Taiwanese Funds: Turning Bullish as Technology Tailwinds Strengthen (NYSE:TWN)

SAM YEH/AFP via Getty Images

Taiwan started the year on a high note with monthly export growth in the low teens, driven by a +30.1% rebound in technology products. Looking more closely, the AI-linked ‘Information and Communication Products’ category was particularly strong, rising +100.6% YoY, driven by growth sectors. Something like a server or storage device. GPU chip and NVIDIA Corporation (nvidia), Taiwan, a global chip supply chain hub, is perhaps best positioned to capture the full spectrum of AI. for example, Anticipated changes in computing requirements ‘Inference’ (compared to GPU-intensive ‘training’) requires ASIC chips (‘application-specific integrated circuits’).

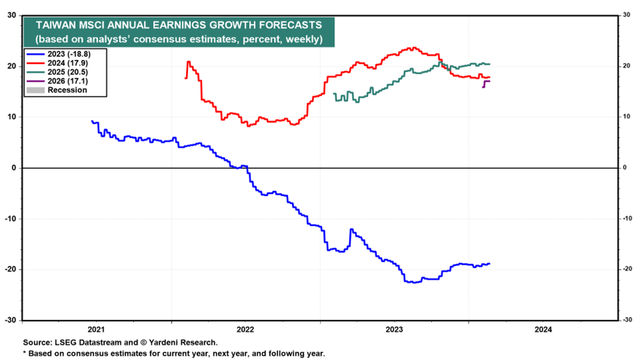

To be fair, many of Taiwan’s smaller chip names have already re-evaluated in the past year, with many outperforming NVDA thanks to AI tailwinds. However, if the current consensus revenue growth rate is For those willing to believe (high teens until 2026) and embrace a cyclical rebound in ‘legacy’ technologies (think mobile and PC), the market is probably looking at a forward P/E of around 17x. This won’t be that expensive. MSCI Taiwan).

Jardeni

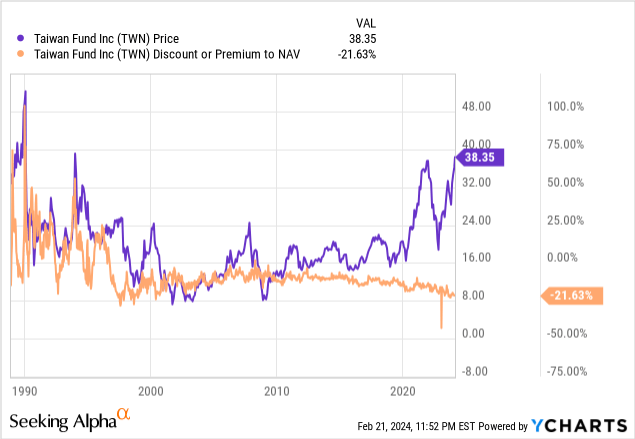

Investors interested in Taiwan’s technology story may want to consider Taiwan Fund Inc., managed by Nomura Holdings, Inc. (NMR).New York Stock Exchange: TWN), a closed-end fund that significantly exceeds the index for the country’s technology sector. To be clear, I was nervous about the fund last year. I was proven wrong on both counts (geopolitics and valuation). Earnings growth continues to significantly exceed expectations, and the positive status quo results from Taiwan’s recent election have lifted the overhang on ‘shovel’ stocks. Meanwhile, early reports are showing more positive earnings surprises in the tech sector ahead of Q4 results, so this may be the best time to accumulate Taiwanese tech funds here. A much wider discount to net asset value (currently ~21% to underlying NAV) and lack of consistent distributions are great features of TWN, along with current marginal redemption support. However, for very long-term investors who do not need immediate liquidity, the discount adds significant cushion and becomes an attractive entry point.

