Satoshi’s Mistake

Satoshi Nakamoto is a god and Bitcoin’s design is perfect. Or maybe it is? There is one feature of the protocol that continues to bug me: the half-life, whatever. I’m sure Naka thought of this. His first Bitcoin would have had a gradual reduction in supply per block. However, the final design as we know it halves the block reward every 210,000 blocks (every 4 years). Clearly, this decision had a huge impact on price action, volatility, and adoption. Unfortunately, it’s not the best supply plan. Let’s explore.

half life

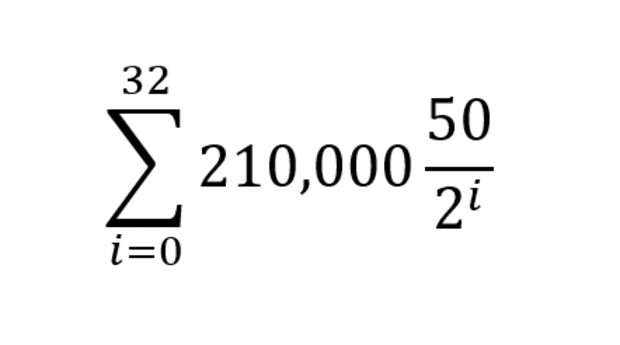

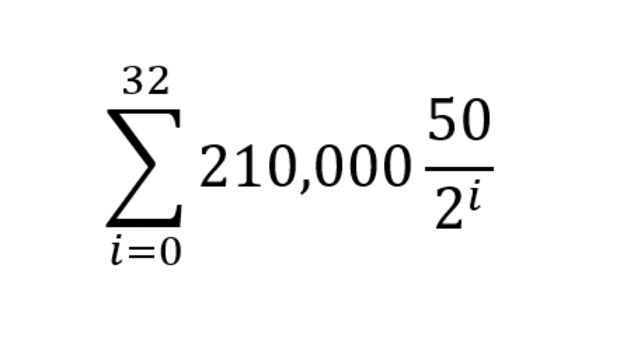

As we know, Bitcoin has a supply schedule that adheres to the following hard-coded rules:

If you’re not familiar with the math, this is the sum (Σ) of all new coins supplied per block from launch until the next 32 halvings. For the first 210,000 blocks (i=0), the block reward was 50 (50/(20) = 50/1 = 50). The first halving follows (i=1), where the block reward for the next 210,000 blocks is cut in half (50/21 = 50/2 = 25). This will continue until the 32nd halving cycle is completed around 2140 and the total supply will reach nearly 21 million coins.

These supply schedule choices have consequences. It shocks the market because supply is suddenly reduced by 50% overnight. As demand remains unchanged and Bitcoin becomes twice as scarce, the price rises. Sudden price spikes lead to a cycle of hype, attracting media attention and attracting new adopters.

Halving is a media campaign built into Bitcoin. But it costs money. Because prices are so volatile, they surge to explosive highs and the roller coaster plunges back into the abyss. This makes Bitcoin less than ideal in most cases, with declines of 75-85% being the norm.

Bitcoin’s key feature is its store of value (SoV) capability, which makes it significantly different from other innovative technologies. If you apply FOMO at the top, the store of value function will only be realized after 4 years. The only way new hodlers can hold Bitcoin is if they fully understand the protocol, trust the code, and know that the price will recover and rise after the next halving. This is a level of abstraction and confidence that most prospective adopters do not have. Negative short-term price movements significantly depress the SoV proposition. It takes months to truly understand Bitcoin (and fiat currencies).

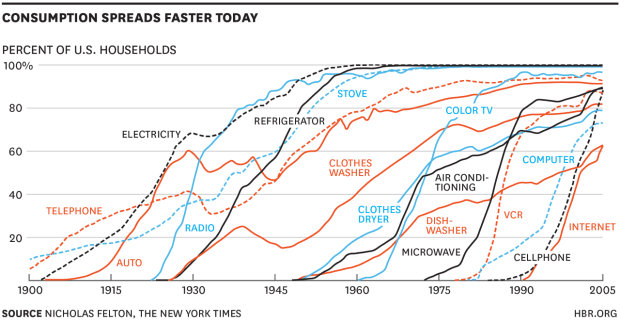

However, with other techniques, the benefits become very clear after first use. TVs, phones, email, and microwave ovens are great examples of innovations whose value is recognized within the first few minutes.

new york times

To highlight the impact of perception, consider the adoption of color televisions and computers. Television is steeper than ever. This is because I experienced its value immediately. Computers were much more obscure devices. So there are exceptions to charts that go against the trend. It’s important to ask why. Bitcoin can be an outlier too! Perception of value plays a large role in the steepness of each individual curve. According to Everett Rogers, who first studied these curves, this is one of the main drivers of technology diffusion. This makes adoption narratives like “It’s like the Internet in 1994” or “The innovation adoption curve is getting steeper over time” less persuasive.

So the question is: Is the current four-year supply schedule ideal?

gradual reduction in supply

The alternative is simple: ISR. There is no halving, but the block reward is slightly reduced with each block. So block 0 has 50 BTC. Block 1 has 49.9999, etc. A linear function is not ideal, but there are other options.

ISR schedules do not prevent volatility, but they can certainly reduce volatility since there are no longer pent-up shocks in the market. These changes will transform Bitcoin into a more stable asset, which will gradually increase its price over time.

So will the media hype and interest decrease? if. But how many more people were left for the trip? What is the sweet spot between these two schedules? You can imagine that ISR could have improved adoption. The halving cycle could greatly obscure the perceived value of Bitcoin.

In the future, we will run this experiment when we are able to test Bitcoin on another planet or launch another simulation. The half-life is expected to be a suboptimal design. Looking back, Satoshi made a mistake…

This is a guest post from Bitcoin Graffiti. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.