Unlocking the Secrets of Trading Basics: A Deep Dive into Technical Analysis

Wondering what’s hot about technical analysis and trading fundamentals? Now, eat some popcorn. We’re going to explain these trading principles in a simple way, with a touch of humor! Say goodbye to complex jargon and discover a quick and easy way to understand all about technical analysis (TA).

As you may have noticed, we started publishing more trading content last summer. We’ve been posting and tweeting for the past six months that the downturn is almost over and it’s time to jump back into crypto. We call the market coins, but we also occasionally cover some memecoins, like $BONK from last week. The last niche of cryptocurrency is better suited to degens and allows trading basics to be thrown out the window. But let’s start with the basics.

Start with trading basics

So what is technical analysis? Imagine you are Sherlock Holmes. But instead of solving a crime, you’re deciphering the mysteries of the stock market. Technical analysis in a nutshell! You don’t need a magnifying glass. All you need are charts, trends, and statistical magic.

Understanding the Technology Side Forget snoozefest financial statements and earnings reports. Technical analysis skips the boring stuff and gets straight to actions like price movement and volume. It’s like reading the stock market tea leaves and predicting future shenanigans based on past mistakes.

In the 1800s, Charles Dow and his Dow Theory laid the foundation for technical analysis. Since then, it’s evolved faster than Pokémon, with researchers like William P. Hamilton adding their two cents. Today we have a treasure trove of patterns and signals to play with.

Important things to know

Indicators: The Cool Kids of Techville There are countless indicators and patterns in the vast world of technical analysis. Trend lines, channels, moving averages, etc. are like the cool kids on the trading block. Some focus on identifying trends, while others measure trend strength and predict the future. It’s like having a crystal ball, only cooler.

Here’s what we’d like to work with:

Inside Information: Rich Assumptions Now let’s take a look at the inner workings of technical analysis. There are two camps in the trading world: fundamental analysis and technical analysis. While numerical analysts in fundamental analysis focus on financial statements, technical experts in technical analysis believe that stock prices are all that matters.

Charles Dow dropped the wisdom bomb that markets are efficient and that prices follow patterns, even when they seem random, like a cat chasing its tail. Analysts today follow three golden rules: Everything is already priced, prices move in trends, and history loves to repeat itself.

patterns to look for

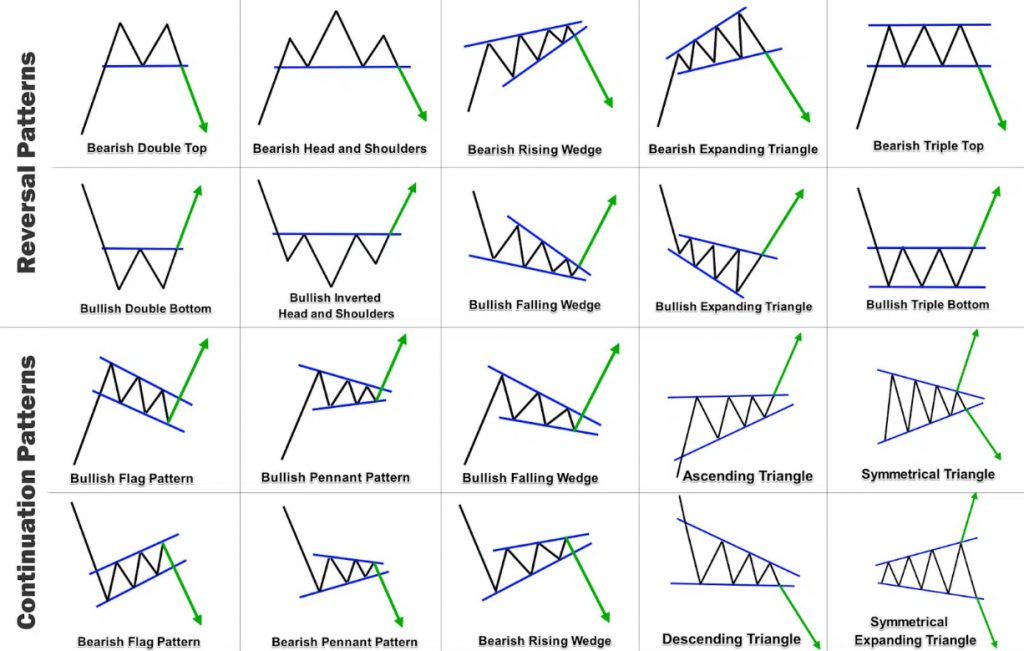

Below is an overview of reversal and continuation patterns.

Print this, sleep on it, and memorize it. Because this is what you are looking for when trading cryptocurrencies.

final thoughts

Simply put, technical analysis is not just about charts and lines. It’s about dancing to the heartbeat of the market. So put on your sneakers and join the party. After all, who said making money isn’t much fun? Happy trading!

If you want to learn more, try Babypips, our free trading course. Although it is not specifically designed for cryptocurrencies, it converts very well to cryptocurrencies.

If you like our content, you can support us by signing up for a Bybit account through our referral link. Don’t forget to claim your bonus if you buy/sell or trade cryptocurrencies.