TWN Overview – Still a growth fund with a high-tech focus. Take a look at the costs

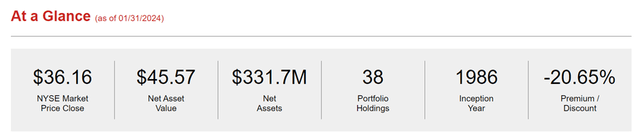

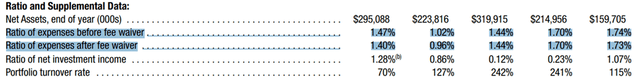

The closed-end Taiwanese fund, actively managed by Nomura Asset Management, saw its asset base ($332 million at the time of writing) increase significantly after a very strong 2023. However, this fund’s headline expense ratio is also higher. 1.5% gross (1.4% net of fee exemption). The costs are quite significant, including lower liquidity and wider bid/ask spreads compared to passive ETFs like the iShares MSCI Taiwan ETF (EWT) and Franklin FTSE Taiwan ETF (FLTW), which charge expense ratios of 0.6% and 0.2%, respectively. . A compromise for TWN.

Nomura

The listed headline expense ratio is nearly 50bps higher than last year, but the 60bps annual management fee cut that Nomura has set for the end of 2022 (vs. 70bps annually when Allianz SE ( OTCPK:ALIZF ) was the investment manager) is worth noting. It’s still in very intact condition. Instead, the additional costs result in various performance incentives rather than increased fees. However, the fund’s +/-25bps performance adjustments go in both directions, so in years when the fund underperforms (e.g. fiscal year 2022), it will move ~25bps in the other direction. Excluding approximately $2.1 million in management fees, Nomura has actually managed its costs well. In many cases, major fund spending items have decreased compared to the previous year.

Nomura

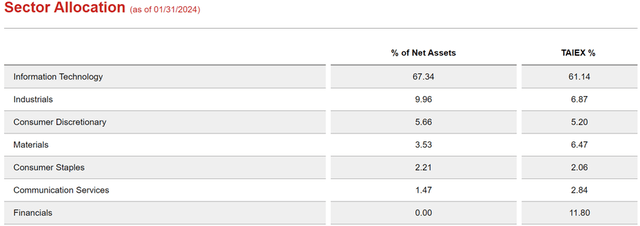

TWN has always been a technology-focused fund, so it’s not surprising that its sector allocation is still heavily biased towards information technology. Technology overweighting is smaller than before at 67.3% of total assets (61.1% for the Taiwanese benchmark Taiwan Capitalization Weighted Stock Index (‘TAIEX’)), but still a few percentage points higher than US-listed passive ETFs. Industrials are the new major overweight at 10.0% (6.9% for TAIEX), while Consumer Discretionary exposure is slightly lower at 5.7% (5.2% for TAIEX). The fund has relatively underweights in all other sectors, with the most notable difference being the financial sector (0% vs. 11.8% for TAIEX).

Nomura

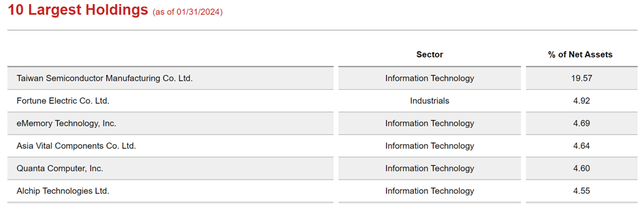

Compared to U.S.-listed passive Taiwan ETFs, TWN actually has a smaller Taiwanese semiconductor manufacturing position at 19.6% (compared to 24.6% for EWT and 22.5% for FLTW). Other notable omissions include MediaTek Inc. (MDTKF) and Hon Hai Precision Industry Co., Ltd. (OTCPK:HNHPF), which are the second and third largest holdings in EWT and FLTW, respectively. Instead, the TWN portfolio is heavier on lesser-known technology supply chain names such as eMemory (4.7%), Asia Vital Components (4.6%), Quanta Computer (4.6%) and Alchip Technologies (4.6%), all of which have performed well. . Recent months have been heavily influenced by cyclical, long-term AI tailwinds. New pre-tech additions, such as power equipment maker Fortune Electric (4.9%), are also connecting supply chains with high-growth sectors such as electrification and automation, in keeping with the fund’s focused, growth-oriented style.

