index ETF”) are provided for information purposes only. The SPY is an exchange-traded fund which seeks to provide the investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500 Index. The S&P 500 Index is a diversified large cap U.S. index that holds companies across all 11 GICS sectors, and as such may differ materially from the securities managed by Right Tail in client accounts. Benchmarks such as the S&P 500 Index and the SPY may be of limited use in understanding the risks and uncertainties inherent in the investment strategies managed by Right Tail.

The information in this Review is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. The Recipient should consult the Recipient’s own tax, legal, accounting, financial, or other advisers about the issues discussed herein. Nothing in this Review regarding tax strategies, tax savings, tax rates, tax efficiency, or any other statements related to taxes should be relied upon as an indication of Right Tail’s suitability to give advice or make decisions with respect to taxes in any jurisdiction.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.