SPBO: Medium Term Corporate Bond Fund, Yield 5.4% (NYSEARCA:SPBO)

Torsten Asmus

proposition

Intermediate-term bonds appear to be the preferred method for institutions to take advantage of the current high interest rate environment. Some market participants believe that the duration profile of long-maturity bonds is too high given the uncertainty. While the U.S. Treasury is a debt placement environment, intermediate bonds offer the best of both worlds.

In this article, SPDR Portfolio Corporate Bond ETF (NYSEARCA:SPBO), explains its makeup, analysis, and what’s next, and explains why we think retail investors shouldn’t jump into this name just yet.

What does SPBO actually do?

According to the literature, the fund seeks to provide investment results commensurate with the performance of the Bloomberg US Corporate Bond Index.

The Bloomberg US Corporate Bond Index is designed to measure performance. This is what the investment grade corporate bond market looks like. The index includes publicly issued, investment grade, fixed rate, taxable, U.S. dollar-denominated corporate bonds issued by U.S. and non-U.S. industrial, utility, and financial institutions. Bonds included in the index must have a par value of at least $300 million and a remaining maturity of at least one year. The index considers investment grade securities rated Baa3/BBB- or higher.

Following the Bloomberg index, the ETF would contain more than 4,000 names, with an average return of a whopping 5.34% and a period of 7 years. The fund contains mostly single A and triple BBB rated bonds, which is very similar to the overall market picture in the investment grade space. Corporate industrial bonds account for the largest share at 58%, followed by corporate finance at 32%.

The fund’s option-adjusted spread is 96 bps. This means that the ETF only earns 96 basis points over the risk-free rate for the company’s risk. In practice, SPBO can be thought of as a diversified corporate bond with a maturity of 7 years, priced at 96bps relative to Treasuries.

Median Treasury durations are attractive, but bond spreads are not. We’ll look at this in the next section.

What type of duration should you buy in the current market?

We believe the risk-free rate has peaked, but it is currently unclear when it will come down. Most investment banks are pricing cuts once or twice this year, mostly in September and December. Duration simply refers to a specific period of time on the yield curve, and when you purchase duration, you are securing a specific yield to maturity.

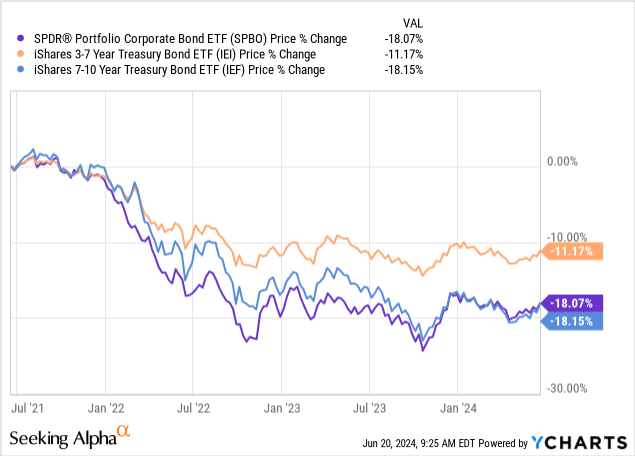

Here, we like intermediate Treasury durations (i.e. fixed Treasury yields), but feel strongly that investment grade corporate bond spreads are too narrow. Some critics argue that spreads are only a small part of the returns SPBO delivers, but let’s take a look at what widening spreads actually does to the fund. To round out the thought process here, you can get some intermediate treasury duration through funds like the iShares 3-7 Year Treasury Bond ETF (IEI) or the iShares 7-10 Year Treasury Bond ETF (IEF). Return profile based solely on the risk-free rate:

SPBO is very highly correlated with IEF as their duration profiles are almost identical. The above graph is a price change graph, not a total return rate, so it does not include the difference in dividend yield. However, due to the credit spread component, we could see SPBO incur larger losses in a severely risk-averse environment.

What happens to SPBO when credit spreads widen?

The Fund discloses interest rate sensitivity (maturity) but does not provide calculations for credit spread sensitivity. Fortunately, these are very similar to bullet corporate bonds, so we’ll assume 7-year credit spread sensitivity here as well. This means a loss of -7% per 100bps when credit spreads widen. Therefore, if the spread rises by 100 bps, the fund will lose -7%, and if the spread rises by 200 bps, the fund will lose -14%.

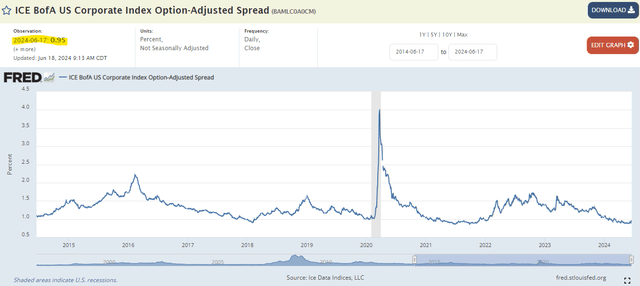

Let’s take a closer look at the performance of investment grade bond spreads over the past few years and derive the average and upper bounds of the spread.

IG spreads are now at the bottom of their historical range.

You can graph the IG spread based on data provided by the Federal Reserve.

IG Spread (Fed)

Please note that the levels of the ICE BofA US Corporate Index OAS are almost identical to those presented by SPBO. If you look at the graph above you can see that we are at the bottom of the range in the 10 year lookback. The average spread is approximately 133 bps, with a high range of 200 bps.

In the risk-averse scenario, an expansion of at least 50bps from current levels is expected, which would imply a loss of -3.5% for the fund. Some market participants are arguing that the next widening of credit spreads will be tempered by lower risk-free rates. The thinking is that if the economy is weak, spreads will widen, but at the same time, the risk-free rate will be lower because the Fed will have to cut rates more aggressively.

The only scenario in which this negative correlation does not hold is the inflation scenario. If inflation continues its alarming upward trajectory and the Fed has to keep interest rates high for longer, or even talk about raising them, we will get a market scenario where spreads widen and risk-free rates rise higher. This would be the worst-case scenario for SPBO from a downside perspective.

When to Buy SPBO

We don’t have a crystal ball, but we believe in regression to the mean. We believe SPBO should be bought due to credit turmoil that could push spreads much higher. In this scenario (negative spread/risk-free rate correlation), even if risk-free rates are slightly lower, we would recommend buying corporate bond funds driven by increased default probability rather than high absolute all-in returns. We are ‘holding’ on the name as spreads are currently at the bottom of their historical ranges.

conclusion

SPBO is a bond-type exchange-traded fund. The vehicle has a duration of seven years and includes a diversified portfolio of investment grade corporate bonds. This fund is best thought of as layering credit risk on top of IEF, and the two ETFs have very similar duration profiles. We believe that today’s environment does not present a good entry point for SPBO, as corporate spreads are at historic lows. We recommend buying duration through IEF and waiting for the credit breakaway and IG spread to exceed 133bps to trigger a buy level in SPBO.