Nomura

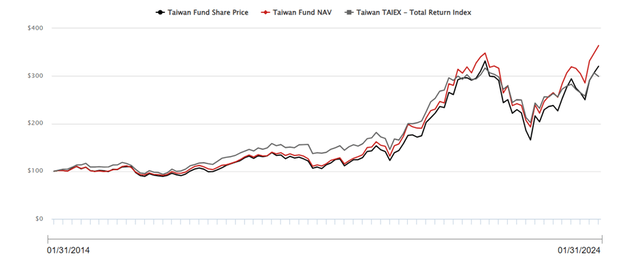

TWN Performance – A track record built on technology and numerous betas; Be aware of NAV discounts

TWN investors will undoubtedly be very pleased with their returns. Last year was one of the all-time highs at 58.1% (31.7% for benchmark Taiwan TAIEX), and so far in 2024 it is the same at +4.6% (+ -2.1% for TAIEX). Over longer 5- and 10-year time horizons, the fund similarly outperformed its benchmark and passive MSCI Taiwan tracker by a wide margin, with NAV returns of +26.8% and +14.6%. The key to the fund’s outstanding performance is its higher beta achieved through large exposure to high-growth, small-cap Taiwanese supply chain names. Therefore, in a scenario where Taiwan’s technology-driven bull market is likely to expand in the coming years, TWN should continue to outperform its benchmark by a significant margin.

Nomura

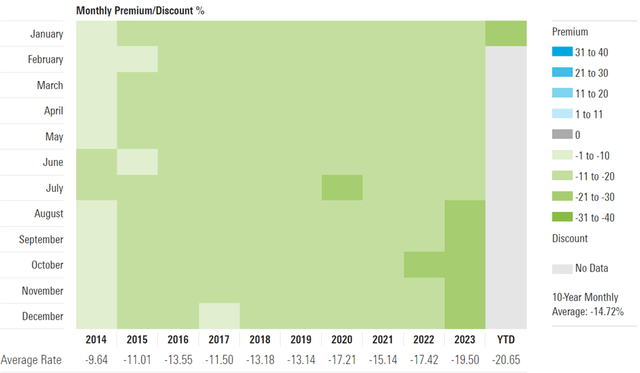

Although this is a relatively minor issue in context, the problem is that the fund is priced at a significant discount to NAV. Despite generating relative outperformance and scaling back its management fee structure in recent years, TWN’s discount has never been wider at ~21%. To begin with, the discount only deducted 1-2 percentage points from returns, but last year investors gave up a whopping 7-8 percentage points compared to NAV. Another problem is that the fund does not consistently realize or return investment gains (e.g. no payout in 2023 and a very negligible payout in 2024). Therefore, this fund is not a fund that investors can exit without giving up some profits. Ongoing share buybacks under a ‘discount management program’ help, but they are too small to change course, so I think investors looking to buy shares at a discount should consider the trade-offs very carefully.

dawn of fame

Optimistic turnaround as technology tailwinds strengthen

In a world where the AI sector is being very aggressively re-evaluated, Taiwan’s supply chain names seem very reasonably priced by comparison. Large-cap names may not look all that cheap at current low-teens earnings multiples, but their valuations look fundamentally right compared to consensus low-teens growth estimates and the outlook for low interest rates. This does not take into account the accelerating pace of technology-driven exports or the selectivity resulting from strengthening AI demand that Taiwanese technology can capture. This leaves geopolitics as the main downside risk. That’s because investors don’t get much of a cushion at all against adverse outcomes. However, tensions have eased significantly since last year’s APEC summit. And with the status quo outcome in this year’s election, I feel much more comfortable taking on a position in the tech-focused TWN. Especially since the portfolio is priced at a discount of up to 21% compared to NAV. From now on, all eyes will be on the fourth quarter report. Early signs point to potential technology-driven revenue upside, which bodes well for TWN.