The first quarter ends with a small offensive! One small-cap sector is exploding! | Exchange places with Tom Bowley

Let’s start by examining the quarterly charts of the S&P 500 ($SPX), NASDAQ 100 ($NDX), and Russell 2000 (IWM) since this long-term bull market began in early April 2013 (44 quarters ago).

S&P 500:

Nasdaq 100:

Russell 2000:

Looking at these three charts, we can draw the first obvious conclusion: If I’m in a bull market, I want to invest in the NASDAQ 100 stocks that dominate both the S&P 500 and the Russell 2000. The 44-quarter percent change (ROC) provides an approximate profit for each stock. This index comes after the long bull market began in 2013, 11 years ago.

But before writing off small-cap stocks, we need to use some perspective and understand that this asset class moves for and against us. They have significantly underperformed the NASDAQ 100 over the past 11 years, so it makes sense to stick with NASDAQ 100 stocks until small caps don’t. They might tell us differently now. Check out IWM’s 11-year weekly absolute price chart and see when IWM has outperformed the NASDAQ 100 in the past.

When we see a major breakout in IWM, the group typically shows relative strength compared to the NASDAQ 100 for at least a few months and up to a year. That relative strength sometimes extends higher from the bottom just before a major breakout. The current pattern appears to be very similar to previous periods when IWM was relatively on the rise. Although IWM has not yet shown relative strength, we have created a custom index (UDI) that tracks the relative INTRADAY performance of IWM and QQQ (an ETF that tracks the NASDAQ 100) and it is currently near record highs. This is after a massive rise that began in October 2023. That said, the current rotation favors small-cap IWM, which supports my theory that we will see outperformance from IWM over the next few months to a year. Check out this chart:

IWM has performed well since 2013, but we all have investment decisions to make and we want the best performers. At least I hope others do too. If I invest in something that’s going up but it’s underperforming, I feel like I’m leaving money on the table. So if you want to overweight one area of the market, you need to see signals that suggest it’s a smart move. Currently IWM is showing these signals. If these signals reverse, it makes a lot of sense to move back to an overweight position in the NASDAQ 100.

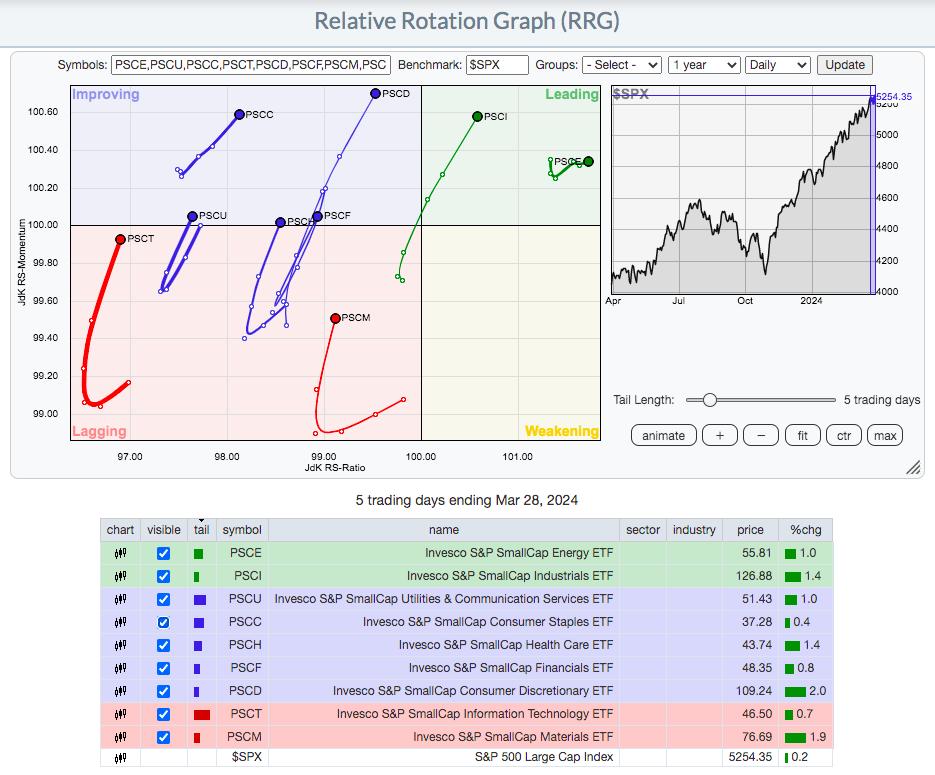

Now that we’ve finally identified the relative strength of the small-cap group that’s broken down, let’s examine where the relative strength of small-caps comes from using the RRG and Invesco Small-Cap Sector ETFs.

Small Cap Energy (PSCE) and Small Cap Industrials (PSCI) are the two best small cap sectors right now as they are the only two small cap sectors in the upper right quadrant compared to the S&P 500. Let’s take a look at these two charts.

Energy (PSCE):

It’s hard not to like the small-cap energy right now, especially inside this bullish ascending triangle continuation pattern. Ultimately, the breakout measures 76-77.

Industrials (PSCI):

The PSCI has already broken out and looks set to be extremely bullish, especially if small cap stocks as a whole continue to strengthen.

In my weekly market recap for Saturday March 30th, I discussed a number of stocks in this space, several of which are just starting what appears to be a very strong upward trend. Click here to view and watch this weekly market summary video. If you liked the video, please hit the “Like” button and subscribe to our channel so you don’t miss any future videos. thank you!

Happy trading!

tom

Tom Bowley is Chief Market Strategist at EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) to provide guidance to EB.com members each day the stock market is open. Tom has been providing technical expertise here at StockCharts.com since 2006 and also has a fundamental background in public accounting, giving him a unique blend of skills to approach the U.S. stock markets. Learn more