The SEC will reject all Bitcoin spot ETFs in January, Matrixport analysts reveal.

Contrary to the broad market consensus, Matrixport analyst Markus Thielen expects the Securities and Exchange Commission to reject any Bitcoin spot ETF proposal in January.

Despite frequent meetings between filers and the SEC in recent weeks and updated S-1 prospectuses, Thielen noted in his report that these applications still fall short of important requirements that must be met before the SEC will approve them.

Thielen based his views on political dynamics and compliance issues. Analysts argued that while ETFs would help cryptocurrencies succeed in the U.S., the SEC chairman still sees the industry as needing stricter compliance.

“SEC Chairman Gensler does not accept cryptocurrencies in the United States, and it may be very difficult to expect him to vote to approve a Bitcoin spot ETF,” Thielen wrote. “This could be implemented by the second quarter of 2024, but we expect the SEC to reject all proposals in January.”

“There are too many scams and bad actors in the cryptocurrency space,” Gensler told CNBC last month. The SEC chairman added, “There is often a lack of compliance with securities laws as well as other laws related to anti-money laundering and protecting the public from bad actors.”

What happens if my Bitcoin spot ETF is rejected?

The cryptocurrency industry has been vying for spot Bitcoin ETFs for years, including BlackRock, Fidelity, Franklin Templeton, Valkyrie and VanEck, with a total of 14 asset managers currently seeking SEC approval.

If the SEC rejects Bitcoin spot ETF applications this month, Thielen expects there will be a cascade of liquidations as billions of dollars of perpetually long Bitcoin futures are liquidated. This could cause the price of Bitcoin to fall sharply by about 20%, returning to the $36,000-$38,000 range, he said.

Bitcoin  BTC

BTC

-7.49%

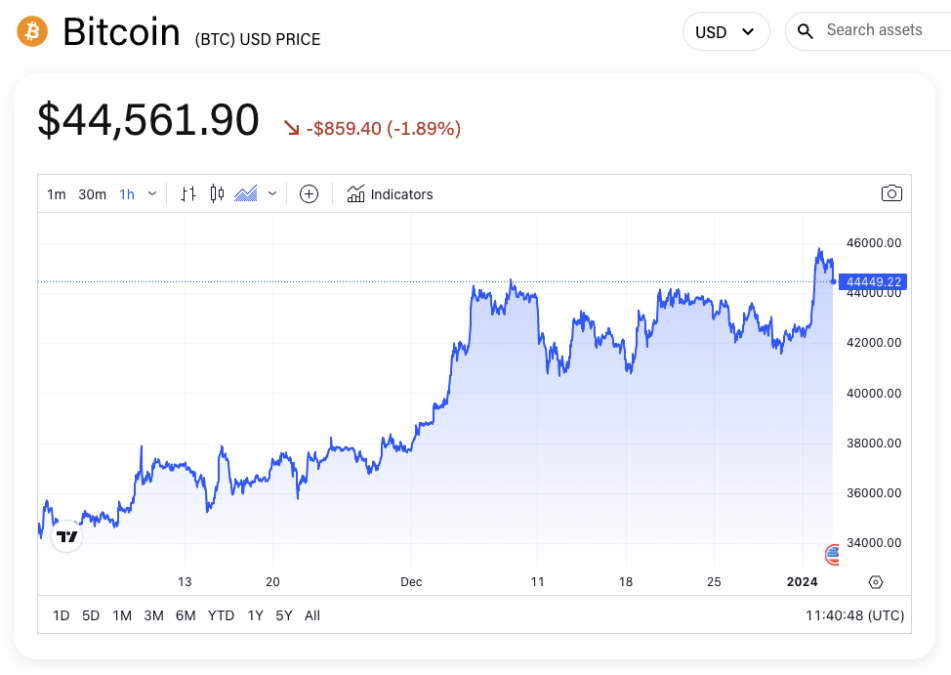

It’s currently trading at $44,562, according to The Block’s. Pricing page. The largest cryptocurrency by market capitalization, which celebrates its 15th birthday on the block today, is up about 5% since the beginning of the year and 65% over the past three months.

BTC/USD price chart. Image: Block/TradingView.

Despite potential near-term volatility due to the SEC’s rejection, Thielen’s 2024 forecast remains optimistic. Based on historical patterns in US election years and Bitcoin mining cycles, Matrixport expects Bitcoin’s value to surpass its starting point of $42,000 by the end of the year, providing hope for long-term investors amid regulatory uncertainty.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.